By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

This is an important week for the U.S. dollar but it starts with very little consistency in the greenback's performance. Softer manufacturing activity in the Chicago region took USD/JPY slightly lower but the majority of the pair’s losses were incurred during the Asian trading session. We don’t expect any leadership from the dollar until mid-week when the ADP report is released and even then, traders may wait until the non-manufacturing ISM numbers to form their views for nonfarm payrolls. Instead, data from other parts of the world will drive currency flows. On Friday, we said the front of the week will be about China and while no ground-making announcements came out of G20, China lowered its reserve requirement ratio after the meeting in an attempt to ease lending, bolster the economy and appease their international counterparts. The general effects of the RRR reduction are questionable but China’s government would not have taken this move if it was not concerned about the economy. Chinese data is notoriously difficult to handicap but this gives us reason to believe that manufacturing- and service-sector activity slowed in February.

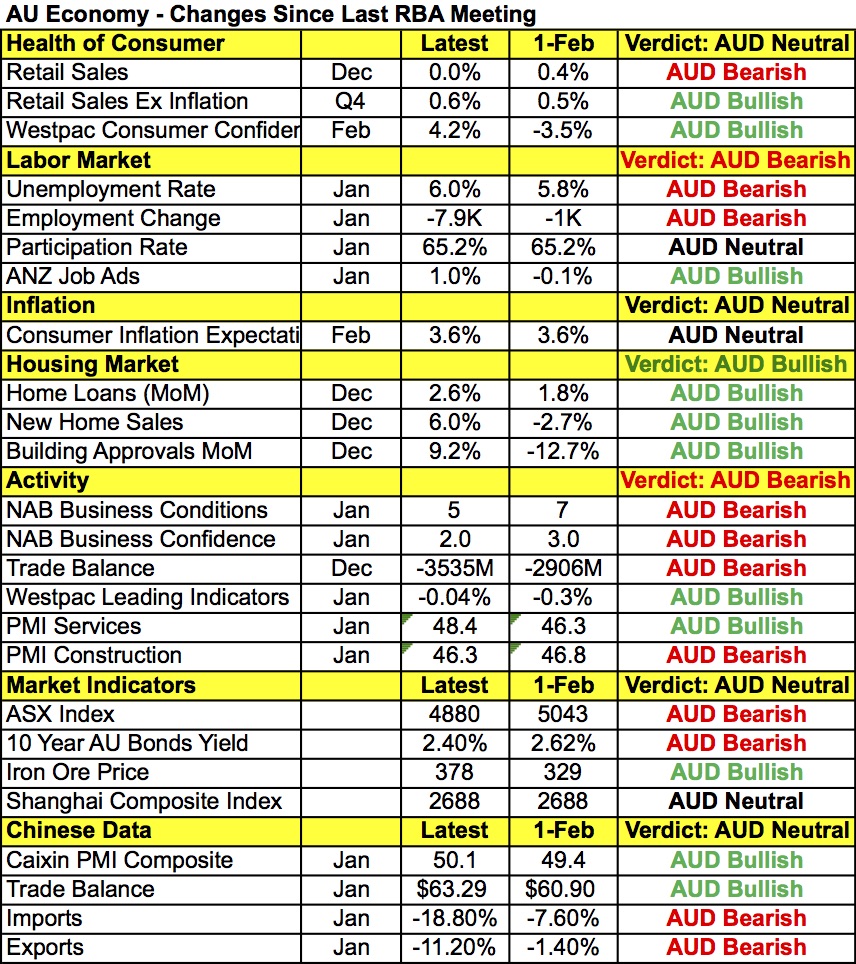

Saying that the Australian dollar, euro and British pound are in play for the next 24 hours is an understatement as these 3 currencies will be in focus throughout the week starting with AUD. Aside from the Chinese PMI, Australia’s manufacturing PMI report was scheduled for release Monday evening followed by the Reserve Bank of Australia’s monetary policy announcement. Taking a look at the table below, there appears to be as much improvement as deterioration in the economy since the last meeting. However most of the areas of strength also entail underlying weakness. For example retail sales excluding inflation increased in the fourth quarter but the monthly data shows a significant slowdown toward year end. The housing market is ambiguously strong but the service sector is still contracting despite the uptick in PMI. Also, while China’s trade surplus increased in January it was only due to significant declines in imports and exports. At the end of the day, the RBA has more to be worried about but they have been stoically optimistic for the past few months so it remains to be seen whether their views have been altered by recent developments. Fresh concerns from the RBA will be needed to drive AUD below 71 cents.

With just 8 more trading days to go before the European Central Bank’s monetary policy meeting, we expect EUR/USD to trade lower as investors position for additional easing from the central bank. The latest Eurozone economic reports reminds everyone why the ECB needs to do more. Consumer prices turned negative in February with year-over-year CPI growth estimated at -0.2% for February. That was the sharpest decline in 12 months and while energy prices contributed to the drop, core price growth, which excludes energy, still declined. German retail sales increased more than expected but year over year, growth slowed. Underlying weakness drove euro below 1.09 with more losses likely if Tuesday’s German unemployment report also surprises to the downside. With investors looking to sell euros ahead of the rate decision, weak numbers will reinforce the market’s conviction, leading to more aggressive declines in the currency, whereas stronger data should only lead to shallow recoveries.

Sterling started the week at a fresh 6-year low despite stronger-than-expected consumer credit and mortgage approvals. Brexit remains an overarching concern for the U.K. and its currency but the real test for the pound this week will be data. Manufacturing-, service- and construction-sector PMIs are scheduled for release and if activity weakens, it could be the nail in the coffin for the pound. The PMI reports are some of the most market-moving pieces of U.K. data and according to the Confederation of British Industry, manufacturing orders dropped by the largest amount in 4 months.

Next to USD/JPY, the second-worst performing currency pair on Monday was NZD/USD. Economic data from New Zealand was extremely weak with the ANZ activity outlook index falling to 25.5 from 34.4 and the business confidence index slipping to 7.1 in February from 23 in January. This shows that not only are NZ businesses reporting weaker activity, but they are also growing less confident about the outlook for the economy as dairy prices fall and global uncertainty continues. Building permits also dropped 8.2%, which was the largest decline since September 2014. The terms of trade and another dairy auction are scheduled for Tuesday. Prices dropped at every auction this year but NZD shrugged off each decline. However given the backdrop of weaker sentiment, they may not be able to look past the deterioration for much longer.

Finally, USD/CAD ended the day unchanged despite the 3% rise in oil prices and better-than-expected Canadian data. The country’s current account deficit widened less than anticipated in the fourth quarter and industrial product prices increased. Raw-material prices dropped, but far less than the market expected. Between the improvement in inflation conditions and the rise in oil prices, USD/CAD should be trading below 1.3500, but this support level is significant not only because it’s a psychologically relevant number but also because it is right above the 61.8% Fibonacci retracement of the 2002-to-2007 decline. Many investors also fear that data including Tuesday’s GDP report and Friday’s IVEY PMI index still needs to catch up with the prior decline in oil.