* Higher oil, commodities lift equities

* Sterling hits seven-year low vs dollar

* Copper at two-week high on hope of China demand revival

* U.S. stock futures signal Wall St to open higher

By Nigel Stephenson

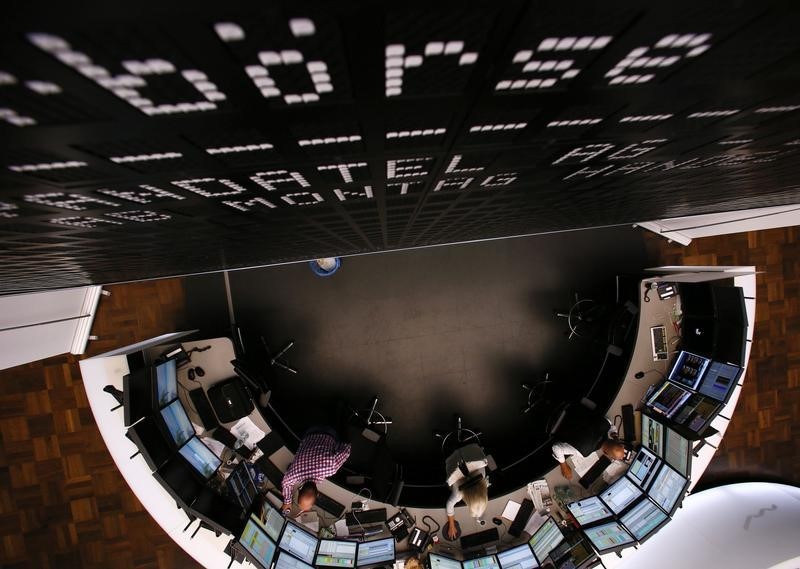

LONDON, Feb 22 (Reuters) - Shares rose in Europe and Asia on

Monday, boosted by higher oil and commodity prices, while

sterling fell sharply against the dollar and euro on concerns

Britain may vote to leave the European Union.

U.S. stock index futures ESc1 1YMc1 SPc1 signalled

Wall Street would open about 1.1 percent higher.

The British pound hit a seven-year low of $1.4067, down 2.3

percent on the day, putting it on track for its biggest daily

percentage loss since February 2009, while the euro rose 1.4

percent to 78.31 pence.

London Mayor Boris Johnson, a political heavyweight in the

ruling Conservative Party, said on Sunday he would support the

campaign to leave the EU in a June 23 referendum, putting him at

odds with Prime Minister David Cameron.

Cameron, who struck a deal to reform Britain's relations

with the EU last week, was due to make his case for staying in

the EU in parliament later on Monday.

With dealers expecting choppy trading in the run-up to the

vote, the cost of hedging against weakness in sterling hit its

highest in more than four years GBPVOL=

"The 'Out' camp were struggling to get a figurehead who was

popular and Boris has given them that boost," said Alvin Tan, a

strategist with French bank Societe Generale (PA:SOGN) in London.

"I think there is genuine worry that Britain might vote to

leave and the uncertainty is going to rise into the referendum."

British shares, however, rose in line with other European

bourses. London's resources-heavy FTSE 100 index .FTSE was up

1.3 percent.

"Brexit is not a story for equities at the moment but that

might change ... For sure the probability of Brexit has

increased after the positioning of Boris Johnson," said Jurgen

Michels, chief economist at BayernLB in Munich.

Ten-year yields on UK government debt GB10YT=RR rose 1

basis point to 1.42 percent, while euro zone benchmark German

10-year yields DE10YT=TWEB were flat at 0.2 percent.

The pan-European FTSEurofirst 300 share index .FTEU3 rose

1.4 percent, led by miners .SXPP , though a 2.9 percent fall in

HSBC HSBA.L after the bank's 2015 profit fell short of

expectations took its toll. HSBC earlier fell close to 5

percent.

Stocks also shrugged off a survey showing private sector

business activity in the euro zone increased at its weakest pace

in more than a year this month, according to Markit's composite

flash Purchasing Managers' Index.

MSCI's broadest index of Asia-Pacific shares outside Japan

.MIAPJ0000PUS gained 1 percent, having rebounded more than 4

percent last week.

China's benchmark indexes rose 2 percent as investors

welcomed Beijing's decision to replace its top securities

regulator and on signs the government was stepping up its

economic stimulus efforts. .SS

Tokyo's Nikkei .N225 closed up 0.9 percent, helped by a

weaker yen JPY= , which fell 0.6 percent to 113.20 per dollar.

The euro EUR= fell 1 percent to $1.1020, its weakest for

almost three weeks.

RIGS

Oil prices rose as a reduction in the number of U.S. rigs

was expected to lead to lower output. Global benchmark Brent

crude LCOc1 rose 4 percent, or $1.31 a barrel, to $34.32.

Russia and the Organization of the Petroleum Exporting

Countries (OPEC) proposed to freeze production at January

levels, though analysts said this would not help cut oversupply

which has seen prices fall 70 percent since mid-2014.

Copper CMCU3 hit a two-week high on hopes for a revival in

Chinese demand. The metal traded up 1.3 percent on the day at

$4,682 a tonne. Zinc CMZN3 hit a four-month high on worries

over a potential shortage.

Gold XAU= fell as stocks and the dollar rose. It was down

2 percent at $1,205 per ounce.