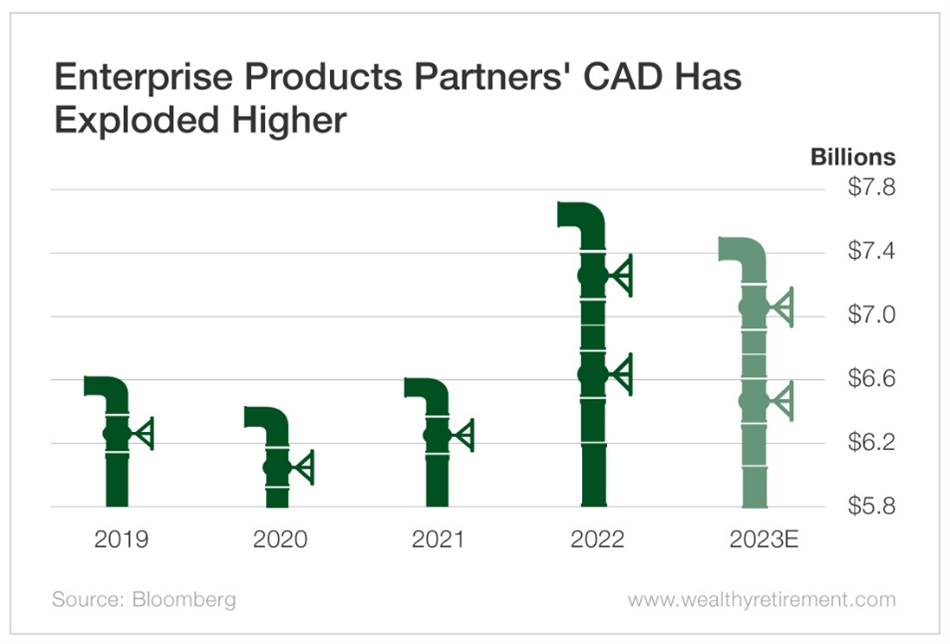

In case you’re unfamiliar with it, Enterprise Products Partners is a 55-year-old oil and gas pipeline company. Its CAD dipped slightly in 2020, but in 2021, it rebounded to 2019 levels. It then exploded higher in 2022, but this year it’s expected to dip from $7.75 billion to $7.55 billion.

Last year, Enterprise Products Partners paid $4.1 billion in distributions. Since it is a master limited partnership, it pays a distribution, not a dividend. Distributions are similar to dividends but have different tax ramifications.

The $4.1 billion distribution was 53% of the company’s CAD. This year, that figure is expected to rise to 57%. That means for every dollar Enterprise Products Partners has in cash flow, it is projected to pay out $0.57 in distributions. That’s a low number, and it means the company can easily afford its distribution.

The other thing Enterprise Products Partners has going for it is its distribution payment history. It has raised its distribution in each of the past 25 years and just raised the payout to $0.50 per share in August. The stock recently yielded a juicy 7.2%.

The strong cash flow and quarter-century-long track record of annual distribution raises tell me the distribution is safe. The only mark against the company is the expectation that CAD will decline this year. However, even if cash flow does come in slightly lower than where it was last year, it will still be more than enough to cover the distribution – and a raise in the near future.

In fact, I like the stock so much that I recommended it in 2020 in The Oxford Income Letter. We’re sitting on a 143% gain as I write, and readers who bought it when I first recommended it are enjoying a gigantic (and safe) 13.4% yield.

Recommended Action: Buy EPD.