HighlightsUtility companies may behave differently from regular ones and are considered regulated monopolies. These companies are engaged in critical services and behave slightly differently than the other stocks.

- Fortis (TSX:FTS) Inc. paid a dividend of C$ 0.535 in Q2 2022.

- The adjusted net earnings of Algonquin witnessed an increase of 19.6 per cent.

- As an investor, you should look for stocks that match with your investment goals.

While investing in utility stocks, investors should analyze the overall market to understand the current pattern, as different economic periods offer different stock situations.

Cash flow and dividend growth rate are other important factors that impact the stock valuation at different times. Therefore, one must be aware while selecting the stocks and not rely on any single factor.

Let’s look at a few utility stocks and their performances:

Fortis Inc . (TSX: FTS) Fortis Inc. is engaged in operating and owning transmission and distribution assets. It operates 10 utility assets in US and Canada. Further, the company has smaller stakes in several Caribbean utilities and electricity generation.

In Q2 2022, the net earnings of Fortis were posted at C$ 284 million as against C$ 253 million in Q2 2021. Fortis announced a quarterly dividend of C$ 0.565, payable on December 1, 2022.

The cash and cash equivalents stood at C$ 338 million at the end of the second quarter of this year. The company's total assets witnessed an increase and were noted at C$ 59,954 million as compared to C$ 57,659 million as of December 31, 2021.

The liabilities also increased and were noted at C$ 38,094 million compared to C$ 36,743 million in the same period.

Algonquin Power & Utilities Corp. (TSX: AQN) Algonquin is a utility company that provides cost-effective, safe, reliable, and sustainable water and energy solutions through its two business groups. These groups are the Renewable Energy Group and the Regulated Services Group.

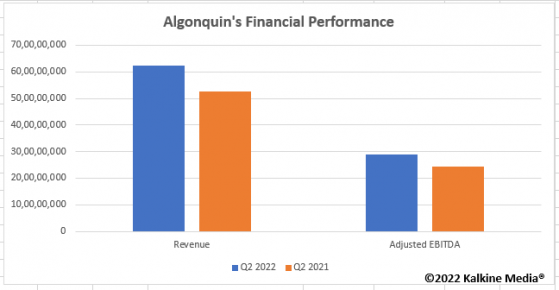

In Q2 2022, the revenue was noted at US$ 624.3 million, a year-over-year (YoY) increase of 18 per cent. Further, the adjusted EBITDA was noted at US$ 289.3 million, with an increase of 18 per cent relative to the second quarter of 2021.

The adjusted Net Earnings were reported at US$ 109.7 million, an increase of 19.6 per cent YoY.

The dividend announced by Algonquin Power & Utilities Corp. was US$ 0.181. The three-year dividend growth for the company was noted at 8.65 per cent.

Canadian Utilities Limited (TSX: CU) Canadian Utilities offers electricity and gas services. For the quarter ending June 30, 2022, the revenue for Canadian Utilities Limited was posted at C$ 933 million and increased by C$ 143 million from the previous year.

In Q2 2022, the adjusted earnings were C$ 136 million, up from C$ 115 million in the same quarter of 2021. Further, the cash flows from operating activities were posted at C$ 513 million in Q2 2022, an increase of C$ 136 million in the same period in 2021.

The company is offering a dividend of C$ 0.444 with a dividend yield of 5.167 per cent. The three-year dividend growth for the company was 2.66 per cent.

Hydro One Limited (TSX: TSX:H) Hydro One Limited is the largest electricity provider in Ontario, operating regulated transmission and power distribution.

The total market capitalization of Hydro One Limited is C$ 19.134 billion. For the quarter ending June 30, 2022, Hydro One’s revenue was reported at C$ 1,840 million compared to C$ 1,722 million in the previous quarter. The company’s net income increased from C$ 238 million in Q2 2021 to C$ 255 million in Q2 2022.

Emera Incorporated (TSX: TSX:EMA) Emera Inc. is a services company engaged in electricity generation, distribution, and transmission. In Q2 of this year, Emera reported an adjusted net income of C$ 156 million versus C$ 137 million in Q2 FY21.

Meanwhile, the net loss was reported at C$ 67 million compared to a net loss of C$ 17 million in the same comparable period.

As of June 30, 2022, the total assets witnessed an increase and were reported at C$ 36,231 million compared to C$ 34,244 as of December 31, 2021.

The cash, equivalents and restricted cash were posted at C$ 296 million.

Bottom Line For investors, long-term investment is paramount. As an investor, you should look for stocks that match with your investment goals. Also, look for the fundamentals before zeroing in on a stock.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.