GuruFocus -

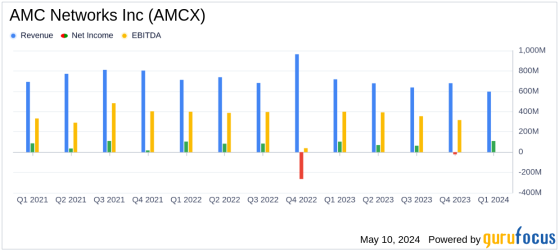

- Revenue: Reported at $596 million, a decrease of 17% year-over-year, falling short of estimates of $602.60 million.

- Net Income: Reported at $45.8 million, significantly below the estimated $68.73 million.

- Earnings Per Share (EPS): Diluted EPS at $1.03, below the estimated $1.67.

- Free Cash Flow: Generated $144 million, indicating strong cash generation capabilities.

- Operating Income: Totaled $110 million, down 36.4% from the previous year, reflecting increased operational challenges.

- Streaming Revenue: Increased by 3% to $145 million, driven by subscriber growth and price increases.

- Debt Reduction: Reduced gross debt by over $500 million since Q3 2023, enhancing financial stability.

On May 10, 2024, AMC Networks Inc (NASDAQ:AMCX) disclosed its financial outcomes for the first quarter ended March 31, 2024, through an 8-K filing. The company, renowned for its original programming and targeted streaming services, reported a mixed financial performance with significant strategic developments aimed at adapting to the evolving media landscape.

Company OverviewAMC Networks owns a variety of linear pay-TV networks including AMC, WE tv, BBC America, IFC, and SundanceTV, with AMC being the most widely distributed network reaching nearly 65 million pay-TV households in the US as of the end of 2023. The company has also been expanding its streaming services, with nearly 11.5 million US streaming subscribers, primarily through its flagship platform, AMC+. Post (NYSE:POST) an international divestiture at the end of 2023, AMC Networks' operations are now predominantly based in the domestic market, accounting for nearly 90% of its total revenue.

Financial Performance AnalysisAMC Networks reported a decrease in net revenues to $596 million in Q1 2024, down 17% from $717 million in the previous year. This decline was partly due to nonrecurring revenues in the prior year. When adjusted for these factors, net revenues saw a 6% decrease. The diluted earnings per share (EPS) stood at $1.03, a significant drop from $2.36 in Q1 2023. The adjusted EPS was reported at $1.16, falling short of the analyst estimate of $1.67.

Despite the revenue downturn, AMC Networks highlighted a positive aspect of its financial health with a net cash provided by operating activities of $151 million and a robust free cash flow of $144 million. These figures underscore the company's ability to generate cash amidst challenging market conditions.

Strategic Highlights and Operational ChallengesThe quarter saw several strategic moves aimed at bolstering AMC Networks' position in a rapidly transforming industry. The debut of "The Walking Dead: The Ones Who Live" significantly boosted viewership on AMC and AMC+, reinforcing the network's content strength. Furthermore, the company expanded its ad-supported streaming offerings and enhanced user experiences across its platforms.

However, the overall decline in linear TV viewership and a challenging advertising market posed significant hurdles, impacting revenue streams from traditional cable services and advertising. The international segment also experienced a downturn, with revenues decreasing by 30%, influenced by the divestiture of the 25/7 Media business and non-renewal of certain distribution agreements.

Debt Management and Future OutlookAMC Networks has taken proactive steps to strengthen its balance sheet through refinancing activities, reducing gross debt by over $500 million since Q3 2023. These efforts are aimed at improving financial flexibility as the company navigates through industry shifts and invests in content and digital transformation.

The company's focus on expanding its streaming services and leveraging its content library to meet changing consumer preferences is expected to play a crucial role in its growth strategy moving forward. However, the ongoing challenges in the advertising and linear TV markets will require continued innovation and strategic adjustments.

For detailed financial tables and further discussion on non-GAAP financial measures such as Adjusted Operating Income and Free Cash Flow, please refer to the full earnings release.

AMC Networks will host a conference call today at 8:30 a.m. ET to discuss these results in more detail. Interested parties can access the call through AMC Networks' investor relations website.

ConclusionAMC Networks Inc faces a transformative period as it adapts to the evolving media consumption landscape. While the first quarter results show some financial strains, the strategic initiatives underway highlight the company's commitment to maintaining its relevance and financial health in a competitive industry.

Explore the complete 8-K earnings release (here) from AMC Networks Inc for further details.

This content was originally published on Gurufocus.com