In 2022, investors faced a challenging market environment as inflation steadily climbed, presenting a conundrum for governments worldwide. Efforts to curb inflation through interest rate hikes risked plunging economies into recession, creating a delicate balancing act for policymakers.

Amid these conditions, equity markets entered a bearish phase, and bonds, traditionally seen as a safe haven during market turbulence, lost much of their protective allure, declining in value alongside stocks.

However, amidst this financial uncertainty, one asset class demonstrated remarkable resilience: infrastructure. Infrastructure investments, known for their stable and predictable cash flows, became a beacon of stability.

This asset class, which includes investments in utilities, transportation, and energy assets, among others, is often celebrated among institutional investors for its defensive nature. A prime example of this interest is the Canada Pension Plan (CPP), which allocates a significant portion of its portfolio to infrastructure assets.

While infrastructure investing might seem like a realm reserved for the institutional elite, retail investors also have the opportunity to participate, primarily through ETFs.

These ETFs offer an accessible means to invest in a diverse portfolio of infrastructure assets, combining the benefits of professional management, high liquidity, and diversification. Here's how Canadian ETFs can serve as a gateway for individual investors to tap into this asset class.

Why invest in infrastructure?

Infrastructure investment presents a compelling case for those looking to enhance their portfolios with assets that offer a blend of income potential, inflation resilience, and diversification benefits.

To illustrate these advantages, let's examine the AGF Systematic Global Infrastructure ETF (NLB:QIF), listed on Cboe Canada, as a prime example.

First and foremost, infrastructure investments are renowned for their attractive income potential. These entities typically generate stable cash flows with low variable costs after initial construction and operational phases are completed. The nature of their business models, often regulated or contracted, allows for predictable revenue streams, making them an excellent source of dividends.

As of March 8, QIF boasts a notable yield of 4.42%. This is largely attributed to its underlying portfolio, which includes electric and gas utilities, pipelines, cell-tower Real Estate Investment Trusts (REITs).

Infrastructure assets are also particularly resistant to inflation due to their often-regulated nature, allowing for inflation-linked pricing adjustments. This mechanism helps preserve the value of the income generated, even in inflationary periods, providing a cushion against the eroding effects of rising prices.

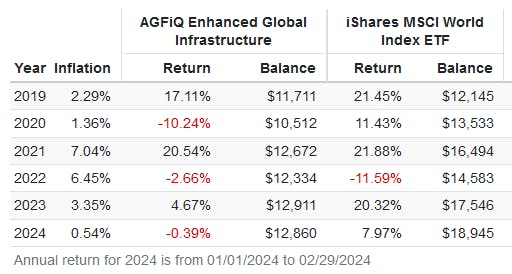

Case in point, during 2022, a year when average inflation hovered around 6.5%, QIF experienced a modest decline of just 2.66%, significantly outperforming broader markets. For comparison, the iShares MSCI World Index ETF (XWD) witnessed a decline of 11.59%.

Finally, infrastructure can play a crucial role in diversifying an investment portfolio. Infrastructure ETFs like QIF complement traditional equity investments by providing exposure to sectors like energy, real estate, and utilities, which may be underrepresented in broad market indices.

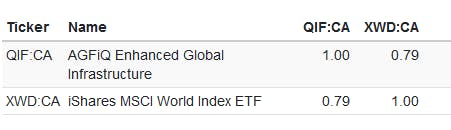

For example, QIF, with its 0.79 correlation to XWD, demonstrates less than perfect synchrony with global equity markets, offering a diversification benefit.

ETFs for investing in infrastructure

QIF is a notable example, but it's far from the only infrastructure ETF available to investors. A practical approach to uncovering a wider array of infrastructure investing opportunities is by utilizing the Cboe Canada ETF screener, a tool that, when searched with the keyword "infrastructure", currently displays 15 different ETF options.

This screener allows investors to further refine their search based on various criteria. For instance, you can organize the results by descending or ascending assets under management (AUM) or expense ratios, helping to identify ETFs that align with your investment size and cost preferences.

Moreover, additional filters can be applied to distinguish between active and passive index ETFs, ESG vs non-ESG ETFs, catering to different investment strategies and risk appetites. You can even filter for ETFs from your favorite provider, such as iShares or BMO (TSX:BMO) Global Asset Management.

This content was originally published by our partners at the Canadian ETF Marketplace.