In a striking move, Berkshire Hathaway (NYSE:BRKa), directed by investment legend Warren Buffett, parted with 10 million shares of Apple (NASDAQ:AAPL), translating to a $2 billion reduction in its investment, during the last quarter of 2023. This decision leaves the conglomerate still holding a significant 5.9% interest in Apple. This divestiture aligns with the launch of Apple's innovative product, the Apple Vision Pro.

Effects on Apple's Financial Health

The market responded to Berkshire Hathaway's sell-off with a 3.46% dip in Apple's stock price within a week, signifying the market's sensitivity to the reduced stake. Meanwhile, the S&P IT sector saw a 2.46% decrease, amidst expectations being recalibrated due to a higher-than-anticipated consumer inflation report, diminishing hopes for near-future reductions in interest rates. Moreover, the Apple Vision Pro's debut and its reception could further influence Apple's share values.

Apple Vision Pro: Disruptive Tech or Overpriced Gadget?

In its venture into virtual reality, Apple introduced the Apple Vision Pro, an ambitious project aimed at mirroring the transformative success of its past products, most notably the iPhone. With a launch price of $3.5K, it stands as Apple's priciest recent offering. Despite this, opinions within the tech community vary, with some less convinced of its groundbreaking potential. Mark Zuckerberg, Meta (NASDAQ:META)'s CEO, through an Instagram post, made a pointed comparison of the Apple Vision Pro to Meta's Quest 3, emphasizing the latter’s superior value and functionality at a $3,000 lower cost.

Industry Implications and Anticipations

The exchange between Apple and Meta highlights the intense rivalry within the virtual reality sector. Despite the Apple Vision Pro's advanced technology and the excitement it is generating, there's skepticism regarding its practicality and potential integration into daily life, reflecting the challenges and competition in innovating and convincing consumers of this new technology's value.

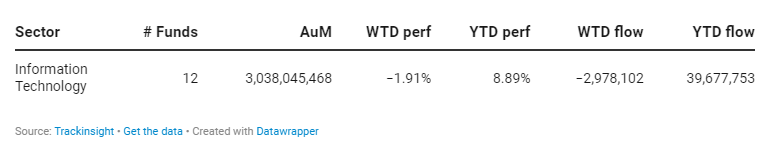

Group Data

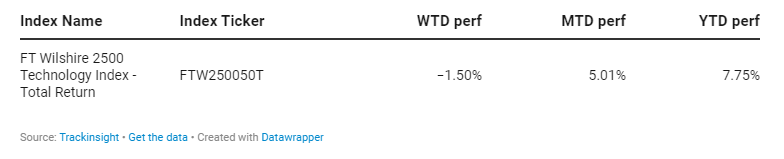

Index Data

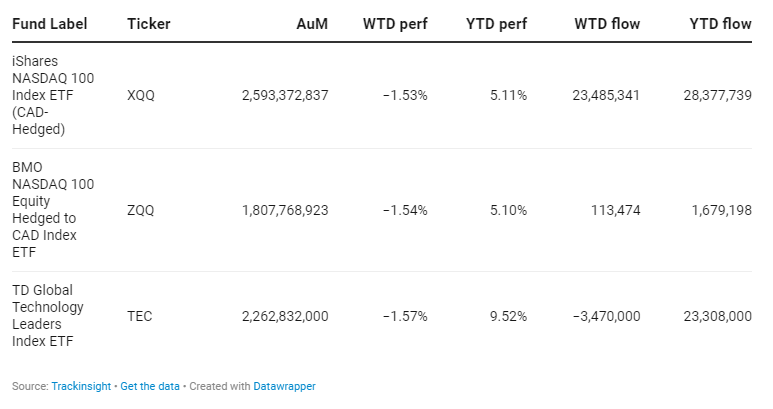

Funds Specific Data