The fund industry has seen a notable surge in the appeal of active ETFs recently. This uptick in popularity can be attributed to a mix of higher competition, better marketing efforts, reduced fees, and the trend of mutual fund conversions to ETFs.

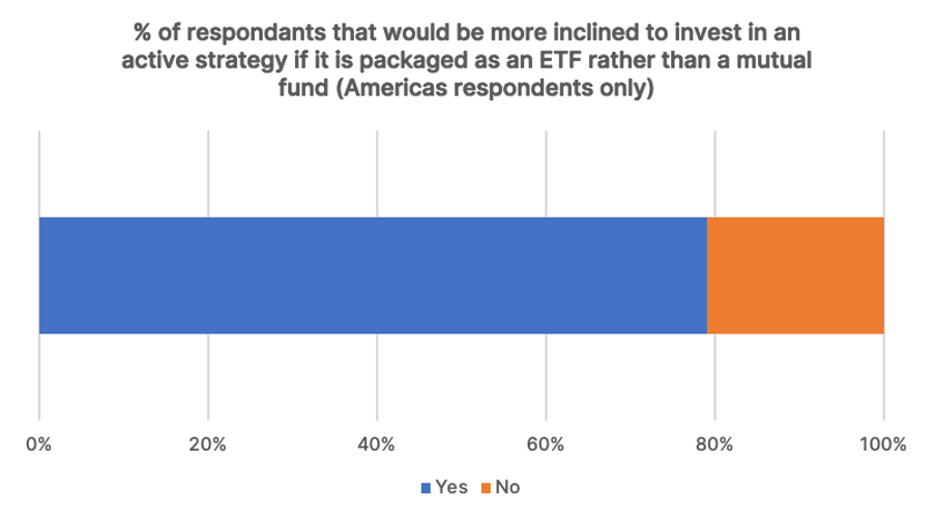

The last point has been instrumental. According to the 2023 Trackinsight Global ETF Survey, 80% of respondents from the Americas stated they would be more inclined to invest in an active strategy if packaged as an ETF rather than a mutual fund.

A standout name spearheading this evolution is Dimensional Fund Advisors (DFA). Historically, DFA was known for its exclusive mutual funds mostly available only to financial advisors, and a unique approach to investing rooted in their factor investing expertise.

“We are encouraged by the strong adoption of our ETF suite, which has further solidified our place as the industry’s largest active ETF issuer and indicates our solutions are helping to meet investor demand.,” says Wes Crill, senior investment director and vice-president at Dimensional Fund Advisors. "Dimensional will continue to expand our offering in collaboration with the financial professionals we work with to provide broader access to systematic active strategies across asset classes."

Here's all you need to know about DFA's actively managed factor ETF lineup listed on the NYSE.

DFA's Historical ETF Inroads

DFA made its initial foray into the ETF realm in November 2020, unveiling its first pair of active transparent ETFs on NYSE ARCA – the Dimensional US Core Equity Market ETF (DFAU) and the Dimensional International Core Equity Market ETF (DFAI).

Another notable milestone followed in June 2021, when the firm kick-started the now popular mutual fund to ETF conversion trend by converting four of its most popular mutual funds into actively managed ETFs, all listed on the NYSE.

These included the Dimensional US Equity ETF (DFUS), the Dimensional US Core Equity 2 ETF (DFAC), the Dimensional US Small Cap ETF (DFAS), and the Dimensional US Targeted Value ETF (DFAT).

Furthermore, Dimensional, now one of the industry's most substantial active ETF issuers, recently applied in July 2023 for an exemption with the SEC, setting the stage to provide ETF share classes of its US mutual funds. This comes after the expiry of Vanguard's patent, which I covered in a previous article.

The rationale behind this move has its foundations in a vision of dual benefit. Firstly, existing mutual fund class shareholders stand to gain through reduced transactional costs and heightened tax efficiency.

Concurrently, prospective ETF class investors are poised to enjoy the perks stemming from this structure, encompassing efficient rebalancing using mutual fund cash flows and a reduction in total portfolio transaction expenses.

DFA's current lineup

According to the ETF Central screener's list of most popular actively managed ETFs in terms of highest assets under management, or AUM, a total of 4 DFA ETFs make the top 10 list as of August 21, 2023.

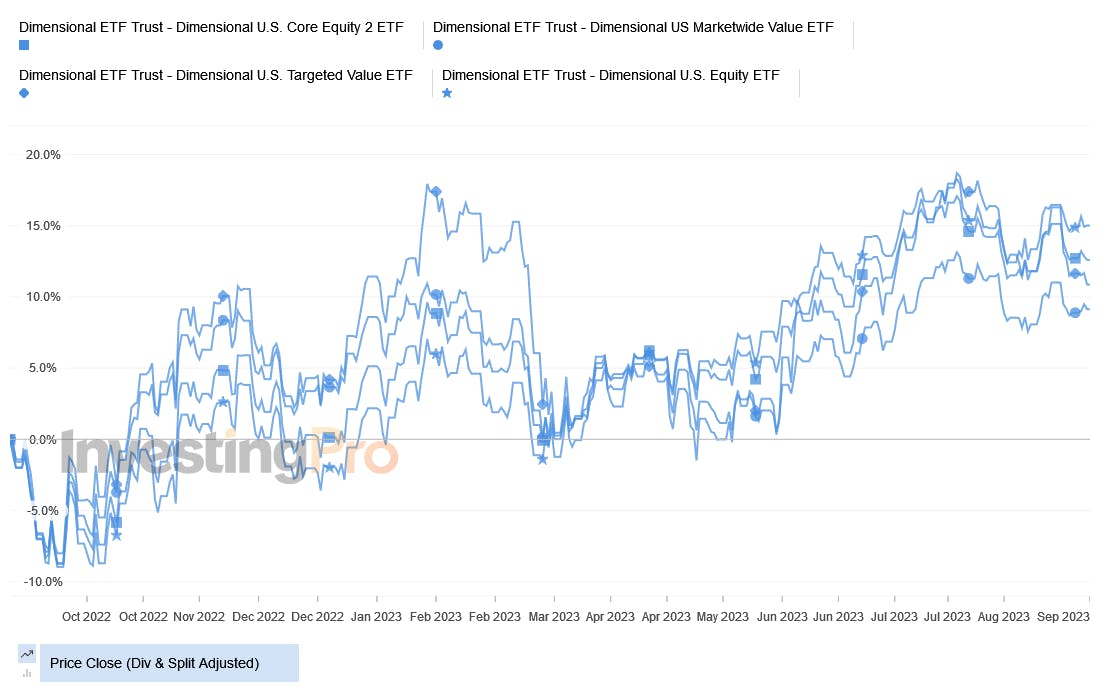

Source: Investing.com Pro

Leading the way in third place is the Dimensional US Core 2 ETF (DFAC), which has seen around $329 million in one-month net inflows as of August 21 and currently sits at nearly $21 billion in AUM. Right now, DFAC charges a net expense ratio of 0.17%.

This ETF mirrors the composition of total U.S. market ETFs, but with an emphasis on value stocks. Consequently, its portfolio has a lower concentration in large mega-cap growth stocks like Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) compared to passively managed index competitors. As its name suggests, it is intended to be a low-cost, actively managed core portfolio holding.

In fifth and sixth place respectively are the Dimensional US Marketwide Value ETF (DFUV) and the Dimensional US Targeted Value ETF (DFAT), sitting at $8.7 and $8.3 billion in AUM respectively.

DFUV has a broad market value-only focus and is benchmarked against the Russell 3000 Value Index. On the other hand, DFAT has a decidedly small-cap value focus, being benchmarked against the Russell 2000 Value Index. DFUV charges a 0.22% expense ratio, while DFAT charges 0.22%.

Finally, we have the Dimensional US Equity ETF (DFUS), which like DFAC also provides investors with broad market U.S. equity exposure by being benchmarked to the Russell 3000 Index. However, unlike DFAC, DFUS has less of a value tilt, with its holdings of stocks like Apple and Microsoft closer to their normal market-cap weights. However, it does have the lowest expense ratio of the four ETFs at 0.09%.

This content was originally published by our partners at ETF Central.