The uranium market experienced a notable upturn in August, continuing its six-week winning streak to levels unseen since April 2022. Uranium futures surpassed the $58 per pound threshold driven by an upbeat demand outlook and persistent supply risks amidst the potential for sanctions affecting Russia's nuclear fuel supply.

Adding to concerns, a vessel carrying uranium was prevented from leaving St. Petersburg due to insufficient insurance coverage, amplifying fears around potential trade disruptions. This event underscores the limitations of local production avenues, with Kremlin-controlled Rosatom Corp. the primary provider of fuel for nuclear power plants around the globe, currently fulfilling roughly 50% of the worldwide need for enriched uranium.

On the demand side, the ongoing construction of large-scale Chinese power plants is helping maintain a steady pace. Similar developments have been observed in the West, with countries competitively pushing to rebuild independent uranium processing capabilities. As an illustration, the French nuclear safety agency has extended operational plans for aging reactors, emphasizing their reliance on this controversial power source.

And, on a separate note, it’s also worth noting that the European Commission recognizes that “nuclear energy, subject to strict safety and environmental conditions (including on waste disposal) that ensure the respect of the do no significant harm principle, can play a role in the transition towards climate neutrality in line with the European Green Deal.”

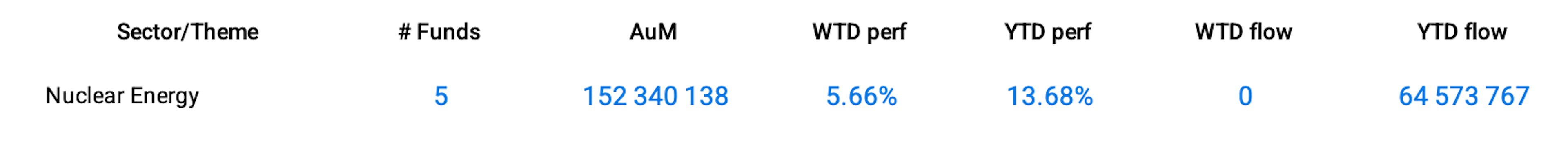

Group Data: Nuclear Energy

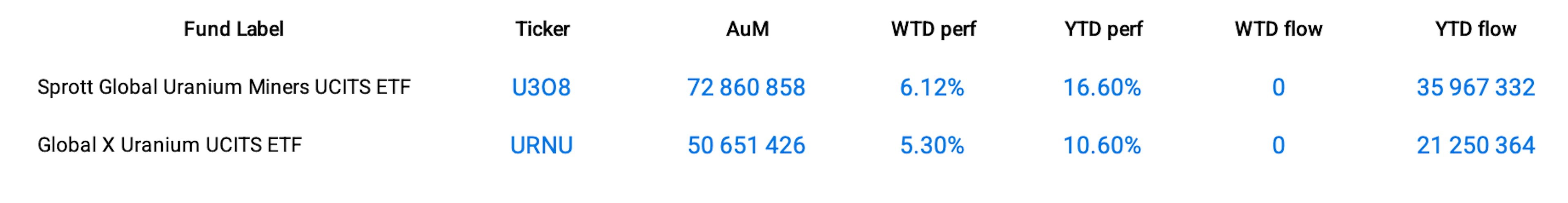

Funds Specific Data: U3O8, URNU