At this time of year, with Xmas fast approaching, I am reminded of the classic Yuletide song Silver Bells, composed by Jay Livingston and Ray Evans and first performed by Bob Hope. However, given the current state of the daily Silver chart, Silver Bears now seems infinitely more appropriate.

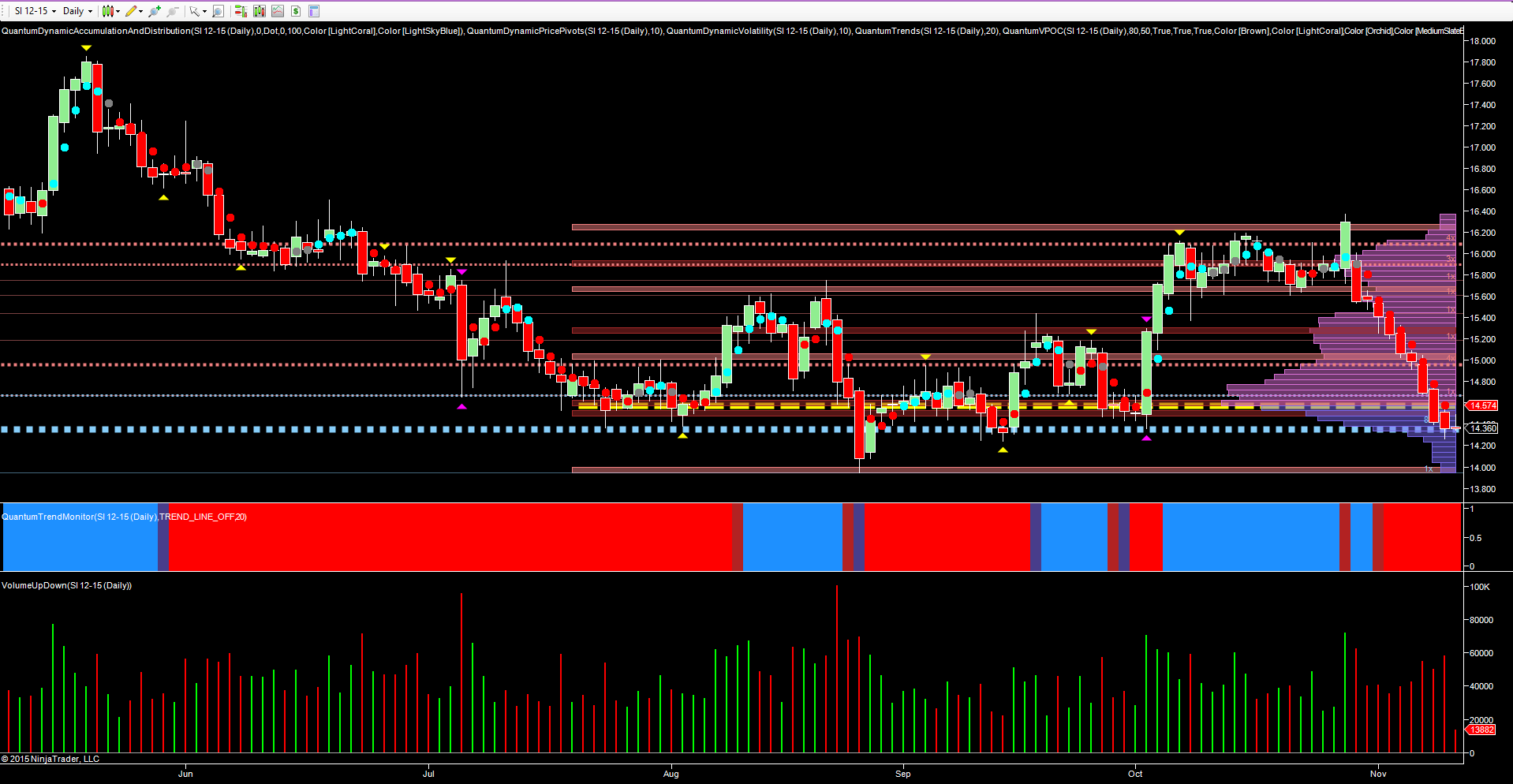

Indeed, I was bold enough to suggest last week that bearish sentiment was once again in the ascendancy, with the industrial metal trading at $15.50 per ounce and set to fall to $14.40 per ounce in the short term, a level which has now been tested and broken. The importance of this level cannot be overestimated for two reasons. First, the last two days of price action have seen silver prices break below the volume point of control on the daily chart, thereby confirming this bearish picture. Second, the price action is now testing the very strong level of potential price support, and one which is clearly denoted with the blue dotted line of accumulation. This is an area that has seen strong buying in the past, and which also provided the platform of support for a recovery in silver prices, both in September and early October, as the support platform duly held firm on both occasions.

However, the worrying signal in the present price action is that the recent unremitting price waterfall has been accompanied with rising volume on the daily chart, thereby validating the current bearish trend. And with the $14.40 price point now taken out, we can expect to see silver prices decline further, down toward the next logical level of support in the $14 per ounce area.

For silver bulls, I hope the level holds. It may, but if not, silver bears will continue to remain firmly in control, for the short term at least.