A spike in commodity prices, largely sparked by robust US economic data driving the Federal Reserve’s strict monetary policy, is delivering considerable economic advantages to Latin American nations - especially Brazil – with commodity-backed stocks benefiting significantly.

Brazil's trade surplus experienced a substantial boost, growing by 140% year-on-year (YoY) to $9.8 billion in August. This rise was due to factors such as strong domestic output and growing demand for steel from China.

Contributions are also anticipated from record soybean imports which are likely to maintain this positive trend. High global demand for soybeans, a key Brazilian export, is majorly stimulating the nation's economy.

This explains why the Brazilian real showed remarkable resilience despite a strong greenback, rebounding from a three-month low to reach 4.86 per USD.

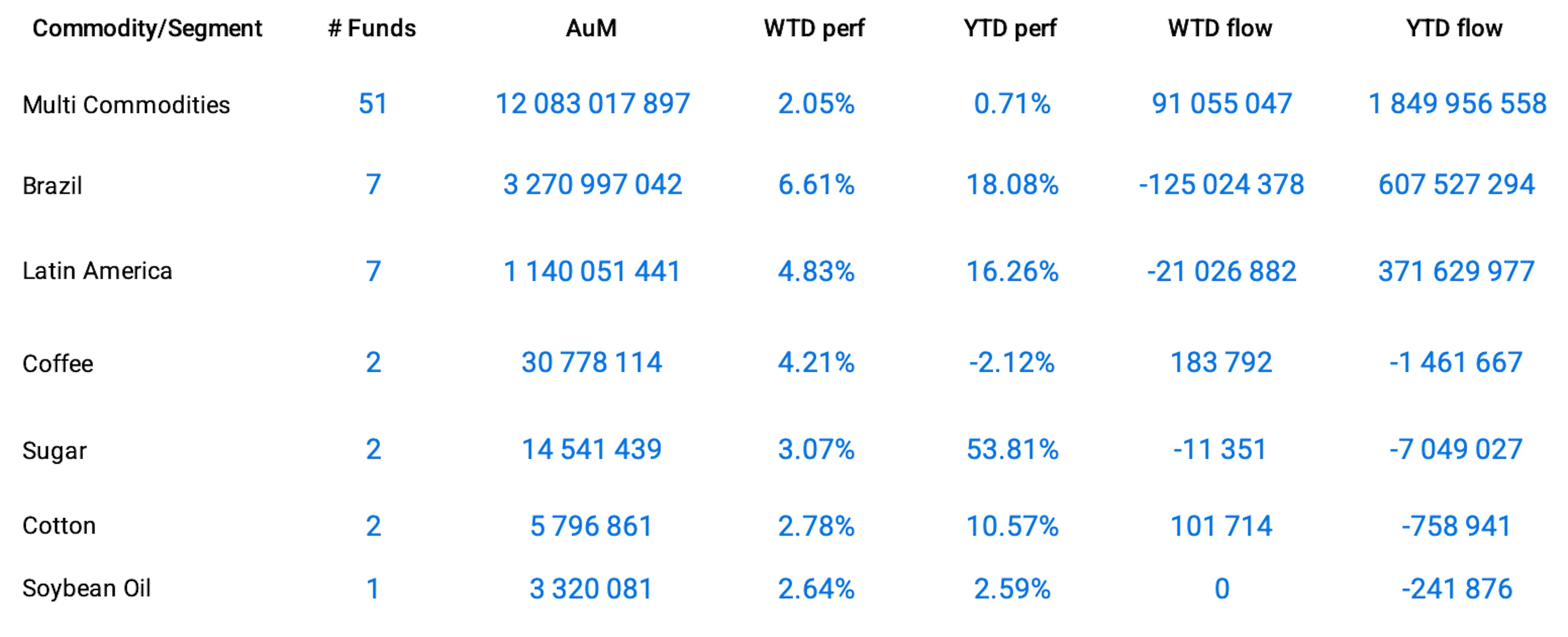

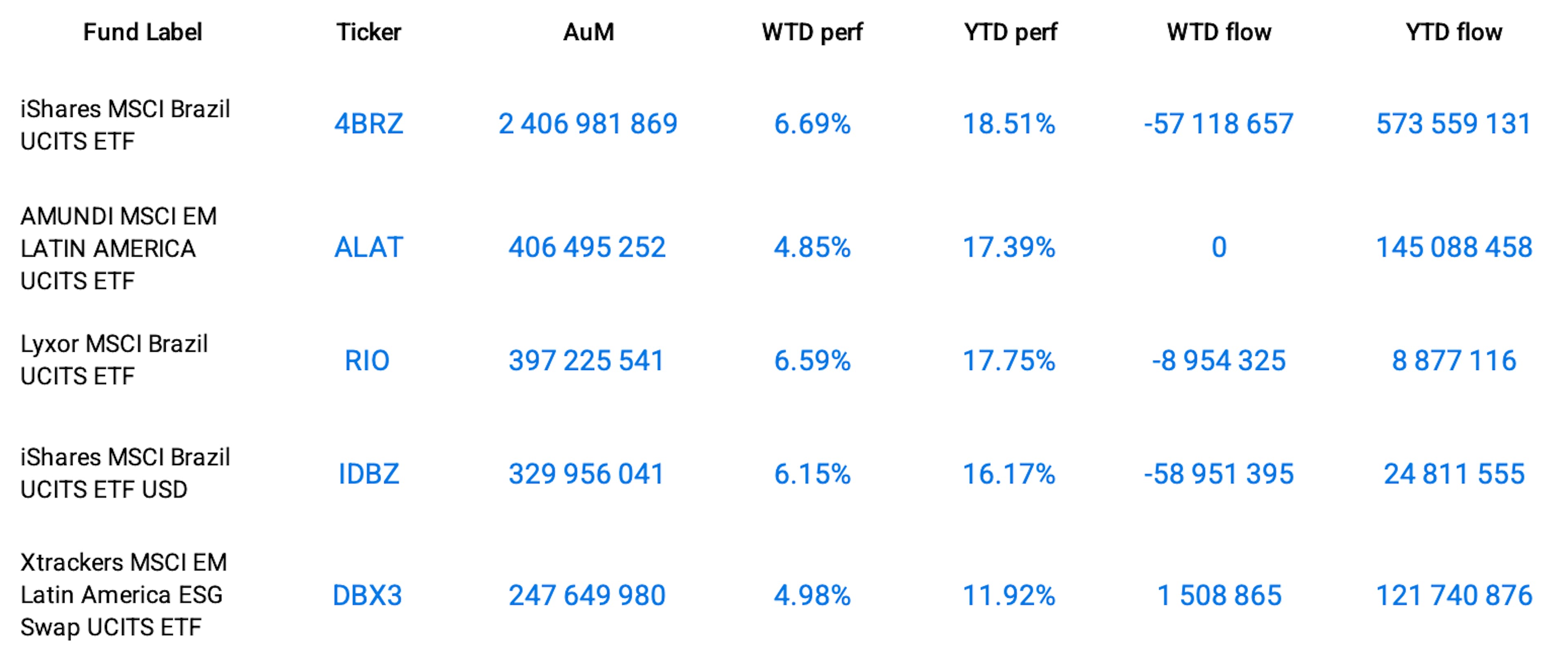

As an illustration, the Brazil and Latin America geographic focus segments gained +6.61% and 4.83% respectively over the week bringing their year-to-date performance to +18.08% and +16.26%.