Financial Performance: EPS of $0.24, GAAP EPS of $0.55, Revenue of $1.71 billion, 25% year-over-year growth in total revenue.

Strategic Partnerships: Partnership with Amazon (NASDAQ:AMZN) allows U.S. merchants to integrate the Buy with Prime app, streamlining transactions. Association with Faire strengthens business-to-business commerce offerings.

Product Innovation: Focus on AI integration and the development of tools like Shopify (TSX:SHOP) Magic.

Shopify Inc has delivered impressive financial performance in the third quarter of 2023, surpassing market expectations and demonstrating its position as a global leader in the digital commerce sector. The company's strong focus on innovation, strategic partnerships, and customer-centric approach have contributed to its success.

Q3 2023 Performance

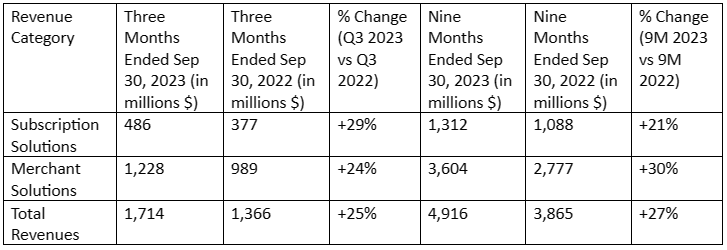

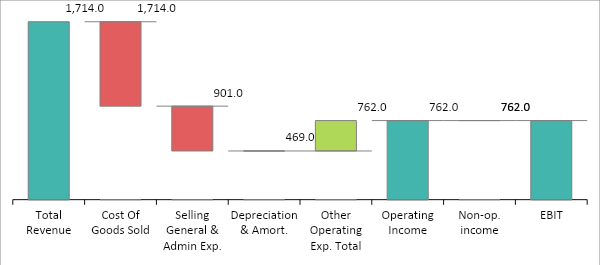

Shopify reported an EPS of $0.24, exceeding the consensus estimate by $0.10, and a GAAP EPS of $0.55, surpassing the estimate by $0.53. Its revenue of $1.71 billion also exceeded market expectations by $44.10 million. These strong financial results reflect the effectiveness of Shopify's business model and its ability to support merchants in the ever-evolving digital landscape.

Empowering Brick-and-Mortar Businesses

The company launched the Retail Plan, which provides brick-and-mortar businesses with the tools to establish an online presence. This initiative has been well-received, as evidenced by a 16% increase in POS Pro location expansion. Shopify's ability to bridge the gap between in-person and digital commerce highlights its innovative approach to supporting traditional retailers and further solidifies its position as a leader in the industry.

Targeting International Markets and Collaborations with Amazon and Faire

Expansion into international markets has been a key focus for Shopify. With the availability of its mobile point-of-sale system, POS Go, now extended to the U.K. and Ireland, Shopify aims to cater to a broader merchant base and tap into new customer segments. Additionally, the launch of Shopify Markets Pro, a cross-border commerce solution, allows merchants to sell and ship products internationally with ease. These strategic efforts to expand globally position Shopify as a preferred choice for businesses looking to access international markets.

Strategic partnerships have played a pivotal role in Shopify's growth and success. Collaborations with industry giants such as Amazon and Faire provide additional opportunities and benefits for Shopify merchants. The partnership with Amazon enables U.S. merchants to add the Buy with Prime app to the Shopify Checkout, streamlining transactions for customers. The association with Faire further strengthens Shopify's business-to-business commerce offerings, solidifying its position as the preferred point-of-sale provider for Faire's independent retail community.

Innovation in Customer Experience: Product Enhancements

Shopify's commitment to continuous product innovation is evident through the introduction of features like one-page checkout and customizable Shop Pay experiences. These enhancements streamline the buying process, improving customer satisfaction and conversion rates. Shopify's focus on AI integration and the development of tools like Shopify Magic further showcase its dedication to enhancing merchant productivity and creativity.

Future Outlook: Continued Growth and Optimization

The company's financial performance in the third quarter demonstrates its ability to achieve both top-line growth and profitability. With total revenue growing 25% year-over-year to $1.7 billion and a significant improvement in net income and diluted earnings per share, Shopify showcases the durability of its business model and its capacity for sustainable growth. Looking ahead, Shopify expects continued revenue growth, with a mid-twenties percentage rate projected for the full year. The company's focus on operational efficiency and disciplined marketing spend will further optimize profitability and drive sustainable growth. With its strong financial performance, strategic initiatives, and dedication to customer success, Shopify remains an attractive investment opportunity in the digital commerce sector.

Conclusion

Taking into account Shopify's impressive financial performance, strong market position, and commitment to continuous innovation, we suggest to add on to Shopify Inc.'s stock. The company's ability to adapt to changing market dynamics, expand into international markets, and form strategic partnerships solidifies its position as a leader in the digital commerce sector. As Shopify continues to support merchants and drive sustainable growth, it presents a compelling investment opportunity with significant long-term potential. However, investors are advised to conduct thorough due diligence aligned with their investment goals and risk tolerance before making any investment decisions.

Disclosure: We don’t hold any position in the stock and this is not a recommendation of any kind as investing carries risk.

This content was originally published on Equisights.com