* MSCI Asia Ex-Japan -0.7 pct

* China shares swing from gains to losses and back

* Amazon, Alphabet earnings disappoint

* Euro falls after Draghi reaffirms end of asset purchase program

By Andrew Galbraith

SHANGHAI, Oct 26 (Reuters) - Asian shares slipped again on Friday morning, deepening this week's markets rout, after disappointing results from Alphabet Inc and Amazon.com heightened concerns over the outlook for U.S. corporate earnings, global trade and economic growth.

The wobbly start for regional bourses came despite a bounce on Wall Street overnight, which was helped by bargain-hunting and positive earnings from Microsoft Corp MSFT.O .

Those gains were put into perspective, however, as shares of both Amazon.com Inc AMZN.O and Alphabet Inc GOOGL.O fell sharply after the closing bell on disappointing earnings. the Nasdaq futures NQcv1 turned down 1 percent and S&P E-mini futures ESc1 fell 0.8 percent, underscoring broad worries about U.S. corporate earnings, and the outlook for the economy, which triggered a plunge on Wall Street on Wednesday and sent global markets into a tailspin.

In Asia, MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 0.69 percent, erasing tiny gains made in the opening hour.

The index has been bruised by a heavy sell-off in the past several days, and is on course for its fifth weekly loss - its longest such streak since 2015. It has fallen more than 3 percent this week.

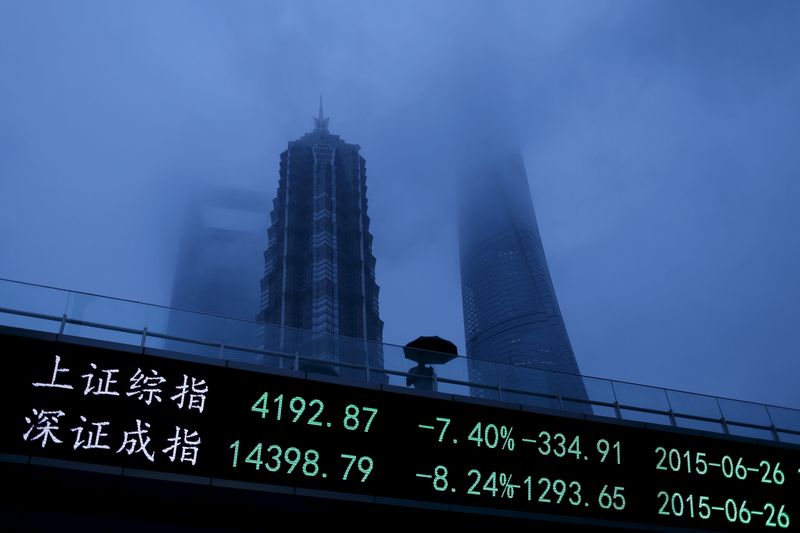

Shares in China moved in and out of the black in choppy trade, with the blue-chip index .CSI300 down 0.39 percent and the Shanghai Composite off less than 0.1 percent.

Chinese shares have been hit by volatility this week amid a string of official announcements and measures aimed at supporting the markets following a recent plunge. The heavy sell-off has raised concerns about risks posed by about $620 billion worth of shares pledged for loans. Hong Kong, the Hang Seng index .HSI was 0.55 percent lower, with tech shares .HSCIIT dropping 1.9 percent.

Tech firms also fell in South Korea, where the broader market .KS11 fell 1.7 percent, deepening losses after the Kospi closed at its lowest level since January 2017 on Thursday.

Chipmaker SK Hynix 000660.KS was down 1.24 percent after falling 3 percent on Thursday, and Samsung (KS:005930) Electro-Mechanics Co Ltd 009150.KS was 5.58 percent lower.

In Australia, shares turned down 0.31 percent after gaining modestly at the start .AXJO . Japan's Nikkei stock index .N225 also snapped back into the red after pushing up in early deals, last trading down 0.22 percent after tumbling 3.7 percent on Thursday.

Financial markets have been whipsawed in recent sessions on concerns over global growth as investors fretted over Sino-U.S. trade frictions, a mixed bag of U.S. corporate earnings, Federal Reserve rate hikes and Italian budget woes. A slowdown in China has been particularly worrying for policy makers and investors, hitting asset markets from stocks to currencies and commodities.

Analysts at Capital Economics sounded a cautious note, suggesting that the bounce in the S&P 500 index on Thursday was only temporary as investors worries about the economic outlook worsen.

"The first, and most important (worry) is that Fed tightening and fading fiscal stimulus will cause the US economy to take a turn for the worse ... The second is that China's economy will continue to struggle," the analysts said in a note to clients.

"As we have been arguing for a while now, these worries are likely to get worse over the next twelve months or so."

Investors will get a chance to check the U.S. economic pulse later Friday when the government releases third-quarter GDP data.

ANZ analysts highlighted weak U.S. core durable goods data as suggesting that "investment is not taking off, even with the apparent tailwind from tax cuts and USD repatriation."

"This indicates that the boost to GDP growth from the fiscal stimulus could be fairly transitory," the analysts said.

In currency markets, the euro edged lower, extending weakness after European Central Bank President Mario Draghi said the bank's 2.6 trillion euro ($2.96 trillion) asset purchase program will end this year and interest rates could rise after next summer, despite fears about the monetary union's economic and political future. single currency EUR= was 0.03 percent lower at $1.1371.

The dollar was off 0.11 percent against the yen at 112.29 JPY= . The dollar index .DXY , which tracks the greenback against a basket of six major rivals, was 0.04 percent lower at 96.636.

The yield on benchmark 10-year Treasury notes US10YT=RR fell to 3.1092 percent compared with its U.S. close of 3.136 percent on Thursday.

Oil prices gave up some ground after earlier rising on signals from Saudi Arabia's energy minister that there could be a need for intervention to reduce oil stockpiles. crude CLc1 dipped 0.74 percent at $66.83 a barrel. Brent crude LCOc1 fell 0.49 percent to $76.51 per barrel.

Spot gold XAU= was down slightly at $1,230.90 per ounce. GOL/ ($1 = 0.8794 euros)