Whilst the spotlight of the metals complex generally focuses on goldwhose demise has been relentless, silver too is following the same path lower. Whilst yesterday’s price action for the industrial metal was less dramatic than for gold, the price action this morning has opened up the same technical weakness now apparent on the daily silver chart.

Yesterday’s price action on the daily chart for silver suggested a continuation of the recent congestion phase which has seen silver prices oscillate between $14.40 per ounce to the upside, whilst building a floor of potential support in the $14.10 per ounce region on the March contract. However, in the overnight session on Globex, silver has opened lower at $13.975 per ounce and been moving lower to trade at $13.915 per ounce at the time of writing, testing the next area of potential support in the 13.800 per ounce area, with the pivot high of Tuesday adding further downwards pressure.

Overhead we now have several deep areas of resistance which are likely to present sustained barriers to any short term recover, with high volume nodes at $14.70 per ounce with the VPOC, and a further level now in place at $14.25 per ounce.

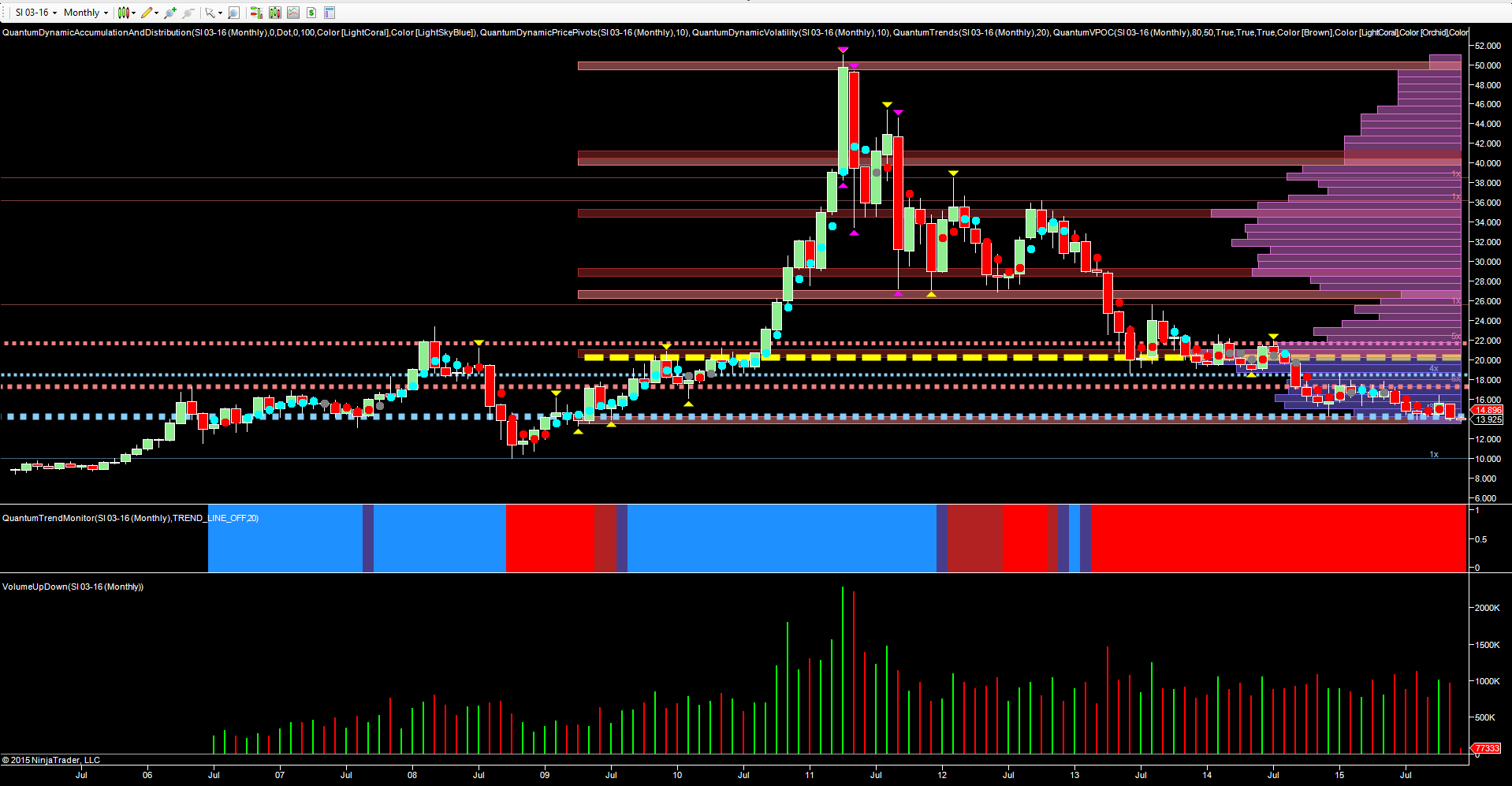

Moving to the longer term monthly chart for silver, this encapsulates the current sentiment, with the trend monitor indicator continuing to confirm the longer term bear trend. In addition, we are now breaking through the potential support platform marginally above the $14.00 per ounce area, as denoted with the blue dotted line of accumulation.

This is a region that has seen strong buying in the past, but which to date has held firm. However, should we close below this key level at the year end, then the trap door will indeed open wide for silver bears, with the potential to test support in the $10 per ounce level during 2016. The volume point of control remains firmly at $20 per ounce and as volumes build in the lower levels, this ultimately will dictate future price agreement on the longer term timeframes.