- India halts rice imports amid shortage concerns in the domestic market

- Cocoa prices surge due to weather and political factors

- Sugar prices are on the rise as reduced production expectations persist

Weather remains a pivotal factor influencing the price dynamics of various agricultural commodities across the globe. This holds true for three major food commodities: cocoa, sugar, and rice, all of which have witnessed a substantial uptick in prices in recent weeks.

When discussing weather-related factors, the focal point of concern is the El Niño phenomenon. In essence, El Niño is the colloquial term for a weather event originating in the Pacific Ocean that can simultaneously trigger heavy rains in North and South America while causing droughts in Southeast Asia and Australia. The latter region, in particular, garners significant attention due to its substantial production of sugar and rice, among other agricultural goods.

In addition to meteorological phenomena, political and trade dynamics are also assuming greater significance, with India and West Africa emerging as dominant players.

Let's take a look at each one of the aforementioned commodities to try to understand what the near future holds for food prices.

Can Rice Bridge the Price Gap?

A pivotal development in the realm of rice price quotations is India's recent decision to halt the export of non-basmati rice in a bid to stabilize domestic market prices. This decision carries far-reaching implications for global markets, given that India, alongside China, holds a dominant position in the industry, accounting for 40% of global trade.

Furthermore, excessive rainfall in China, particularly in highly productive rice-growing regions, is adversely affecting crop yields, while Thailand is urging farmers to conserve water due to severe drought conditions. The convergence of these factors is expected to bolster demand and sustain price increases in the foreseeable future.

The first target level for buyers is the price gap located in the $17.5 price resistance. Breaking this level would open the way for an attack on this year's maximums of around $20.

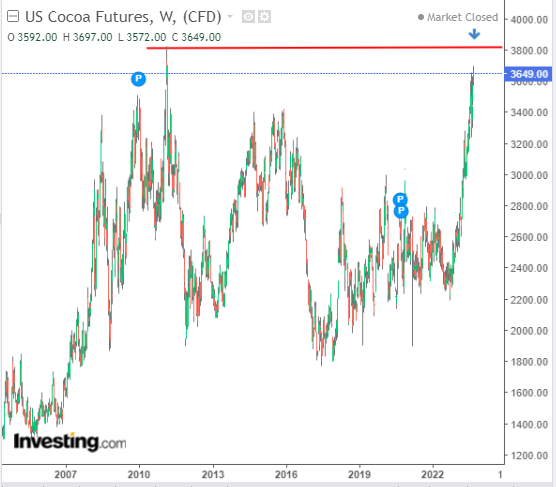

Cocoa Approaches Multi-Year High

Cocoa has experienced a remarkably dynamic uptrend for nearly a year, driving its valuation perilously close to the 2011 peak at approximately $3800.

Once again, adverse weather conditions took center stage, exacerbating their impact owing to the heavy reliance on cocoa cultivation in the West African nations of the Ivory Coast and Ghana. The region's fraught political climate further compounds the situation, exerting upward pressure on cocoa prices.

The current base scenario is an attack on the aforementioned multi-year high, which, with a combination of weather and political factors, appears highly likely.

Sugar Resumes Uptrend

China, the European Union, India, Mexico, and Thailand have all revised their sugar production forecasts downward for this season. This has inevitably intensified supply-side pressures that have been noticeable since mid-June. Brazil is the only country witnessing an increase in production, but even this surge isn't sufficient to offset the deficit from other regions.

Furthermore, stockpiles are dwindling, with the World Sugar Organization estimating a decrease of approximately 0.8 million tons. This indicates an imminent return to an upward trajectory in sugar prices. Just as with cocoa, we anticipate a challenge to recent price highs, in this case, the local peaks observed in April of this year.

If the breakthrough materializes, the next target for the demand side will be in the neighborhood of $28-$29, marking the highest levels since 2011.

***

Disclosure: The author holds no position in any of the instruments mentioned in this report.