Financial Performance: Operating revenues of approximately $6.3 billion, Passenger revenues experienced a year-over-year increase of nearly 22%.

In-Flight Experience and Customer Preference: Enhanced in-flight experience, including incorporation of Disney+ Originals. Strengthened competitive edge in the airline industry, potentially leading to increased market share and stock value.

Route Expansion: Strategic route expansion, including flights to Stockholm and increased capacity on the Copenhagen route.

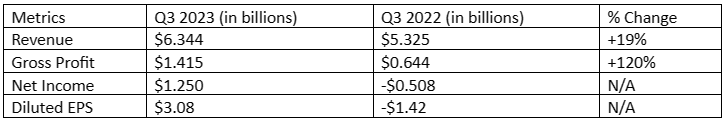

Air Canada (TSX:AC) has exceeded market expectations and demonstrated a strong financial performance in the third quarter of 2023. The company's revenue and gross profit have experienced significant year-over-year growth, highlighting its ability to capitalize on various markets and drive substantial revenue growth. Air Canada's strategic initiatives, including fleet expansion, operational improvements, and route expansion, position the company for future success and strengthen investor confidence in the stock's potential.

Resilient Q3 2023 Performance

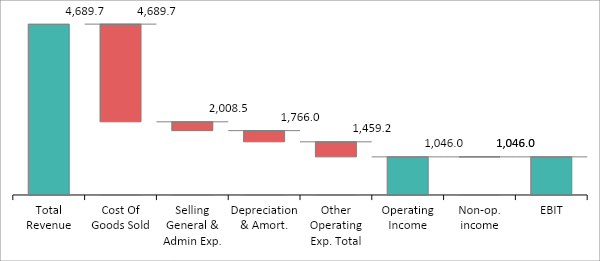

In terms of financial performance, Air Canada reported operating revenues of approximately $6.3 billion, marking a substantial 19% increase from the third quarter of 2022. The company's operating income surged by $771 million to reach $1.4 billion, reflecting an operating margin of 22.3%. Passenger revenues experienced a remarkable year-over-year increase of nearly 22%, contributing to the overall strong performance. Adjusted EBITDA reached $1.8 billion, translating into a market-leading adjusted EBITDA margin of almost 29%. Air Canada's prudent approach to managing expenses, controlling costs, and optimizing operational efficiency has resulted in this stellar financial performance.

Fleet Expansion and Operational Improvements as Key Drivers

Air Canada's strategic focus on fleet expansion and operational improvements stands as a key driver for the company's stock performance in the coming years. The airline plans to enhance its capacity by introducing leased narrow-body and wide-body planes in 2024, facilitating significant growth. Operational enhancements and better fleet utilization contribute to operational efficiency and cost-effectiveness. Furthermore, the introduction of new efficient aircraft promises higher performance and aligns with Air Canada's long-term objectives. Air Canada's ability to maintain stable demand across various market segments, coupled with its diversification strategy, serves as another driver for its stock performance. The company reports sustained recovery in Small and Medium-sized Enterprises (SME) bookings, indicating resilience in business travel. Additionally, Air Canada's strategic shift towards international markets, particularly in the Pacific region, capitalizes on emerging opportunities and enhances revenue streams. By maintaining a diversified portfolio and adapting to changing travel patterns, Air Canada ensures a stable revenue base, reinforcing investor confidence in the stock's growth potential.

The enhanced in-flight experience provided by Air Canada, such as incorporating Disney+ Originals into its entertainment offerings, enriches the travel experience and could attract more passengers seeking quality in-flight entertainment. This enhancement of the family travel experience strengthens Air Canada's competitive edge in the airline industry and could serve as a key differentiator, potentially leading to an increase in customer preference and, consequently, a rise in the airline's market share and stock value. Air Canada's strategic route expansion, such as flights to Stockholm and increased capacity on the Copenhagen route, strengthens its presence in Scandinavia and enhances its trans-Atlantic network. These strategic moves can boost the airline's international market competitiveness, increase passenger numbers, and contribute to an enhanced stock outlook.

Disciplined Capital Allocation with Emphasis on Debt Repayment

Air Canada's commitment to deleveraging and financial discipline also contributes to its stock performance. The company's focus on reducing net leverage and optimizing its capital structure demonstrates prudent financial management. Its disciplined approach to capital allocation, emphasizing debt repayment and balance sheet strengthening, resonates positively with investors. These financial strategies safeguard the company's stability and flexibility, strengthening the stock's outlook.

Conclusion

In conclusion, despite potential fluctuations in the stock's value outlined in the bear and bull cases, Air Canada's robust financial performance and strategic initiatives position it as a compelling investment. The bear case scenario, with a price of $23.15, still indicates growth potential, while the bull case at $32.50 suggests even greater upside. Considering the company's resilience and strategic focus, we suggest to buy on the stock, emphasizing the need for investors to weigh risks diligently and align their decisions with individual risk tolerance and investment goals.

Disclosure: We don’t hold any position in the stock and this is not a recommendation of any kind as investing carries risk.

This content was originally published on Equisights.com