WTI crude oil prices finished the week down 1.53% after a massive U.S. fuel inventory build raised concerns about demand in the largest oil market. U.S. crude inventories climbed 1.3 million barrels to reach 432.4 million in the week that ended on January 5th, defying analysts' expectations of a significant drop. The Energy Information Administration (EIA) report also indicated gasoline reserves had risen by 8 million barrels, while distillate supplies experienced a 6.5-million-barrel surge.

However, supply disruptions persisted in the Middle East after more violence in the Red Sea (NYSE:SE), one of the most vital trade routes between Europe and Asia. U.S.-led forces - together with the United Kingdom and with support from Australia, Bahrain, Canada, and the Netherlands - successfully conducted several airstrikes against the Iran-backed Houthi group in Yemen after the latter’s escalating attacks against commercial vessels.

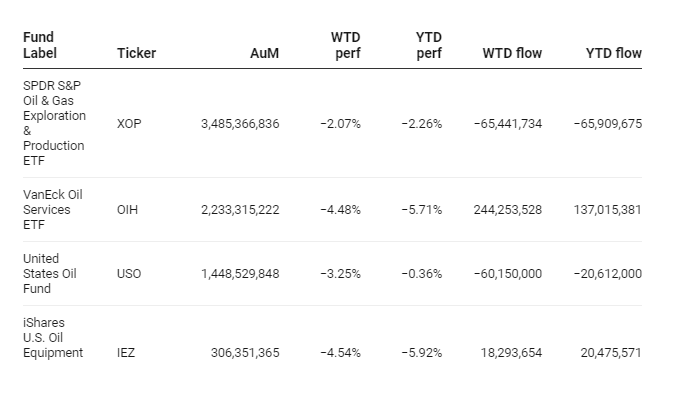

In an environment of substantial uncertainty, the VanEck Oil Services ETF (OIH) lost 4.48% for the week. The iShares U.S. Oil Equipment & Services ETF (IEZ) was down 4.54%.

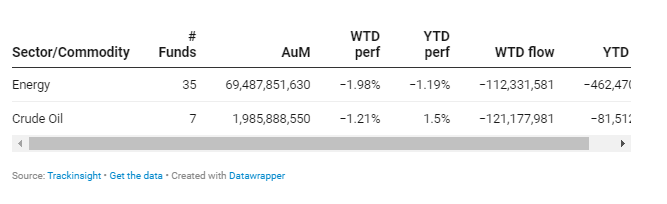

Group Data

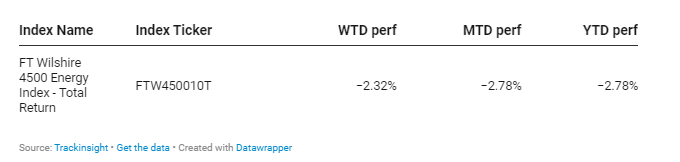

Index Data

Funds Specific Data