Highlights

- Magnet Forensics saw its top line surge by 41 per cent year-over-year to US$ 23.14 million in Q2 2022

- TCSYS said that its Software-as-a-Service (SaaS) revenue spiked by 40 per cent YoY to C$ 7.7 million in Q4 2022

- MDA reported C$ 1.52 billion in backlog in Q2 2022, representing an increase of 138 per cent from Q2 2021

Growing price pressure and recession worries weigh on investors worldwide as they face increased interest rates in recent months, which might stay elevated in the short term until inflation drops to the desired level (two per cent). Despite such an environment, growth seekers (usually known to have a high appetite for risk) might search for fundamentally sound stocks that could provide substantial returns in a longer duration.

Considering this perspective, Kalkine Media® presents the following seven growth stocks listed and traded on the Toronto Stock Exchange (TSX) that high-risk investors can explore right now:

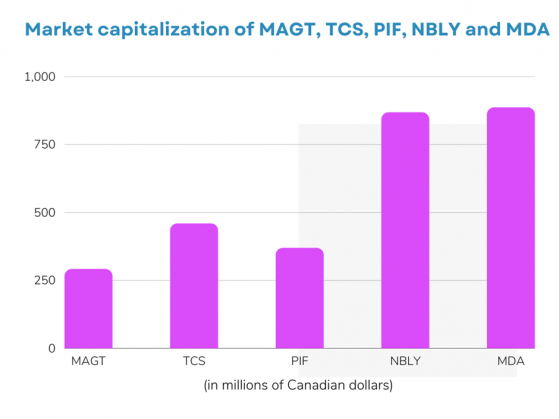

1. Magnet Forensics Inc (TSX: MAGT) Magnet Forensics is a C$ 291.8 million market capitalization company that builds digital investigation software. Magnet Forensics saw its top line surge by 41 per cent year-over-year (YoY) to US$ 23.14 million in Q2 2022. The software company said that revenue increment in the latest quarter was mainly due to a US$ 4 million increase in software maintenance and support revenue and a US$ 2.7 million surge in term license revenue, underpinned by Magnet’s growing customer base.

Magnet Forensics noted a gross margin of 93 per cent in the second quarter this year, relative to 94 per cent in Q2 2021. This decline in gross margin came as revenue growth in the software license and software maintenance and support segment was partially offset by increased professional services revenue, which is lower on margin. Magnet posted a net loss of US$ 1.01 million in Q2 2022, significantly lower than a net profit of US$ 1.59 million in the previous year’s second quarter as it spent more on Sales & Marketing and Research & Development (R&D).

Besides this, Magnet Forensics posted a revenue guidance range of US$ 92.5 million to US$ 94.5 million for fiscal 2022, representing a 32 per cent to 34 per cent surge from 2021. On September 1, Magnet recently announced expanding its digital forensics and cybersecurity footprints internationally to Australia to help enterprises and public safety agencies in the Asia Pacific region.

2. TCSYS Inc (TSX: TCS) TCSYS said its Software-as-a-Service (SaaS) revenue spiked by 40 per cent to C$ 7.7 million in the fourth quarter of 2022 compared to C$ 5.49 million in the same quarter a year earlier. The technology firm highlighted that its SaaS subscription booking climbed 29 per cent to C$ 4.5 million in the latest quarter compared to C$ 3.5 million posted in the second quarter last year. Professional services revenue also grew by six per cent YoY to C$ 12.89 million in Q2 2022. However, this revenue growth was somewhat marred by declines in other segments.

TCSYS reported total revenue of C$ 34.28 million in the second quarter this year, up by six per cent from Q1 2021. In addition, this small-cap company also distributes a quarterly dividend (currently C$ 0.07).

©Kalkine Media®; ©Garis Studio via Canva.com

3. Polaris Renewable Energy Inc (TSX: PIF) Polaris Renewable Energy is a small-cap utility company focused on geothermal and hydroelectricity projects. Polaris posted a total energy production (net) of 163,119 MegaWatt per hour (MGh) in the second quarter of 2022, higher than the 150,676 MWh produced a year ago. On the financial front, the C$ 369-million market cap company increased its total revenue to US$ 15.18 million in the latest quarter, relatively up from US$ 14.16 million in Q2 2022.

Polaris Renewable saw a significant net loss of US$ 1.54 million in Q2 2022 relative to a net profit of US$ 0.15 million in the same period last year. Despite reducing profitability, Polaris distributed a quarterly dividend of US$ 0.15 on August 26 and is said to be focused on maintaining its dividend policy.

4. Neighbourly Pharmacy Inc (TSX: NBLY) Neighbourly Pharmacy is a C$ 868.36 million market capitalization firm that operates a community pharmacy network across Canada. Neighbourly said that its revenue reached C$ 114.37 million in Q1 FY2023, reflecting a YoY rise of 34 per cent, mainly supported by pharmacy acquired in the previous four quarters. The healthcare company also posted an increased store count of 175,000 in the latest quarter compared to 132,000 in Q1 2022. Furthermore, Neighbourly will distribute a quarterly dividend of C$ 0.045 on September 27.

While disclosing its financial results for Q1 2023, Neighbourly Pharmacy also highlighted that its pharmacy network expanded to 275 locations with the Rubicon Pharmacies acquisition in June. The pharmacy network operator said that this acquisition added 100 pharmacy locations in western Canada along with the acquisition of another four pharmacies at the end of last fiscal year.

5. MDA Ltd (TSX: MDA) The small-cap aerospace technology and defense solutions provider, MDA, reported C$ 1.52 billion in backlog in the second quarter of fiscal 2022, representing an increase of 138 per cent from the same period of 2021. The advanced technology firm saw its revenue at C$ 154.7 million in the latest quarter, indicating a surge of 22 per cent from Q2 2021, augmented by revenue growth in the Robotics & Space Operations and Satellite Systems businesses.

MDA improved its gross profit to C$ 51.4 million in the second quarter this year compared to C$ 44.6 million in Q2 2021. However, the space technology company noted a net loss of C$ 8.8 million in the latest quarter, higher than C$ 0.1 million in the same quarter a year earlier.

Bottom line Portfolio diversification is a key element that investors should consider at all costs to avoid losses emerging from the sector or industry-specific unfavourable news. Therefore, the TSX growth stocks discussed could also diversify one’s portfolio, apart from significant capital gains in the future. Some TSX stocks like TCSYS, Polaris Renewable, and Neighborly also pay dividends to their shareholders, thereby expanding your income stream.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.