Stocks finished the day flat after a hot ADP report sent rates higher, and a cool ISM report sent rates back to flat. That left stocks moving sideways after a brief move higher in the midday and a decline into the close.

So, if you are counting, the S&P 500 finished the day below the 10-day exponential moving average for the second day in a row. The last time was on February 21, followed by a higher gap after NVIDIA (NASDAQ:NVDA) reported results.

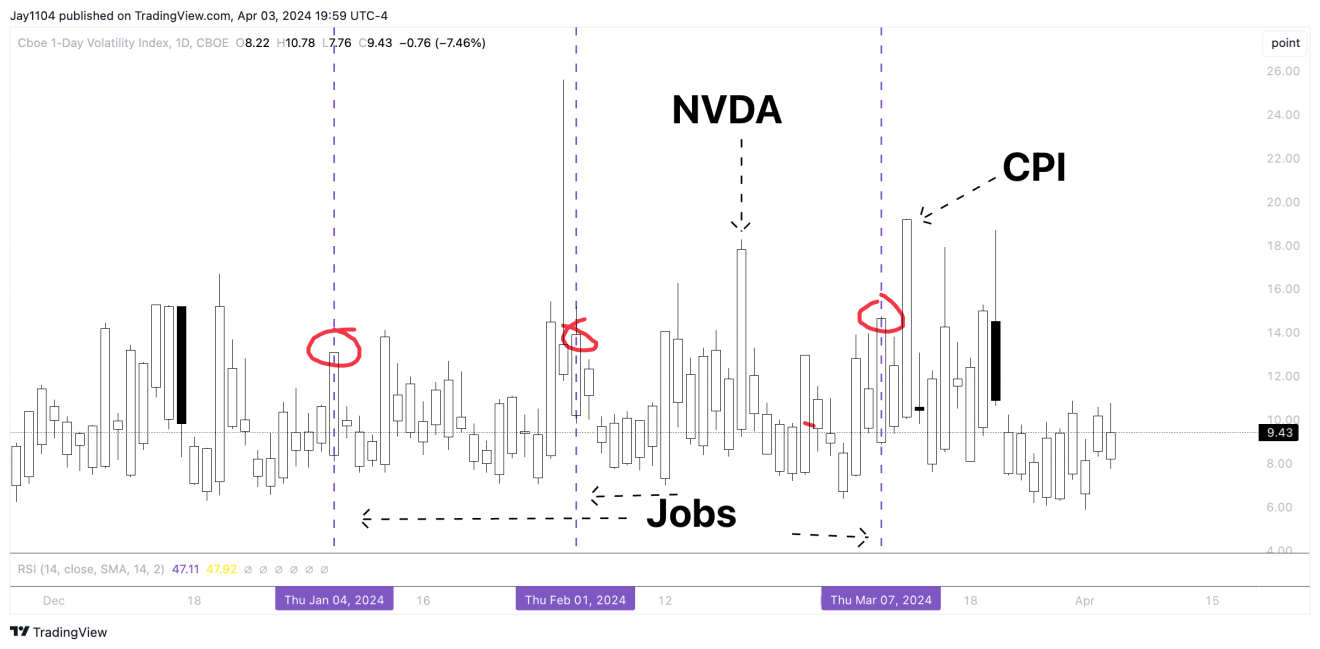

Today will be Job Reports Eve, which means we must watch the VIX1D closely to see how high it gets heading into the report on Friday morning. It doesn’t seem high enough to make a difference right now, but I would expect the VIX 1-day rise today; maybe it even gets into the mid-teens.

The past three reports have seen the VIX1D get up to around 13 to 14, compared to the VIX1D reaching 18 before the Nvidia report and 19 ahead of the CPI report. So, if the VIX1D stays in that 13 to 14 range, it probably doesn’t result in much volatility crush on Friday.

Meanwhile, copper prices surged yesterday and pushed higher above resistance at $4.15. It certainly looks like copper is in a recovery phase at this point and has some room to run until it hits resistance at around $4.30.

Oil also surged yesterday over resistance at $85.50, and if it can hold these levels and consolidate, it looks as if it will go higher and possibly back into the 90s.

Given the gains in copper and oil, I would think that we would see rates rise and push higher. Yesterday, they tried to move higher, and then they appeared to get nervous following the weaker-than-expected ISM report.

Still, the 10-year looks like it is consolidating just above resistance at 4.35%. The cup and handle pattern suggests that the 10-year moves higher to around 4.55%.

It seems pretty clear that inflationary risk assets are rising. At some point, this will have to catch up to interest rates, and rates will have to respond to the higher commodity prices and potential impacts on the inflationary outlook.