ECB Today; Beware of the Crowded Trade:

It’s not a question of if, but rather by how much Draghi and the European Central Bank will increase its stimulus program tonight. Still fighting off the lingering effects of deflation on the stuttering European economy, Draghi has pledged to do whatever it takes to give the economy the kickstart required.

“Whatever it takes!”

Striking huh. Well, traders have known this for months now and there will be no surprises when the lever on the printing presses stays firmly pushed in the on direction heading forward. Consensus seems to be that the Euro is heading to parity but with the market already heavily short and most of what’s coming priced in, we could need one a hell of a damning set of details to see any hard drops in the Euro sustained.

Key details to keep an eye on after the release are whether the deposit rate was cut by 0.1% or 0.2% as well as any clues as to how far after September 2016 the QE end date will be pushed back to. I have heard chatter of a monthly bond buying increase of 20 billion Euros, as well as an extension somewhere deep into 2017 seen as likely.

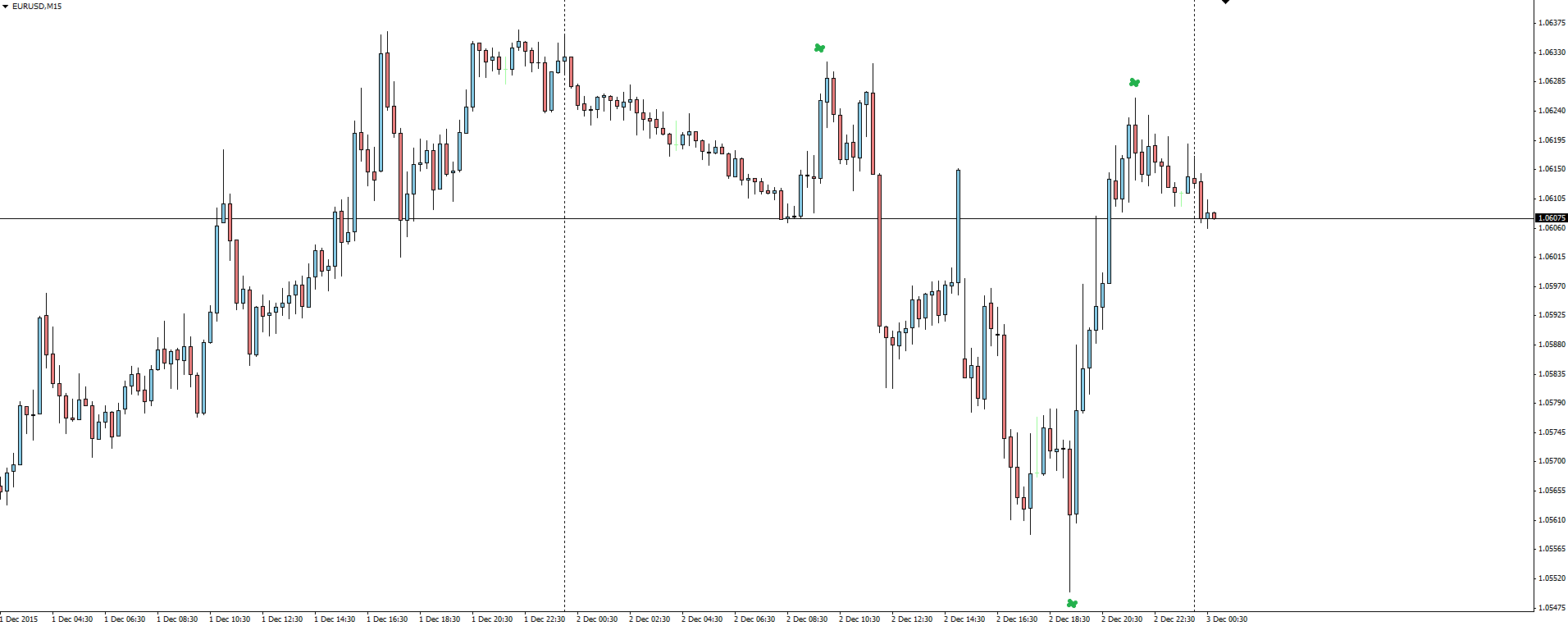

EUR/USD 15 Minute:

If there’s chatter, then you know that markets have priced at least a good portion of this into the market already. Beware the crowded trade.

Keep in mind that overnight the sometimes criticised ADP Non-Farm Employment Change report was released, beating the 191K expectation by adding 217K jobs to the economy. The Fed will be happy if NFP gives a similar number. Overall employment beats will trump manufacturing misses every time.

Stay smart out there.

Featured on the Forex Calendar Thursday:

AUD Trade Balance

GBP Services PMI

EUR Minimum Bid Rate

EUR ECB Press Conference

USD Unemployment Claims

USD Fed Chair Yellen Testifies

USD ISM Non-Manufacturing PMI

Chart of the Day:

Further to yesterday’s AUD technical analysis post, we stick with the Aussie Dollar theme and today take a look at a couple of AUD/CAD charts.

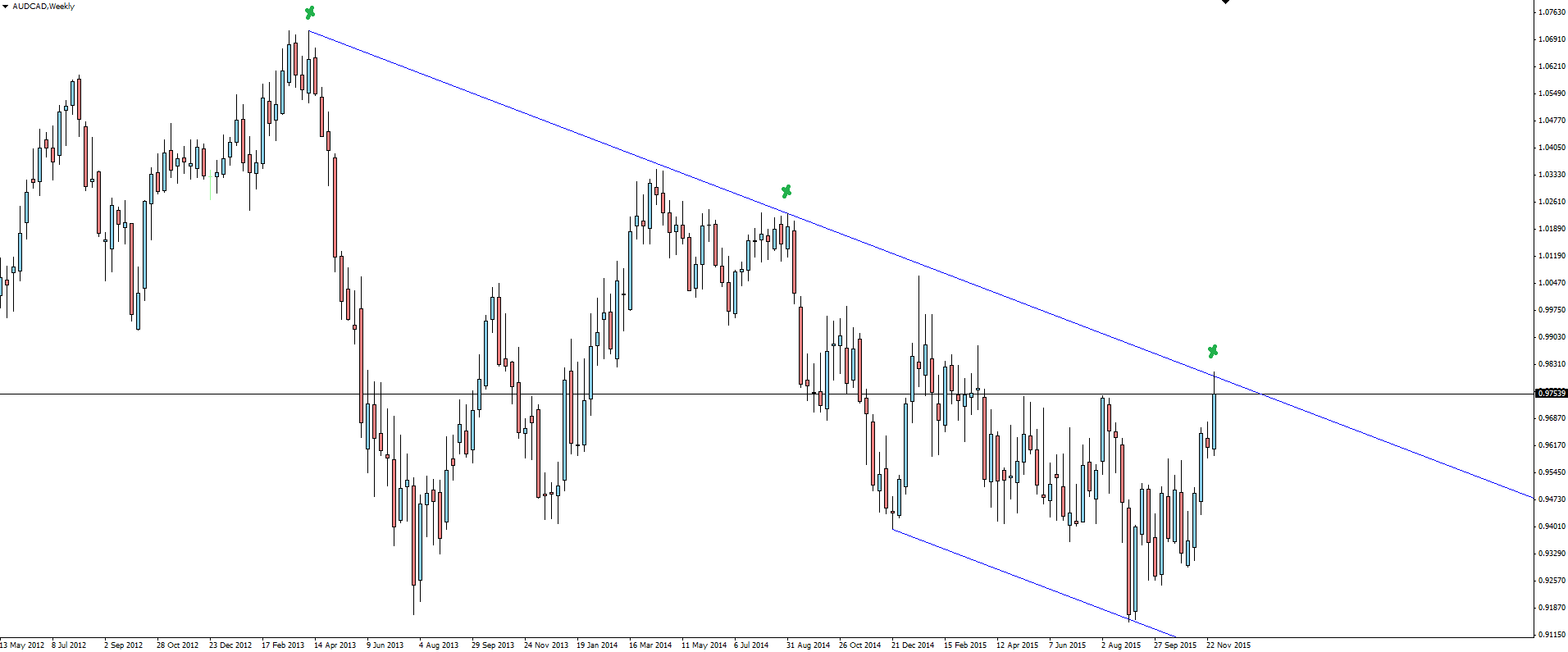

AUD/CAD Weekly:

The AUD/CAD weekly chart follows the familiar pattern of short term AUD strength encountering channel resistance.

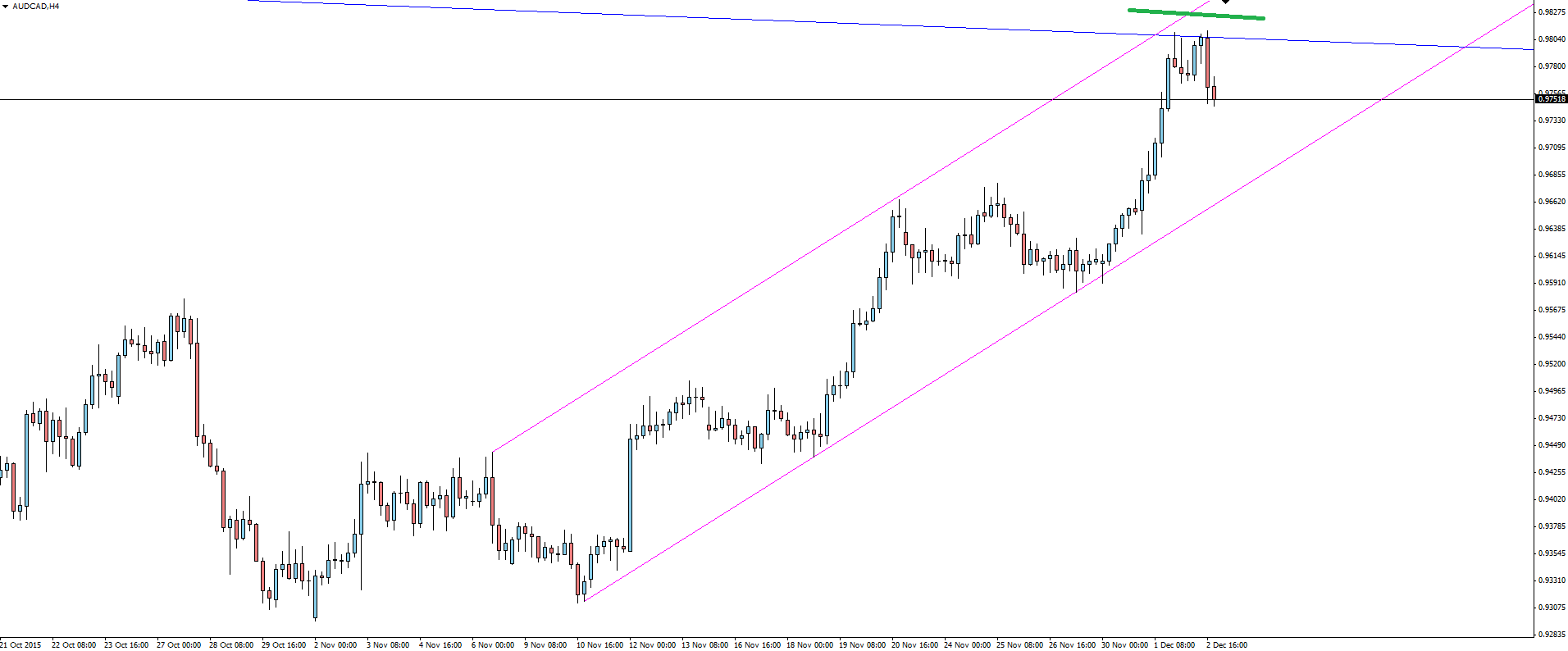

AUD/CAD 4 Hourly:

The strength followed by the resistance price has encountered is shown perfectly on the 4 hour chart. From here, I am watching the way that price is coiling on the clean double top that it has presented us where we know stops are accumulating above.

Do you see the stops accumulating at the highs lasting??

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices, or an offer of, or solicitation for a transaction. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.