* Regulator has received notice from bank of intent to leave

* Bank says Asia Pacific remains important part of business

* Scotiabank shares up 0.7 percent (Adds Scotiabank comment)

By Liang-Sa Loh and Matt Scuffham

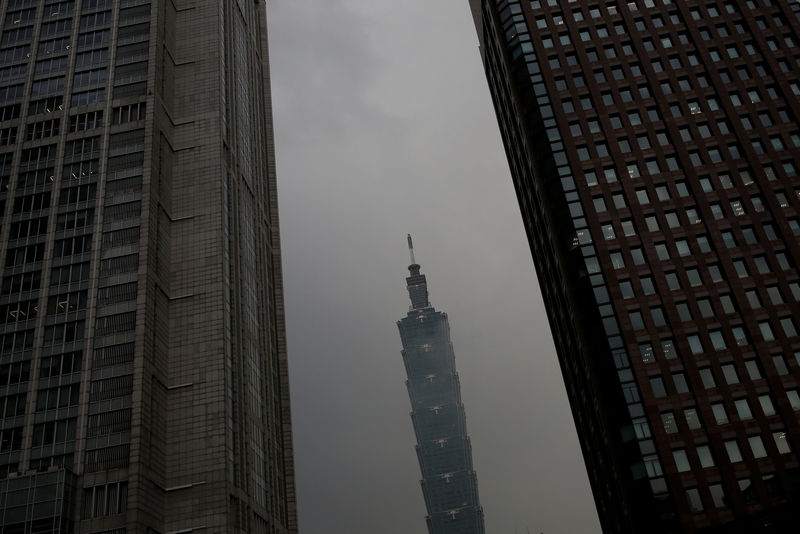

TAIPEI/TORONTO, Aug 8 (Reuters) - Bank of Nova Scotia BNS.TO , Canada's third-largest bank, has applied to Taiwan's financial regulator to exit the local market, the regulator and bank said on Monday, part of a revamp of its Asia strategy.

Bank of Nova Scotia, which operates under the Scotiabank banner, has been re-jigging its operations and shifting focus along with other rivals in the Canadian banking sector, as they deal with a slowdown in their home economy and the fallout from weaker oil prices. Analysts have said Central and South America may become Scotiabank's main focus outside Canada.

Scotiabank said its Taiwan office is being closed as part of a recent review of its activities in the Asia Pacific region, which it said remained an important part of its corporate, investment banking and capital markets business.

"We continually review our operations to drive efficiency and competitiveness, as well as to ensure we are meeting the needs of our customers," Scotiabank said in an e-mailed statement.

An FSC spokesman confirmed that it had received notice from the bank of its intent to leave the market.

The bank said in December that it may consider selling its 49 percent stake in Thai auto loan provider Thanachart Bank Pcl, which is majority owned by Thanachart Capital Pcl TCAP.BK , in a bid to boost its capital ratios. A source familiar with the matter told Reuters at the time that Scotiabank was weighing the sale as it found managing an Asian retail presence cumbersome. Toronto-based bank has the broadest international presence of all Canadian banks, but its operations in Asia account for only a fraction of its overall revenues. Its revenues from Asia were C$394 million in fiscal 2015, accounting for just 4.5 percent of its international banking revenue and 1.6 percent of Scotiabank's overall revenues.

Shares in Scotiabank were up 0.6 percent at 1445 ET.

The bank has also moved some of its headcount in sales and trading to Singapore from Hong Kong over the last two months, said a source familiar with the matter. In terms of business footprint in Asia, it has three branches each in China and India and a securities trading license in Japan.

The central bank of Vietnam in March granted a decision to withdraw the bank's license for its representative office in Hanoi, it said in a statement on its website. No reason was given.