- Despite bullish markets, Johnson & Johnson's stock price has declined over 4% year-to-date.

- Attention has now turned to the upcoming acquisition of Shockwave.

- Investors eagerly anticipate next week's earnings for insights into Johnson & Johnson's performance.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

Despite the widespread bull market since the beginning of the year, Johnson & Johnson's (NYSE:JNJ) stock has continually disappointed investors.

To break free from the downward spiral, the Pharma giant has recently stepped on the gas in its acquisition strategy in the medical market. The company's latest target is Shockwave, a specialist in cardiovascular therapy technology.

Investor attention is now turning to the upcoming quarterly results, set to be published next Tuesday. These results present an opportunity for Johnson & Johnson stock to reverse the downtrend, provided the number exceeds forecasts.

Otherwise, given yesterday's U.S. inflation data, which isn't favorable for stock markets, we may see the bears testing last year's lows formed in November.

Expanding Influence in the MedTech Segment

After recent acquisitions like Abiomed (NASDAQ:ABMD) and Laminar, Johnson & Johnson is now finalizing its $13.1 billion purchase of Shockwave.

This company specializes in therapies to break down calcification in arteries, reducing the risk of heart attacks. This move aims to diversify J&J's business and expand its portfolio, especially considering the looming threat of losing patent protection for the drug Stelar, which generates significant annual revenue.

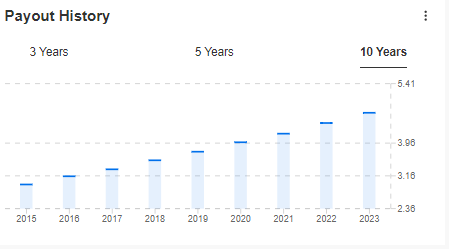

One concern is whether this extensive spending on acquisitions will affect dividend payments, a fundamental aspect of Johnson & Johnson's appeal. However, with a history of over 50 years of dividend payments and a high coverage ratio of interest payments, the risk of a significant decline in dividend payouts is limited.

Source: InvestingPro

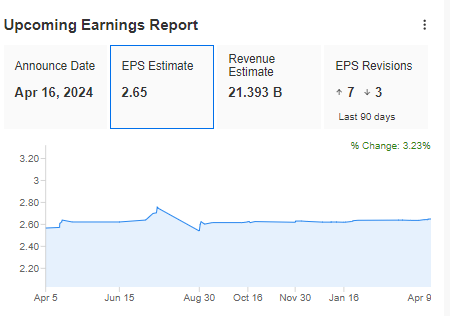

What to Expect From Johnson and Johnson's Upcoming Earnings?

The following consensus will be the benchmark for market reaction:

Source: InvestingPro

If the final readings match forecasts, it will mean a decrease from last year's figures, when earnings per share stood at $2.68 and revenues reached $24.746 billion. This negative outlook contributes to the ongoing selling pressure on the stock.

Technical View: Downtrend to Continue?

The downward trend that started last month continues, with a high probability of dipping below the $150 per share mark. If sellers succeed in this move, the primary scenario is to target last year's lows of around $145 per share.

If the quarterly results beat forecasts, there's a chance for a rebound, aiming first for around $158 per share. Breaking above the tough resistance at $163 would signal a potential shift in trend.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $10 per month.

Use the code INVESTINGPRO1 and get almost 40% off your 1-year subscription - less than what a Netflix (NASDAQ:NFLX) subscription costs you! (And you get more out of your investments too). With it you'll get:

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.