By David Stanway and Yilei Sun

SHANGHAI (Reuters) - The death toll from China's coronavirus epidemic has soared past 1,000, the government said on Tuesday, as worry grew that the extent of economic disruption to the world's second-largest economy was greater than estimated.

Companies struggled to get back to work after an extended Lunar New Year holiday while hundreds of Chinese firms said they would need billions of dollars in loans to stay afloat. Layoffs also began, despite assurances by President Xi Jinping that widespread sackings would be avoided.

"The coronavirus outbreak completely changed the dynamics of the Chinese economy," JPMorgan (NYSE:JPM) analysts said in a note to clients as they again downgraded forecasts for Chinese growth this quarter.

Another 108 virus deaths were reported on Tuesday, a daily record, taking to 1,016 the total of those killed in China, the National Health Commission said. All but five of the deaths were in the central province of Hubei, the epicenter of the outbreak.

Reuters graphics on the new coronavirus: https://graphics.reuters.com/CHINA-HEALTH-GRAPHICS/0100B5CD3DP/index.html

There were 2,478 new confirmed cases on the mainland by Monday, down from 3,062 the previous day, bringing the total to 42,638. It was the second time in two weeks that authorities recorded a daily drop in new cases, offering a hint of hope the epidemic was peaking.

Asian stock markets rallied as investors took some comfort from the drop, even though experts have warned it is too early to assume the numbers represent a trend.

The World Health Organization (WHO) said the spread of cases outside China could be "the spark that becomes a bigger fire".

Heavily sold currencies such as the Australian dollar

Only 319 cases have been confirmed in 24 other countries and territories outside mainland China, according to WHO and Chinese health officials, with two deaths, one in Hong Kong and the other in the Philippines.

While a WHO team has arrived in China to help investigate the outbreak, the agency began a two-day meeting of 400 researchers in Geneva aimed at accelerating research into diagnostics, drugs and vaccines.

GRAPHIC: Comparing new coronavirus to SARS and MERS - https://graphics.reuters.com/CHINA-HEALTH-VIRUS-COMPARISON/0100B5BY3CY/index.html

SACKINGS START

More than 300 Chinese companies are seeking bank loans totaling at least 57.4 billion yuan ($8.2 billion) to help cope with the disruption caused by locked down cities, closed factories and crippled supply lines, two banking sources said.

Among the prospective borrowers are food delivery giant Meituan Dianping (HK:3690), smartphone maker Xiaomi Corp (HK:1810) and ride-hailing provider Didi Chuxing Technology Co, the sources said.

Chinese firm Xinchao Media said on Monday it had laid off 500 people, or just over a tenth of its workforce, and restaurant chain Xibei said it was worried about how to pay the wages of its roughly 20,000 workers.

Authorities said they would roll out measures to stabilize jobs, in addition to previously announced cuts to interest rates and fiscal stimulus designed to minimize any downturn.

But analysts at investment bank Nomura said measures of returning workers and passenger traffic flows suggested the virus had "a devastating impact on China's economy in January and February".

In a note, they wrote, "We are concerned that global markets thus far appear to be significantly underestimating the extent of disruption."

Bankers in Asia were bracing for a deal drought with several auctions of assets facing delays or re-assessments and preparations for Chinese initial public offerings slowing.

"Nothing is happening," said a Hong Kong-based investment banker with a Wall Street bank.

Hubei, where the flu-like virus emerged from a wildlife market in the provincial capital of Wuhan in December, reported 2,097 new cases and 103 new deaths on Feb. 10, its health authority said.

SHIP IN LIMBO

Public anger over the handling of the outbreak has been rising and Hubei's government dismissed the provincial health commission's Communist Party boss, Zhang Jin, and director Liu Yingzi, state media said.

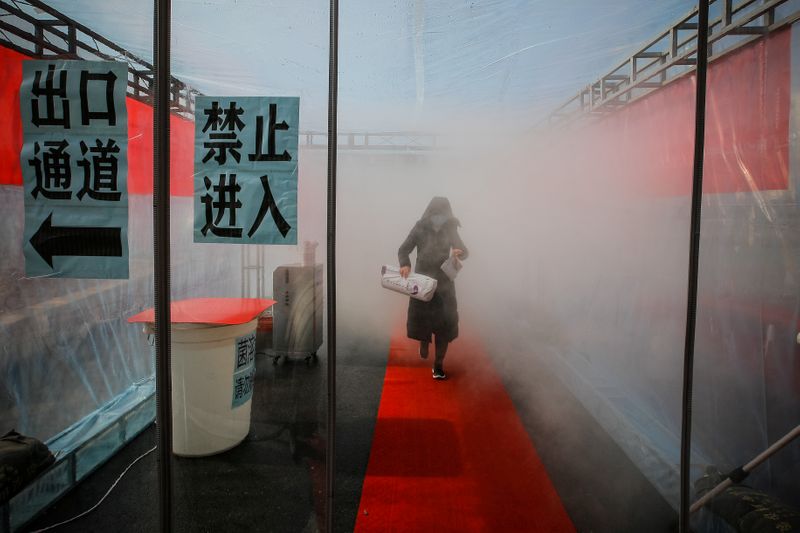

Hubei remains in virtual lockdown, with its train stations and airports shut and roads blocked.

One Beijing government official said it would be harder to curb the spread of the virus as people return to work. "The capacity of communities and flow of people will greatly increase the difficulty," he said.

About 160 million people are expected to return to their homes across China over the next week following the end of the holiday, a transport official said.

The virus has caused chaos in Asia, with many flights suspended, businesses disrupted and entry restrictions imposed by governments trying to ward off its spread.

It has also roiled the world of luxury cruises.

The Diamond Princess cruise ship with 3,700 passengers and crew remained quarantined in Japan's port of Yokohama, with 65 more cases detected, taking the number of confirmed cases from the Carnival Corp-owned (N:CCL) vessel to 135.

Thailand said it had barred passengers from disembarking another Carnival Corp ship, Holland America Line's MS Westerdam, the latest country to turn the vessel away due to coronavirus fears although no confirmed infections have been found on board.

It has already been turned away by Japan and the Philippines.

"Now we are back in limbo," passenger Stephen Hansen told Reuters by email.