Kalkine Media -

The term "penny stock" has a very broad definition. Different investors will provide you with varied responses. Nonetheless, it is widely accepted that a penny stock is any stock that trades for less than $5.Highlights

- The MIR stock surged by 58.82 per cent year-to-date (YTD).

- The DMGI stock has returned 137.04 per cent YTD.

- The OM stock surged 82.5 per cent YTD.

If you're looking for some of the Canadian penny stocks, then you can further explore this article. Also, you should know that penny stocks are extremely volatile and risky.

MedMira Inc. (TSXV: MIR) It is a biotechnology company that researches, develops, and produces rapid diagnostics and technologies. Recently, MedMira announced that it is expanding its presence in the US and Latin America by partnering with Maternova, a distribution company with a specialization in maternal and infant health.

The MIR stock surged by 58.82 per cent year-to-date (YTD) and 17.39 per cent in the last 30 days.

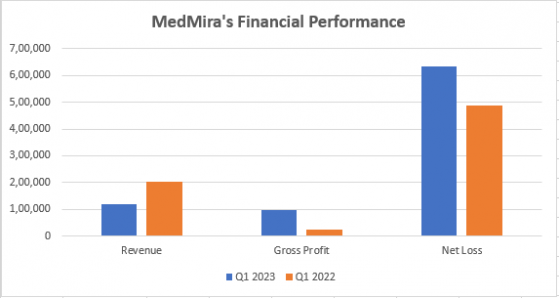

Although the stock has been performing well, its financials in the first quarter of fiscal 2023 were not exciting. In Q1 2023, the company's revenue was C$ 120,770 compared to C$ 202,161 in Q1 2022.

©2023 Krish Capital Pty. Ltd

Meanwhile, the net loss increased to C$ 632,449 in Q1 2023 from C$ 489,009 in Q1 2022.

DMG Blockchain Solutions Inc. (TSXV: DMGI) It is a blockchain and crypto company. Also, it is involved in server hosting and other comparable service agreements for software solutions and businesses providing transaction verification services.

In 2022, DMG Blockchain claimed to increase its hashrate from 15 PH/s to 700 PH/s. Also, during the fiscal year's end, DMG's balance sheet had C$ 10.5 million in cash and virtual currency with no debt.

DMG's income before other items was C$ 1.52 million in 2022, compared to a loss of C$ 6.83 million in 2021.

The DMGI stock has returned 137.04 per cent YTD and 56.1 per cent in the last three months.

Osisko (TSX:OSK) Metals Incorporated (TSXV: OM) With a concentration on zinc mineral properties, Osisko Metals Corporation is a Canadian company in the base metal sector. On February 22, Osisko signed a C$ 100 million agreement with Appian Natural Resources Fund for a joint venture.

For the three months that ended September 30, 2022, Osisko had cash and cash equivalents worth C$ 3.72 million. The value of the total assets stood at C$ 114.35 million.

Osisko narrowed down its net loss to C$ 1.36 million compared to C$ 2.95 million in the same period of the previous year.

The OM stock surged 82.5 per cent YTD and about 49 per cent in a month.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.