Entering the stock market is a long-term journey. Investors look for steady growth and income from their investments in the stock market. Regular dividend from stocks is also a long-term way to earn money from the stock market.Highlights

- On August 16, 2022, Liberty LLC owned by Algonquin Power, announced its acquisition of Sandhill Advanced Biofuels, LLC.

- In Q2 2022, the revenue of NorthWest Healthcare was reported at C$ 111.8 million as compared to a year ago quarter.

- On September 22, 2022, WSP Global Inc (TSX:WSP). announced its acquisition of Capita Real Estate and Infrastructure Ltd. and GL Hearn Ltd.

However, rising interest rates and inflation may have an impact on dividend stocks. You can study the market and kick-start your long-term portfolio.

Here are six dividend stocks along with their recent financial performance to study:

For Q2 of fiscal 2023, the sales growth of Dollarama Inc. was reported at 18.2 per cent. The EBITDA also grew by 25.8 per cent. Further, operating income also rose by 30.3 per cent and was noted at C$ 287.4 million.

As of July 31, 2022, the cash of Dollarama Inc. decreased to C$ 70.86 million compared to C$ 71.05 million on January 30, 2022. The quarterly dividend paid by the company was noted at C$ 0.055 per share and the three-year dividend growth was at 11.22 per cent.

On October 27, 2022, the stock price for Dollarama Inc. was C$ 81.70.

For Q2 2022, Algonquin Power's revenue and adjusted EBITDA, both increased by 18 per cent and were reported at US$ 624.3 million and US$ 289.3 million respectively, compared to Q2 2021.

Further, the adjusted net earnings rose to US$ 109.7 million with an increase of 19.6 per cent for the same comparative period. The company follows dividend cycle on a quarterly basis and pays US$ 0.181 per share to its shareholders. The dividend yield was noted at 6.241 per cent.

On August 16, 2022, Liberty LLC owned by Algonquin Power, announced its acquisition of Sandhill Advanced Biofuels, LLC.

For Q2 2022, the revenue of Northwest Healthcare grew by 24 per cent and was reported at C$ 111.8 million as compared to the year-ago quarter.

The total assets for the company also increased in Q2 2022 and were reported at C$ 8,123.89 million as against C$ 7,064.4 million in Q4 2021. The earnings per share (EPS) is at C$ 1.99 and the P/E (price-to-earnings) ratio was noted at 5.4.

The company pays a dividend of C$ 0.067 on a monthly basis, which is next payable on November 15, 2022.

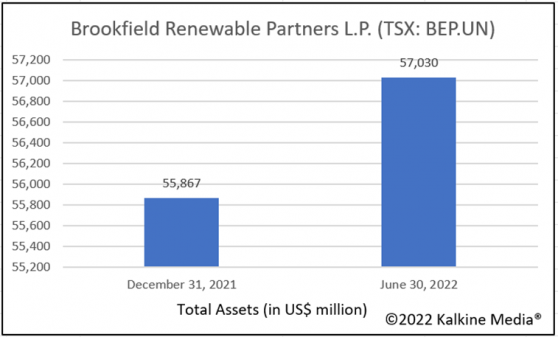

For the quarter that ended June 30, 2022, Brookfield Renewable Partners registered a revenue of US$ 1,274 million compared to US$ 1,019 million in the year-ago quarter.

For the reported quarter of fiscal 2022, the net income was posted at US$ 122 million versus US$ 110 million in Q2 2021. The cash and cash equivalents also rose to US$ 823 million versus US$ 530 million.

The dividend paid by the company on a quarterly basis is US$ 0.32 per share.

The graph below shows the changes in the total assets of Brookfield Renewable Partners within six months.

For Q2 2022, the revenue of WSP Global Inc. grew by five per cent to C$ 2.8 billion compared to Q2 2021. The adjusted EBITDA also rose to C$ 352.2 million and increased by 2.8 per cent, as against C$ 342.6 million in Q2 2021.

On September 22, 2022, the company announced the completion of its acquisition of Capita Real Estate and Infrastructure Ltd. and GL Hearn Ltd.

For Q2 2022, the organic loan growth of goeasy Ltd increased by 191 per cent to C$ 216 million from $74 million in Q2 2021.

The EBITDA rose to C$ 90.47 million compared to C$ 62.49 million. goeasy Ltd pays a dividend of C$ 0.91 per share on a quarterly basis.

Bottom Line: Amid a volatile market, long-term investors can follow a detailed approach to tap the substantial value for the future. Look for dividend stocks that may survive the market hiccups and sail through the bumpy ride. Also, different stocks can be explored such as mid-cap or small cap to add the element of diversification. Stock market is continuously exposed to volatility and uncertainties.

With the ever-changing condition of the market, investors should be up-to-date with the latest market trends. It is easy to get swayed by uncertainties but making your portfolio risk-proof takes effort and vigilance. With diversification you are not prone to the risks.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.