Uranium prices have recently reached a peak not seen in over a decade. According to the latest data, uranium is trading at $65.50 per pound, marking its highest value in 12 years. This increase can be attributed to several factors, primarily the global resurgence of nuclear power. The Nuclear Energy theme gained 10.02% over the week, reaching an impressive year to date performance of +44.84%.

The escalating costs of gas and mounting concerns about energy security are driving nations worldwide to reconsider nuclear power as an alternative source of energy. According to a report by the World Nuclear Association, this shift towards nuclear power could potentially double uranium demand from its current level of 65,650 tonnes annually to an estimated 130,000 tonnes each year.

In addition to these market dynamics, geopolitical events are also influencing uranium supply and demand balances. Russia's significant role in the global uranium market and recent political instability in Niger – one of Africa’s largest uranium producers – have further contributed to this upward trend in prices. Last but not least, Cameco (TSX:CCO), one of the largest global providers of uranium fuel, has unexpectedly reduced production for its Canadian uranium mining operations.

The reasons include equipment reliability issues at Cigar Lake and continued uncertainty over planned production output at Key Lake, as it resumes operations after an extensive period of care and maintenance.

Group Data: Nuclear Energy

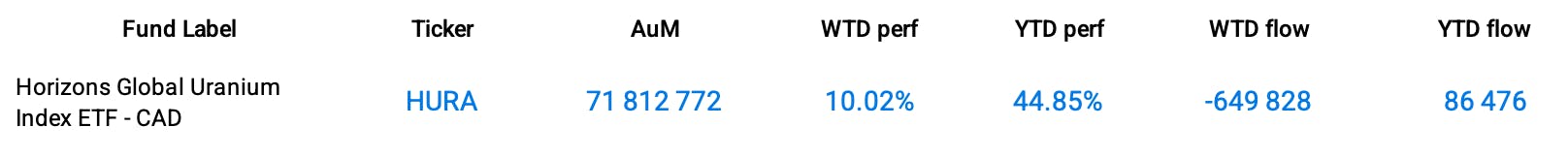

Funds Specific Data: HURA

This content was originally published by our partners at the Canadian ETF Marketplace.