Gold futures slipped lower Tuesday morning as strength in the U.S. dollar and fresh highs for U.S. stock benchmarks recently reflected waning demand for haven gold as investors awaited a speech from President Donald Trump.

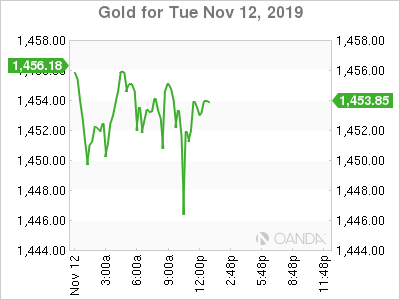

December gold GCZ19, -0.16% on Comex fell $3.80, or 0.3%, to $1,453.30 an ounce after shedding 0.4% on Monday, hitting its lowest settlement since Aug. 1, according to Dow Jones Market Data.

December silver SIZ19, -0.34%, meanwhile, shed 5 cents, or 0.3%, to $16.745 an ounce, following a 0.1% slide for gold’s sister metal a day ago.

Gold appears to be in a holding pattern while also barely hanging on a thread ahead of Trump’s speech at the Economic Club of NY. Trump’s ECNY speech is scheduled for noon Eastern Time and could provide a spark for precious metals and other assets if the president says something about the long-running U.S.-China trade scuffle.

With gold hovering around key support, a Trump Christmas surprise could deliver a blow to all safe-havens. If Trump chooses to announce any major trade breakthroughs, we could see U.S. stocks reinvigorated and safe-havens punished across the board.

Meanwhile, stocks have been somewhat buoyant with the Dow Jones Industrial Average DJIA, +0.15% notching its ninth all-time high of 2019, while the U.S. dollar, as measured by the ICE (NYSE:ICE) U.S. Dollar Index DXY, +0.09%, edged up 0.1%. Stocks gains and a stronger dollar can undercut appetite for assets considered havens like bullion.

Platinum PLF20, -1.31% slipped further to the lowest level since September 2018.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.