- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Canadian Active Bond ETFs That Survived Rising Interest Rates in 2022

Bond investors had a few great decades of strong performance, but that all came to an end in 2022. After enjoying years of falling interest rates and yields, the opposite is now occurring. Thanks to aggressive interest-rate hikes from U.S. and Canadian central banks, bonds tanked.

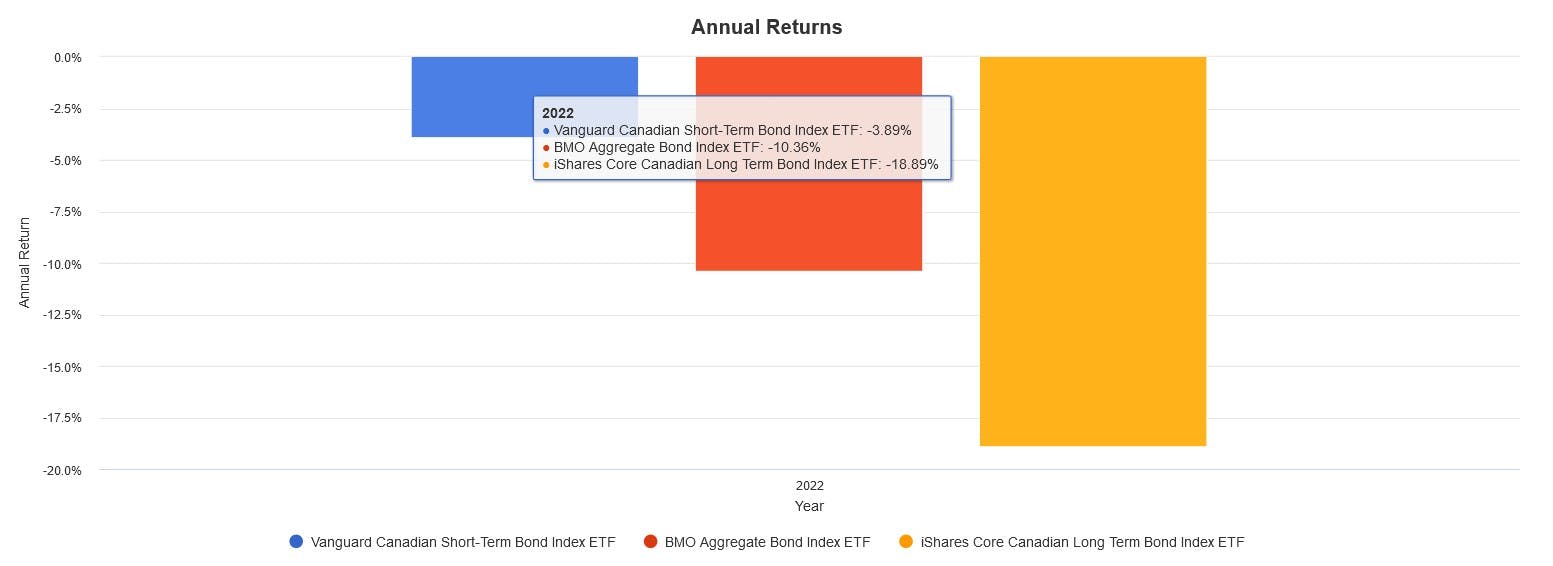

Year-to-date, short, intermediate, and long-term aggregate Canadian bond ETFs have lost significant value, much to the chagrin of investors holding a healthy allocation of them in a supposedly "balanced portfolio." The last time bonds performed this badly was in the late 1970s / early 1980s.

The double-edged sword of passive investing is that tracking the market's performance exactly as it is, means accepting occasional gut-wrenching drawdowns. Therefore, some investors may want to consider actively managed strategies that try to outperform a benchmark.

Despite the higher fees, actively managed ETFs saw strong inflows over the past year as investors sought a safe refuge. While they can underperform over the long-term, they might be a good tactical holding for risk-conscious investors who don’t mind lagging a benchmark occasionally.

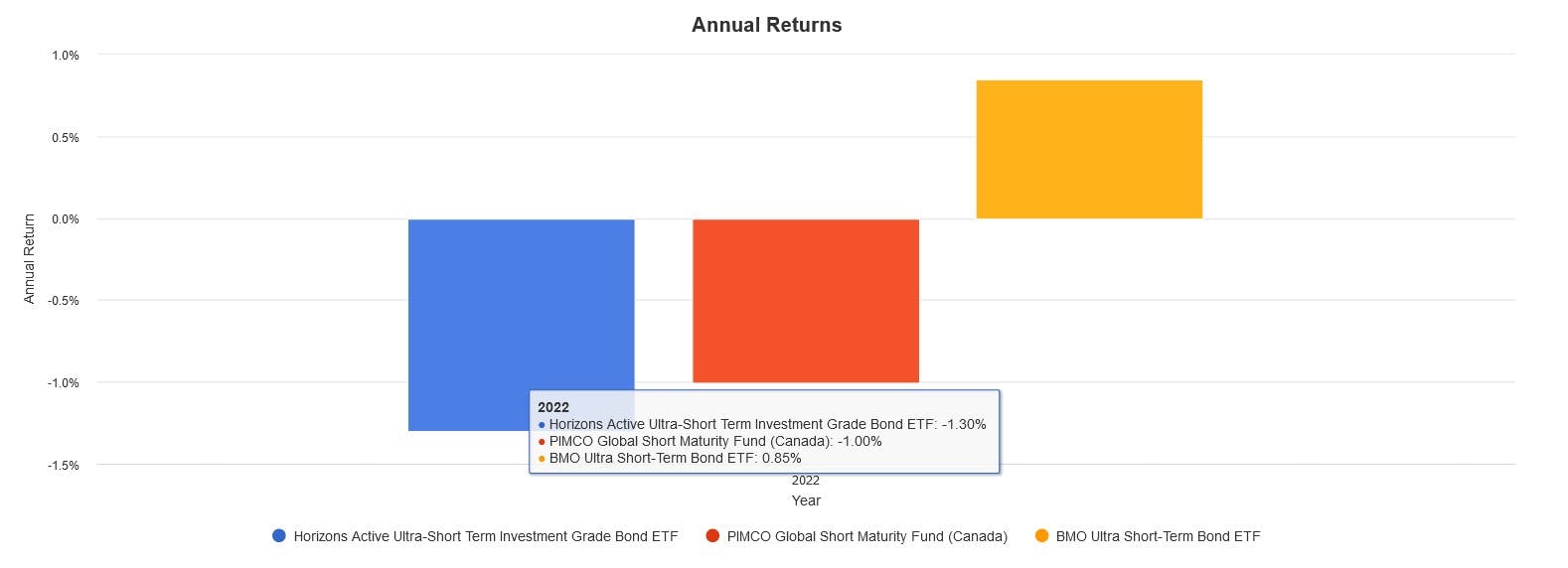

With that in mind, let's review three actively managed bond ETFs that managed to survive the rising rate environment of 2022 relatively unscathed.

Horizons Active Ultra-Short Term Investment Grade Bond ETF (HFR)

HFR was specially designed to mitigate the effects of interest rate fluctuations. The ETF primarily holds short-term Canadian corporate bonds weighted towards investment-grade ones from the financial sector. To mitigate interest rate risk, HFR targets an overall average duration of no more than one year.

Recall that duration measures a bond ETF's overall sensitivity to interest rate movements. For example, a bond ETF with a duration of 1.00 year would be expected to lose 1.00% in net asset value if interest rates increased by 1.00%, all else being equal.

HFR currently has a weighted average duration of 0.80 years, which is extremely short. This ETF has actually benefitted from increasing bond yields, currently paying a high yield to maturity of 5.75%. With HFR, you're decreasing interest rate risk by taking on higher credit risk from the corporate bonds.

PIMCO Global Short Maturity Fund (PMNT)

PIMCO is a global fixed-income leader well-known for its suite of actively managed bond funds, with PMNT being a great example of a Canadian-listed one. The ETF's objective is to provide current income that exceeds that provided by short-term government bonds as measured by the 3‑Month CDOR.

To achieve this, PMNT invests primarily in U.S. agency securities, investment-grade U.S. corporate bonds, international developed bonds, and money market instruments. The ETF is prohibited from investing in high-yield securities in order to preserve principal and achieve high liquidity.

PMNT currently has a low effective duration of 0.39 years and charges a reasonable expense ratio of 0.38%, lower than many active fixed-income ETFs. The ETF has attracted assets under management (AUM) of $548 million and makes monthly distributions.

BMO (TSX:BMO) Ultra Short-Term Bond ETF (ZST)

Last on the list is ZST, which holds a diversified portfolio of short-term fixed-income securities with maturities of under a year. The ETF is able to hold investment-grade corporate bonds, government bonds high-yield bonds, floating rate notes, and preferred shares.

ZST is actively managed, with the ETF manager rebalancing its holdings based on fundamental analysis that assesses factor-like relative strength indicators and risk-adjusted yield expectations. Currently, ZST maintains a weighted average duration of 0.36 years and an average yield to maturity of 4.90%.

ZST currently costs a low expense ratio of 0.16%, which is always beneficial for short-term fixed income ETFs that yield less. It also comes in ZST.L, which is an accumulating version that automatically reinvests distributions for greater simplicity and convenience.

Performance of Bond ETFs in 2022

Here's how HFR, PMNT, and ZST performed year-to-date as of November 30th, 2022 with all distributions reinvested on time:

The question is, are these actively managed short-term bond ETFs worth it? This question depends on your investment objectives. If you're looking for a low-risk asset with low fees, then a HISA ETF or GIC might be more suitable. If you're looking to outperform the bond market, lower interest rate risk, and can accept higher fees and tracking error, then these ETFs might be suitable.

This content was originally published by our partners at the Canadian ETF Marketplace.

Related Articles

The strong performance of U.S. equities, particularly that of the Magnificent Seven, has led investors to gain increasingly more exposure to the asset class in recent years. CI...

Why Solar Stocks and ETFs Are Up Solar stocks and ETFs have been on a recent upswing, fueled by a positive development within the Chinese solar industry. The China Photovoltaic...

In a previous edition of my "ETF Buyer's Guide" series, I explored the differences between Vanguard and SPDR sector ETFs, highlighting that SPDR ETFs tend to be larger and more...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.