-

Impressive Q3 FY2023 Results: Net revenue increased by 19% to $2.2 billion. Strong growth in comparable sales and significant expansion in international and direct-to-consumer channels.

-

Remarkable Performance in Greater China: Experienced a remarkable 53% surge in net revenue in Greater China.

-

Direct-to-Consumer Channel Success: Strategic initiatives, including benefits for Essentials members, contributing to strong e-commerce performance.

Resilient Q3 2023 Performance

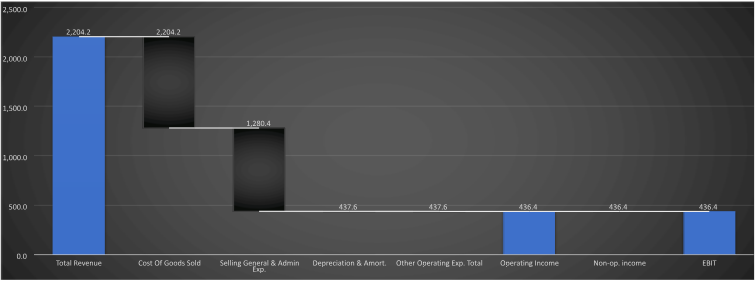

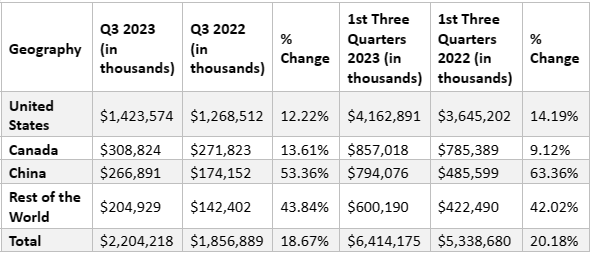

Lululemon Athletica (NASDAQ:LULU) Inc. has delivered impressive financial results in the third quarter of FY2023, surpassing market expectations and highlighting the company's strong growth trajectory. The company's net revenue experienced a robust 19% increase, reaching $2.2 billion, compared to $1.85 billion in the same quarter of FY2022. Lululemon's core business fundamentals remain strong, with notable growth in comparable sales and significant expansion in both international and direct-to-consumer channels.

Driving Success Through Strategic Retail and E-Commerce Excellence

The brand's strong performance is attributed to several key factors. Firstly, Lululemon's co-located store strategy has proven successful, with approximately 150 stores adopting this approach. The company plans to implement co-located remodels in 25 to 30 more stores in the upcoming year. This strategy leverages high traffic and sales productivity, resulting in incremental volume and strengthening the company's position in the North American market. Lululemon's direct-to-consumer channel continues to excel, with an 18% increase in net revenue or 19% growth on a constant-dollar basis. This channel represents 41% of the total net revenue, emphasizing the company's success in engaging customers through its e-commerce platforms. Strategic initiatives, including benefits for Essentials members, have contributed to the brand's strong e-commerce performance. By leveraging exclusive rewards and maintaining regular-priced sales, Lululemon has differentiated itself from competitors who heavily rely on discounting.

Unveiling the Wundermost Collection and Conquering Global Markets Particularly in China

Furthermore, Lululemon's balanced global growth and expansion efforts have yielded positive results. The North American market saw a 12% increase in net revenue, while the company experienced a remarkable 53% surge in Greater China. Lululemon's ability to gain market share in the US, despite challenges in the active apparel industry, exemplifies its resilience and effective strategies. The brand's focus on product innovation, such as the successful launch of the Wundermost collection, allows it to meet evolving consumer demands and diversify its product portfolio. The company's international expansion has also played a significant role in its success. Lululemon reported a 49% increase in net revenue from its international business, underscoring its ability to penetrate new markets and attract a global customer base. Market performance in Greater China has been particularly remarkable, highlighting the success of the brand's localization efforts and large-scale marketing campaigns.

Key Considerations for Future Growth

Looking ahead, Lululemon's focus on strategic growth drivers will continue to bolster its position in the market. The company's partnership with Peloton, a five-year exclusive global collaboration, is expected to further enhance its brand presence and customer engagement. The partnership will enable Lululemon Studio All-Access Members to access Peloton classes, creating a unique fusion of fitness and apparel that could significantly impact the stock's performance. As Lululemon enters into the next quarter, several key factors should be closely monitored. Post-holiday consumer behavior will provide insights into the brand's sustained sales performance and market resonance. The success of the company's initiatives to amplify its men's business will be crucial for future growth, as will the dynamics of international expansion, particularly in Greater China.

Conclusion

Lululemon Athletica Inc.'s robust financial position, diversified revenue streams, and strategic initiatives, we assign "Buy" rating. Despite industry challenges, its current stock value of $489.30, coupled with optimistic scenarios projecting $559.68 (Bull Case) and $253.00 (Bear Case), Lululemon's resilience and market presence make it an appealing investment opportunity. Investors should conduct thorough due diligence, considering both bullish and bearish possibilities, before making informed decisions.

Disclosure: We don’t hold any position in the stock and this is not a recommendation of any kind as investing carries risk.