Investing.com - While many investors are questioning the further bullish potential of NVIDIA shares, with the stock up 70% year-to-date and more than 200% year-over-year, analysts at Evercore believe it could go much higher still.

The firm announced yesterday that it had initiated coverage of Nvidia (NASDAQ:NVDA) at 'Outperform' with a price target of $1160, representing potential upside of 38% from Wednesday's closing price.

Analysts also said that in their most bullish scenario, Nvidia shares could rise to $1,540 over the next year, more than 80% above current levels.

This high price target is based on the idea that Nvidia is much more than a chip company, something Evercore believes investors are not taking into account.

"We believe that investors are underestimating 1) the importance of the chip + hardware + software ecosystem that Nvidia has created, 2) that computing eras last 15-20 years and are typically dominated by a single company with a vertically integrated ecosystem", wrote the analysts.

This single leader "typically captures 80% of the value created during its respective IT era, while others compete for the remaining 20%", they said.

Evercore therefore expects Nvidia to capture 80% of the parallel processing market by 2030, which could be worth more than $350 billion.

"We believe that the tectonic shift to the current era of parallel processing and IoT computing began five to eight years ago and that NVDA is the dominant ecosystem player in parallel processing, which is only in the early stages of generating exceptional returns for its investors," Evercore concluded.

What does InvestingPro tell us about Nvidia shares?

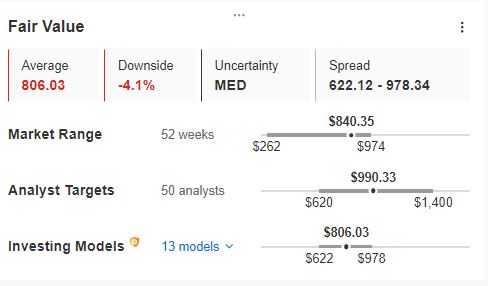

Firstly, InvestingPro data shows us that the 50 analysts following Nvidia shares have an average target of $990.33, well below Evercore's target (upside potential of +17.8%).

In addition, the InvestingPro Fair Value, which summarises 13 recognized financial models, stands at $806.03, i.e. 4.1% below the current share price.

It would therefore seem that a degree of caution is called for about Nvidia shares. In this context, waiting for the next quarterly results on 22 May to reassess the opportunity might be the best choice.

In this regard, we note that InvestingPro data shows that analysts are expecting EPS of $5.51, more than 5 times higher than in the same quarter of the previous year, on sales of $24.288 billion, almost 3.4 times higher than a year earlier.

It is also worth noting that Nvidia has beaten expectations in terms of EPS and sales for the last 5 consecutive quarters.

In addition to the tools mentioned in this article, you'll find :

- ProPicks: Stock portfolios managed by a fusion of AI and human expertise, with proven performance.

- ProTips: Digestible information to simplify masses of complex financial data into a few words.

- Exclusive pro news: To understand what's going on in the market before anyone else.

- Fair Value and Health Score: 2 summary indicators based on financial data that provide instant information on the potential and risk of each stock.

- Advanced stock screener: Search for the best stocks according to your expectations by taking into account hundreds of financial metrics and indicators available on InvestingPro.

- Historical data for thousands of metrics on tens of thousands of global stocks: To enable fundamental analysis pros to dig into all the details themselves.

- And many more services, not to mention those we plan to add soon!