Gold rallied sharply thanks to the uncertainty and the flight of capital to safe haven bets. The range came under pressure and ultimately broke, sending the metal up before a strong NFP report led to a pullback. It now looks to retest the top of the range which could provide a buying opportunity.

Gold had a solid week to start the year as the flight of capital to safe haven assets saw gold rally strongly sending the metal as high as $1,113.03. The range came under pressure as China's stock market threatened a meltdown as the circuit breakers twice halted trading when the losses reached 7% last week.

The US Nonfarm Payroll figures were released at the end of the week and saw gold pull back from the highs. Overall the report was strong with 292k jobs added in December vs 200k expected. The losses were limited as wage growth remained poor, which will inevitably lead to questions about the fed's timing of the next interest rate rise. US dollar strength at the beginning of this week has seen gold continue to pullback, and now a retest of the top of the broken range is a possibility.

This week has already seen a number of FOMC members speak, with more to come. Fed’s Kaplan said the Fed will have enough data to make a decision on rates, despite Fischer saying they wouldn’t. Keep an eye on the Fed's beige book and US retail sales. Any hint at a slower than expected pace of rate rises will see gold continue to rally.

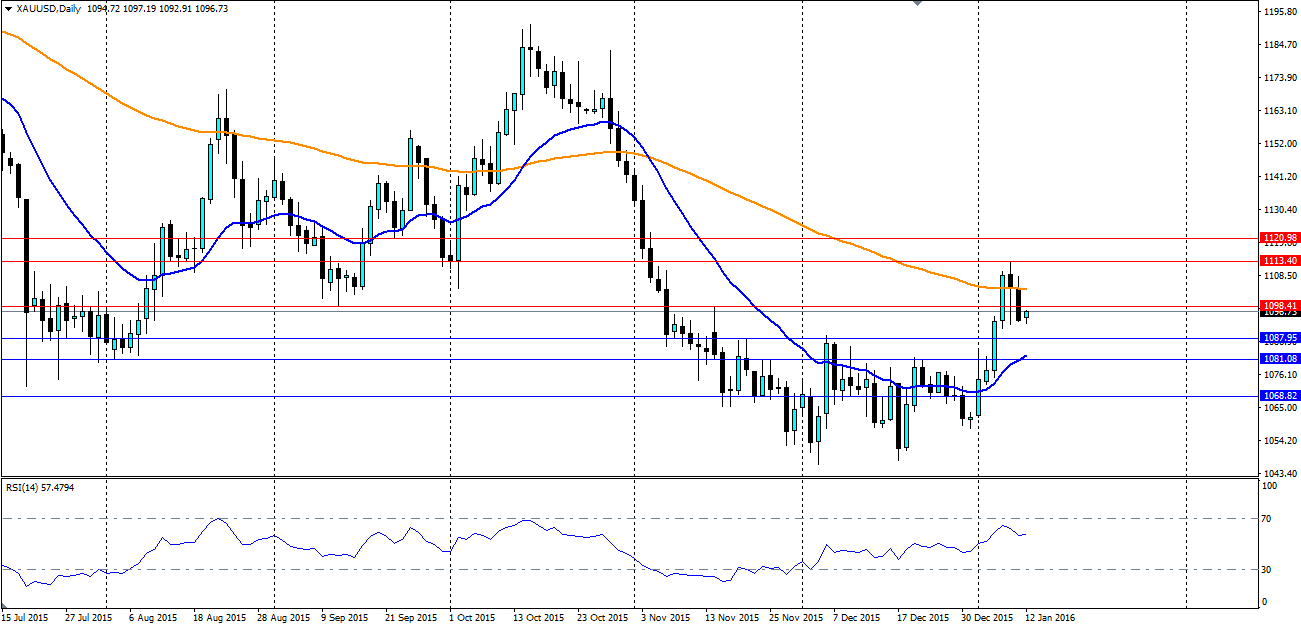

Technicals show the range breaking down with gold climbing over the 100 day MA for the first time since October. We could see a pull back to the top of the range before a continuation of the trend higher. Look for support at 1087.95, 1081.08 and 1068.82 while resistance is at 1098.41, 1113.40 and 1120.98.