By Wayne Cole

SYDNEY (Reuters) - Asian shares were hauled higher by S&P 500 futures on Monday and oil prices hit a five-week peak as countries' efforts to re-open their economies stirred hopes the world was nearer to emerging from recession.

Warm weather is enticing much of the world to emerge from coronavirus lockdowns as centres of the outbreak from New York to Italy and Spain gradually lift restrictions that have kept millions cooped up for months.

"The economies of Europe and the U.S. likely bottomed out in April and are slowly starting to come back to life," wrote Barclays (LON:BARC) economist Christian Keller in a note.

"However, incoming data from most economies highlight the depth of the contraction, raising risks of longer-term scarring that might undermine the recovery."

Data in Japan confirmed the world's third largest economy slipped into recession in the first quarter, putting it on course for its worst postwar slump as the coronavirus takes a heavy toll.

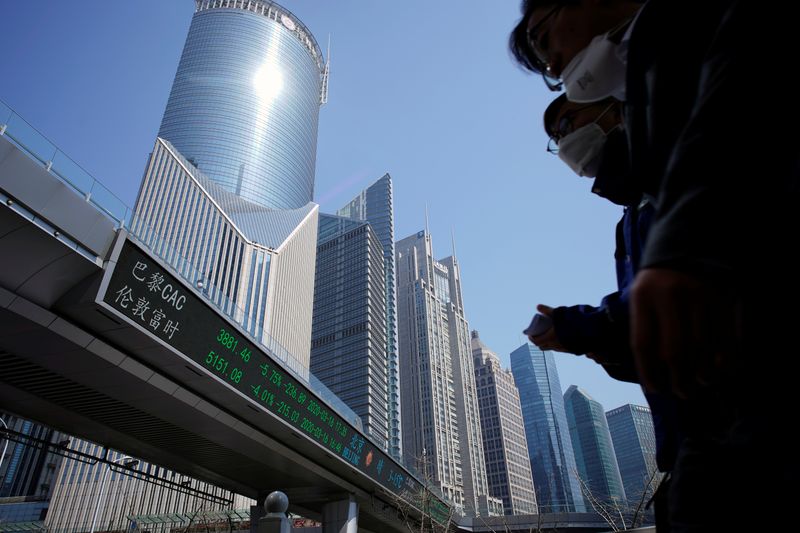

Still, MSCI's broadest index of Asia-Pacific shares outside Japan edged up 0.1%. Japan's Nikkei (N225) rose 0.5% and Chinese blue chips (CSI300) 0.5%.

More carefree were E-Mini futures for the S&P 500 (ESc1) which added 1.1%, even though results from a raft of U.S. retailers are likely to make messy reading.

EUROSTOXX 50 futures gained 1.9% and FTSE futures 1.6%.

Federal Reserve Chairman Jerome Powell took a cautious line in an interview over the weekend, saying a U.S. economic recovery may stretch deep into next year and a full comeback might depend on a coronavirus vaccine.

Late Sunday, Powell outlined the likely need for three to six more months of government financial help for firms and families.

Data out on Friday showed retail sales and industrial production both plunged in April, putting the U.S. economy on track for its deepest contraction since the Great Depression.

Adding to the uncertainty were the trade tensions between the United States and China, with Beijing warning it was opposed to the latest rules against telecoms equipment company Huawei.

U.S. lawmakers and officials are crafting proposals to push American companies to move operations or key suppliers out of China that include tax breaks, new rules, and carefully structured subsidies.

DIVIDENDS DICED

In a report on the outlook for corporate dividends, Janus Henderson Investors argued Europe and the UK would be more badly affected than North America, while technology, healthcare, food and most basic consumer sectors should be safer.

Its base case scenario was for a 15% drop in global dividends this year, worth $213 billion, and a worst-case fall of 35%.

One focus this week will be the U.S. Treasury Department's first auction for its 20-year bond on Wednesday. Treasury plans to borrow a record amount of nearly $3 trillion this quarter.

So far, the market has easily absorbed the flood of new debt with 10-year yields holding to a tight range around 0.64%.

The dollar has also been largely range-bound, with its safe-haven appeal keeping it well supported overall. Against a basket of currencies, it was last at 100.340 having drifted 0.7% higher last week.

The euro was steady at $1.0820 (EUR=), while the dollar was a fraction firmer on the Japanese yen at 107.13

The pound briefly touched a seven-week low at $1.2073

In commodity markets, the flood of liquidity from central banks combined with record-low interest rates to help lift gold to a seven-year peak. The metal was last up 1.2% to $1,762 an ounce, with silver and palladium also on a roll.

Oil prices rose as demand picked up as countries around the world eased travel restrictions, with U.S. oil showing no signs of last month's price rout ahead of the expiry of the June WTI contract on Tuesday.

Brent crude futures firmed $1.08 to $33.58 a barrel, while U.S. crude rose $1.27 to $30.70.