(Corrects in 3rd paragraph to say three-year instead of

three-month lows)

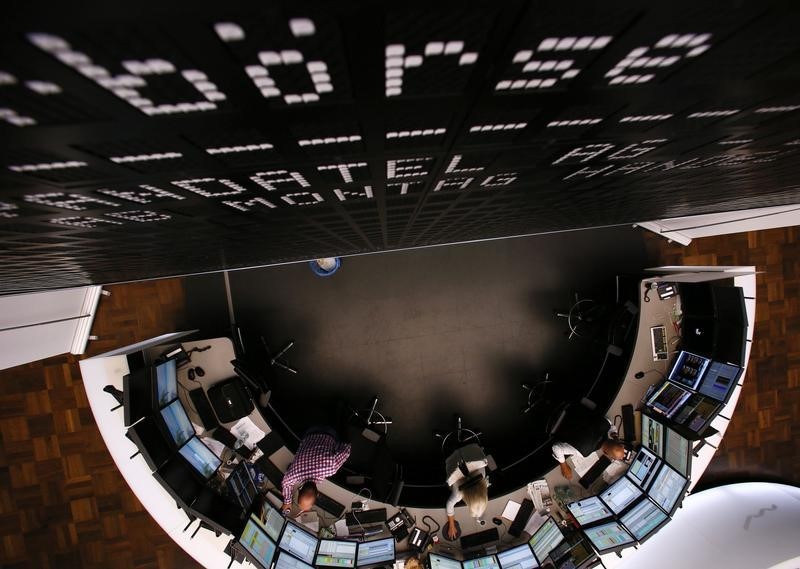

* Europe stocks led lower by miners, Asia closes lower

* Wall Street expected to open down about 0.6 percent

* Weak data rekindles growth, deflation fears

* Metals prices fall; oil edges higher

By Sujata Rao

LONDON, May 4 (Reuters) - World stocks fell for the second

successive day on Wednesday and metals prices declined,

pressured by signs of a renewed and prolonged downturn in global

growth.

In a holiday-shortened week, share prices fell in Asia and

Europe. The gloom looked set to carry over to Wall Street,

according to index futures ESc1 1YMc1 .

Lacklustre manufacturing data from across the world set off

this week's selling spree, notably Chinese factory activity

shrinking for the 14th straight month and British output at

three-year lows.

Tuesday's surprise interest rate cut in Australia and

downgraded growth and inflation forecasts from the European

Commission also weighed.

Data on Tuesday showed euro zone retail sales falling by a

bigger-than-expected 0.5 percent in March. Later this week, the

focus will shift to U.S. monthly jobs data, numbers seen key to

the Federal Reserve's interest rate outlook.

In addition, corporate earnings have consistently undershot

expectations -- U.S. S&P 500-listed companies' first quarter

earnings are down 5.4 percent versus year-ago levels and are set

for a third quarter of declines.

"The deflationary pressures remain and it's hard to see

markets making much headway at the moment," said Richard

Griffiths, associate director at Berkeley Futures.

Investors increasingly view the world's biggest central

banks as powerless to stem the growth malaise despite cutting

rates to zero or into negative territory and buying trillions of

dollars worth of bonds.

MSCI's index of world stocks was down half a percent to

three-week lows after falling 1 percent on Tuesday for its

biggest one-day fall in a month .MIWD00000PUS .

Emerging equities also extended losses, falling more than 1

percent .MSCIEF .

The pan-European FTSEurofirst 300 index .FTEU3 dropped

almost 1 percent to its lowest in more than three weeks, by a

3.2 percent drop in basic resources stocks .SXPP .

Britain's miner-heavy FTSE 100 index .FTSE fell 1.3

percent.

Shares in Dialog Semiconductor DLGS.DE slumped 14 percent

after the maker of chips used in Apple (NASDAQ:AAPL) and Samsung (KS:005930) phones

reported a 58-percent drop in underlying operating profit,

continuing the saga of underwhelming profits at tech firms.

"We see a continuation of the risk-off pattern that gained

ground yesterday," said Daniel Lenz, a strategist at DZ Bank.

MSCI's main Asia-Pacific stocks index, excluding Japan,

.MIAPJ0000PUS fell 1.2 percent. Japanese markets are closed

most of this week for a holiday.

STABILISATION

The worst of the near-term market angst may be dissipating,

however.

The flight from risk had played out in forex markets with

investors favouring currencies from economies with current

account surpluses, such as Japan. But the yen JPY= slipped off

18-month highs against the dollar of 105.55. It traded at 106.77

per dollar, down 0.2 percent on the day.

The euro EUR= fell 0.2 percent to $1.1472.

The dollar rose 0.3 percent against a basket of currencies

.DXY , recovering from 15-month lows hit on Tuesday.

On bond markets too there were some signs of stabilisation.

U.S. Treasuries and German Bunds, typically the assets of

choice in a weak-growth environment, saw yields tumble this

week, with the former hitting two-week lows while 10-year Bund

yields posted their biggest daily fall of 2016.

Ten-year Bund yields steadied but stayed almost 10 bps below

last Friday's levels when they were close to six-week highs

DE10YT=TWEB .

Crude futures inched higher after two days of losses LCOc1

CLc1 though Brent remains around 7 percent below 5-1/2-month

highs hit at the end of April.

Copper, often viewed as a key growth barometer, remained

under the cosh, hit by the weak manufacturing data and stronger

dollar. London three-month copper CMCU3 followed Tuesday's 2.6

percent fall with a further 1.2 percent drop, to $4,863 a tonne.

Aluminium CMAL3 and zinc CMZN3 also fell.