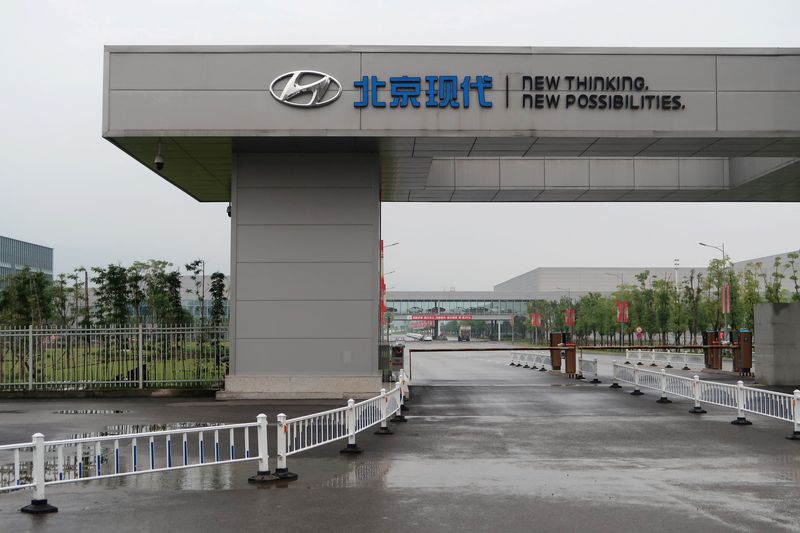

SHANGHAI (Reuters) -Beijing Hyundai Motor has cut the minimum asking price for its auto plant in China's southwestern city of Chongqing by almost 30%, to 2.58 billion yuan ($353.38 million), after putting it up for sale in August.

No buyer or timeline has been set for disposal of the plant, part of a joint venture of Hyundai Motor and Beijing Automotive Group Co, as the South Korean automaker rejigs China strategy amid fierce price competition and slowing demand.

"We plan to strengthen efforts to improve profitability through rationalisation of production," the firm said on Monday in response to queries from Reuters, without commenting on the cut.

"No buyer or schedule has been decided," it added.

The price cut was disclosed in a filing last month on the China Beijing Equity Exchange that did not give a reason for the reduction from the original price of 3.68 billion yuan.

Beijing Hyundai Motor is selling the land use rights, equipment and other facilities at the plant, which started production in 2017 with annual capacity of 300,000 cars.

The sale decision came after Hyundai vowed in June to further restructure its China business to focus on profitability.

Hyundai, which had five plants in China at its peak, sold one in 2021. It plans eventually to run just two, optimising production for export to emerging markets.

Rivalry has intensified in China's automobile market, the world's largest, as automakers battling weakening demand step up competition on price.

U.S. automaker Tesla (NASDAQ:TSLA) has been the outlier among foreign brands in terms of China performance, almost doubling its share of the domestic electric vehicle market to 13.2% in August from 7.5% in July.

($1=7.3010 Chinese yuan renminbi)