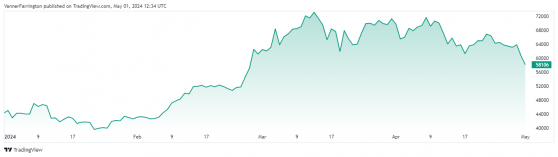

Proactive Investors - Bitcoin flopped 5% against the US dollar on Tuesday and continued to march another 4% lower today, bringing the world’s largest cryptocurrency to a two-month low of $58,131.

“The recent downtrend can be attributed to increased profit-taking by investors who entered the market during the downturns of 2022 and 2023, as well as ETF investors who witnessed significant price appreciation on their shares after entering the market in the early weeks of 2024,” said Matteo Greco, research analyst at Fineqia International.

Greco also highlighted the “stagnant demand” for spot-bitcoin exchange-traded funds, which are now entering their four months in existence.

“ETFs with BTC as the underlying asset experienced approximately $325 million in outflows during the week, following the $205 million outflows observed the week prior. This marks the third consecutive week of net outflows for BTC ETFs,” noted Greco.

On a week-on-week basis, bitcoin is now 13% lower.

Bitcoin remains 38% higher year to date

Ethereum (ETH), the second-largest cryptocurrency, was slapped 6.3% lower on Tuesday and continued to cede ground against the US dollar today.

At the time of writing, the ETH/USD pair was swapping 11% lower week on week at $2,918.

In the broader altcoin space, Solana (SOL) and Shiba Inu (SHIB) fell more than 20% in the past seven days, while Binance’s BNB token and Ripple (XRP) have kept their losses to the upper single digits.

Global cryptocurrency market capitalisation currently stands at $2.16 trillion, with bitcoin dominance at 52.9%.

Read more on Proactive Investors CA