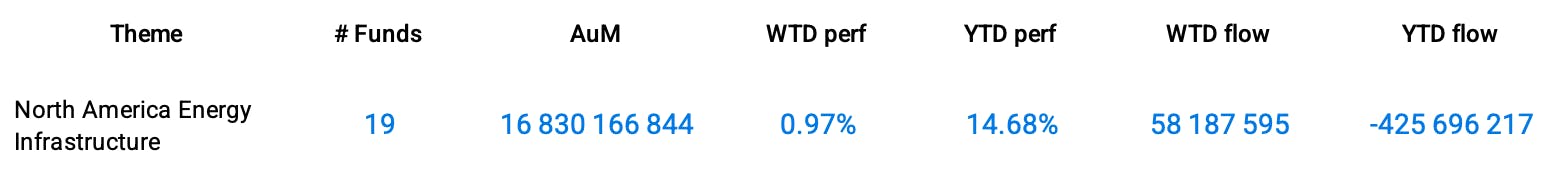

Financial markets witnessed a significant decline over the course of the past week. However, despite the downturn, MLP funds invested in energy infrastructure demonstrated resilience, gaining a respectable +0.97% over the week. This performance can be partially attributed to the level of oil prices which were hovering around $90 per barrel.

MLP funds are publicly traded partnerships that combine the tax benefits of a partnership with the liquidity of publicly traded securities. These investment vehicles are typically associated with stable recurring income and consequently are often considered as defensive assets during periods of market volatility.

In light of recent market events, investors appear to be turning their focus towards defensive sectors such as energy infrastructure through MLP funds. This shift is likely due to the funds’ potential for providing both tax advantages and steady revenue streams even under adverse market conditions.

While MLPs predominantly operate within the energy sector, they are not directly exposed to commodity price risks like traditional oil companies. Their revenues largely depend on volume rather than price. Hence, they offer some degree of insulation against volatile oil prices.

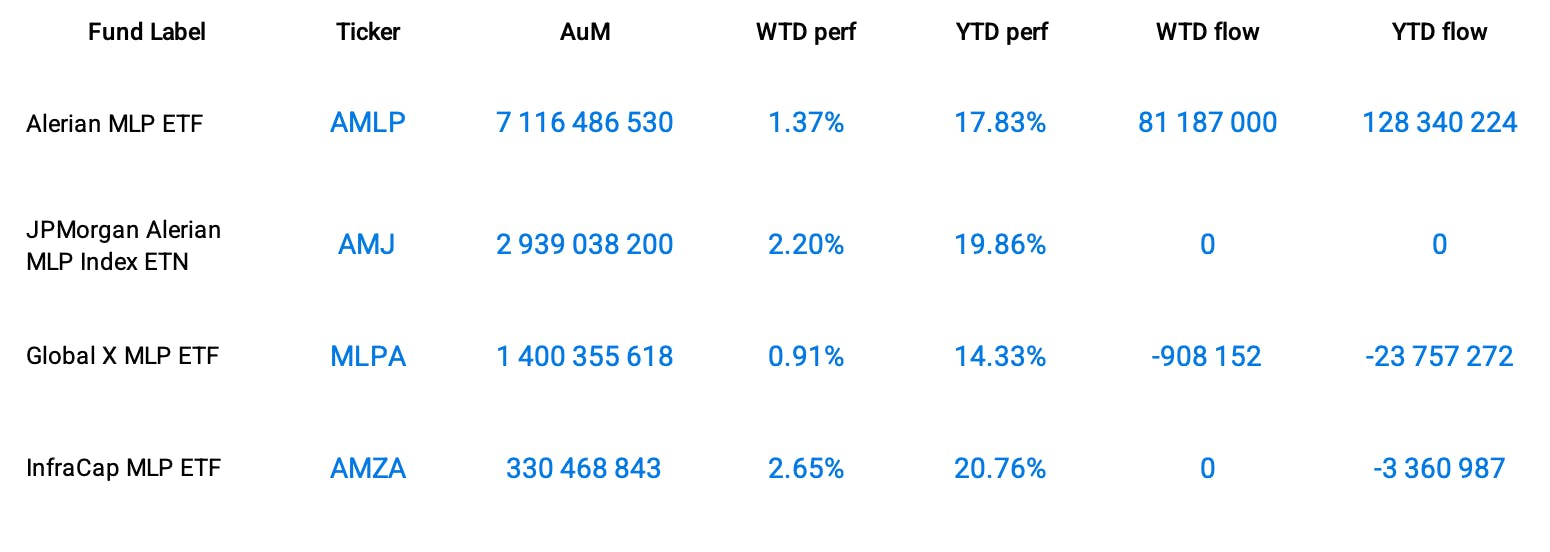

Illustrating this point, the Alerian MLP ETF (AMLP) gained +1.37% over the week, attracting inflows of $81 million over the same period. This brings the fund’s year-to-date performance to +17.83%.

Group Data: North America Energy Infrastructure

Funds Specific Data: AMLP, AMJ, MLPA, AMZA

This content was originally published by our partners at ETF Central.