By Stephen Nellis

(Reuters) - More than a dozen business groups representing automakers, medical device makers and manufacturers sent a letter to President Joe Biden on Thursday calling on him to work with U.S. lawmakers to provide federal funding for the construction of new chip factories.

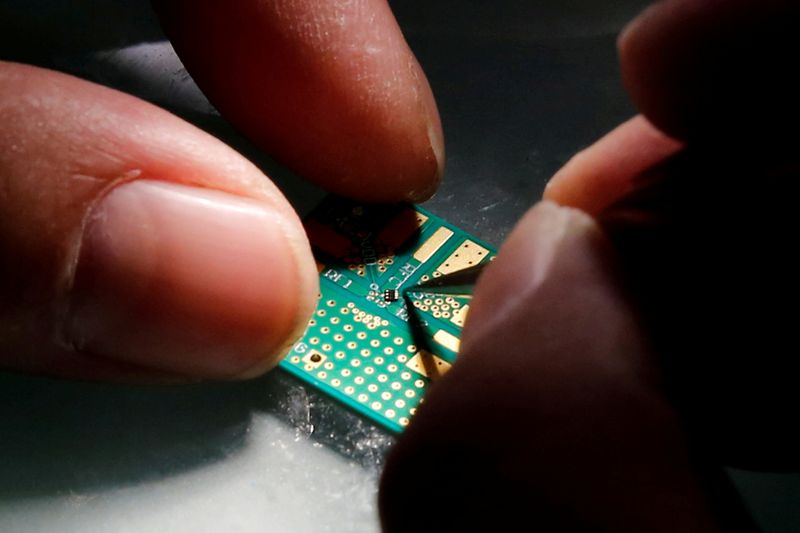

The groups, which include the U.S. Chamber of Commerce as well as industry-specific associations representing General Motors Co (NYSE:GM), Caterpillar Inc (NYSE:CAT) and Medtronic (NYSE:MDT) PLC, among others, sent the letter as a shortage of semiconductors continues to disrupt U.S. automobile factories and threatens to lower the automakers' profits by billions of dollars.

A group of chipmakers last week sent a similar letter. Congress authorized programs last year to provide subsides for chip research and factory construction, but U.S. lawmakers still need to provide specific funding for the program.

"To be competitive and strengthen the resilience of critical supply chains, we believe the U.S. needs to incentivize the construction of new and modernized semiconductor manufacturing facilities and invest in research capabilities," the business groups wrote in their letter on Thursday.

The majority of chip production, especially for advanced computing chips, now occurs in Asia, where major contract manufacturers such as Taiwan Semiconductor Manufacturing Co Ltd (TSMC) and Samsung Electronics (KS:005930) Co Ltd handle production for hundreds of different chip companies. Both TSMC and Samsung are planning new U.S. chip factories in the next few years that could benefit from the program if it is funded.

In addition to funding existing programs, the business groups also called for an "investment tax credit" that could help defray the cost of semiconductor manufacturing tools, which can cost billions of dollars for new factories and typically far outstrip the cost of buildings.

American toolmakers such as Applied Materials Inc (NASDAQ:AMAT), Lam Research Corp (NASDAQ:LRCX) and KLA-Tencor Corp (NASDAQ:KLAC) dominate the industry, though Netherlands-based ASML Holding (AS:ASML) NV and Japan's Tokyo Electron Ltd are also major players in some segments.