As 2023 draws to a close, the anticipation for the launch of the first U.S.-listed Bitcoin ETF (TSX:EBIT) reaches new heights, with January 2024 marked as a potential milestone for approval.

In this race, financial giant BlackRock (NYSE:BLK) is pitted against cryptocurrency veteran Grayscale, with other notable players like Ark Invest and Bitwise also in contention.

While the SEC deliberates on whether to greenlight these prospectuses or impose further delays, the investor community remains active and engaged. Bitcoin has rebounded from its low at the beginning of the year, peaking at $44,084 on December 5th. The brief 2022 "crypto winter" has seemingly thawed.

In the meantime, with the spot Bitcoin ETF still in regulatory limbo, there are multiple alternative ETFs that investors have been flocking to gain exposure to the cryptocurrency market. Here's a look at the major categories and some notable ETFs.

Bitcoin futures ETFs

Bitcoin futures, or "strategy" ETFs emerged a few years ago as a form of regulatory compromise with the SEC. Unlike a potential spot Bitcoin ETF, these ETFs do not purchase and hold actual Bitcoin in cold storage. Instead, they operate by using derivatives, specifically CME Bitcoin futures.

CME Bitcoin futures are contracts that speculate on the future price of Bitcoin. Investors in these ETFs are essentially betting on the price movement of Bitcoin without owning the actual cryptocurrency.

The major difference lies in this indirect exposure – while these ETFs reflect Bitcoin's price movements, they do not offer direct ownership of Bitcoin, which can lead to differences in performance compared to the actual cryptocurrency's market price.

This distinction is crucial for investors to understand when considering these types of ETFs for cryptocurrency exposure.

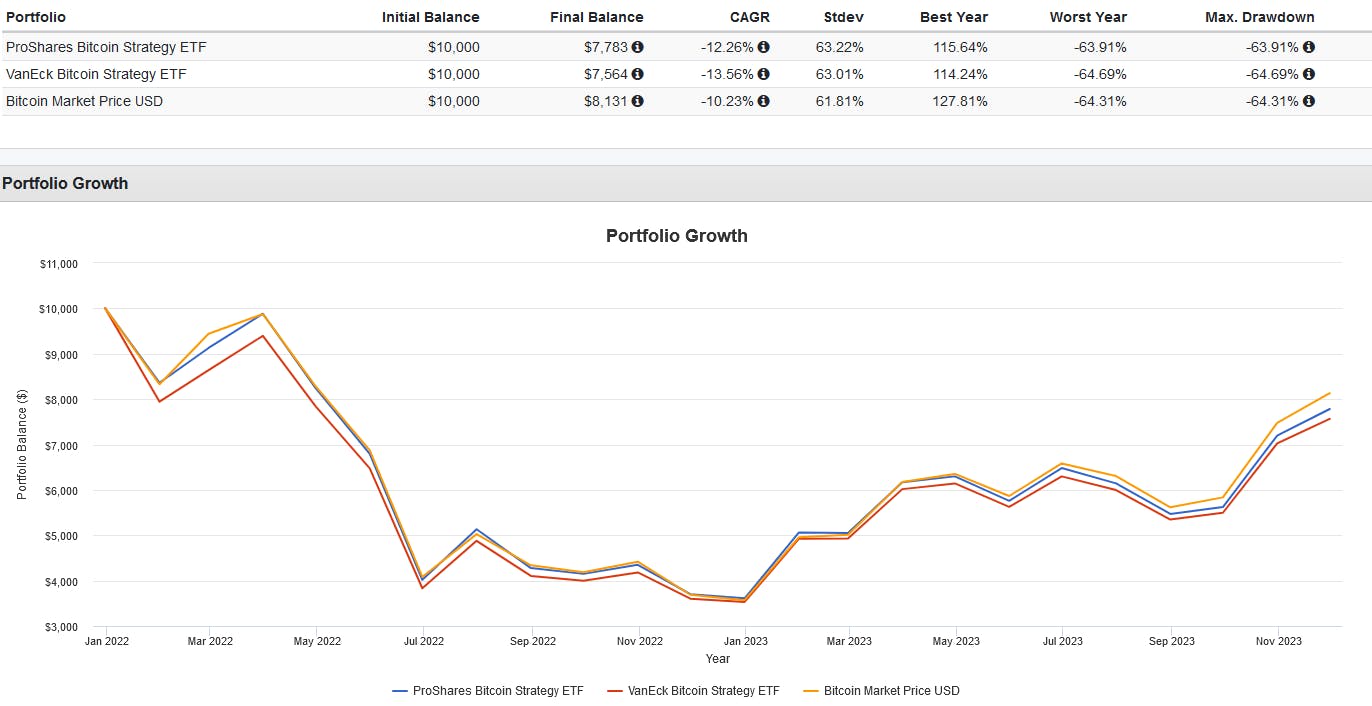

That being said, notable examples like the NYSE-listed ProShares Bitcoin Strategy ETF (BITO) and the VanEck Bitcoin Strategy ETF (XBTF) have done a fairly good job following the Bitcoin spot price, albeit over a short time frame and with some expected tracking error.

Other ETFs to watch here include the Global X Blockchain & Bitcoin Strategy ETF (BITS), the Hashdex Bitcoin Futures ETF (DEFI), and the Bitwise Bitcoin Strategy Optimum Roll ETF (BITC).

Bitcoin miner ETFs

Investing in Bitcoin miner ETFs offers another way to gain exposure to Bitcoin without the use of futures.

These ETFs invest in publicly listed companies deeply entrenched in the cryptocurrency industry, such as exchanges like Coinbase (NASDAQ:COIN), miners like Riot Blockchain, and firms holding significant Bitcoin reserves, like MicroStrategy.

This strategy adds an element of equity risk, akin to investing in gold miners instead of gold bullion. While it's correlated with Bitcoin's price, it also bears additional risks inherent to the companies' operations and embedded leverage.

Compared to futures ETFs, Bitcoin miner ETFs generally have lower fees and don't involve derivative risk. However, investors should be aware that they're not just betting on Bitcoin's price but also on the success and stability of these crypto-related companies, which in 2022 saw some exchanges fail.

Notable examples of these ETFs include the Bitwise Crypto Industry Innovators ETF (BITQ), the VanEck Digital Transformation ETF (DAPP), the Valkyrie Bitcoin Miners ETF (WGMI), and the Invesco Alerian Galaxy Crypto Economy ETF (SATO).

Portfolio diversification ETFs

Finally, Bitcoin's emergence as a distinct asset class has allowed fund managers to explore new avenues for portfolio diversification beyond traditional stocks and bonds.

For example, the WisdomTree Enhanced Commodity Strategy Fund (GCC) incorporates Bitcoin futures into its portfolio, allocating up to 5% in these futures alongside traditional exposures like agricultural, energy, base metals, and precious metals.

A more advanced example is the WisdomTree Managed Futures Strategy Fund (WTMF). This fund employs a managed futures strategy, a trend-following approach across multiple futures markets, including commodities, currencies, equity, and rates, and also incorporates up to 5% in Bitcoin futures.

The goal is to achieve positive absolute returns, which means generating a positive return regardless of market conditions. This approach is desirable for its low correlation to traditional equities and bonds, offering diversification benefits and potentially reducing overall portfolio risk.

This content was originally published by our partners at ETF Central.