The battery metals stocks on our list have seen the greatest amount of investor interest over the past month

SmallCapPower | November 15, 2017: The expected surge in demand for lithium over the next couple of years has driven a bull market for battery metals. Supported by rising lithium prices and the achievement of project milestones, the battery metals stocks on our list have returned 190% on average month over month (M/M).

Lithium Energi Exploration Inc. (V:LEXI) – $0.94

Non-Gold Precious Metals & Minerals

Lithium Energi Exploration is a Canada-based battery metals exploration company with properties in Argentina. The Company holds three lithium brine concessions that comprise 128,000 hectares along Abermarle Inc. and FMC Corp’s properties. The Companies three properties include the Laguna Caro area (17,760 ha), the Antofalla North area (41,500 ha) and the Antofalla South area (69,110 ha).

- Market Cap: $57 Million

- M/M Return: 408.1%

- Average Daily Volume – 30 days: 878,000

- Average Daily Volume – 90 Days: 343,000

Advantage Lithium Corp. (V:AAL) – $1.27

Specialty Chemicals

Advantage Lithium is a Canada-based company with a total of five assets in Argentina and the United States. The Company’s flagship asset, the Cauchari project, is a 75/25 Joint Venture between the Company and Orocobre Limited (TO:ORL). The project comprises 28,500 hectares, and is located 10 kilometers south of Orocobre’s LCE production plant in the Jujuy Province, Argentina.

- Market Cap: $173 Million

- M/M Return: 144.2%

- Average Volume – 30 days: 1,352,000

- Average Daily Volume – 90 Days: 648,000

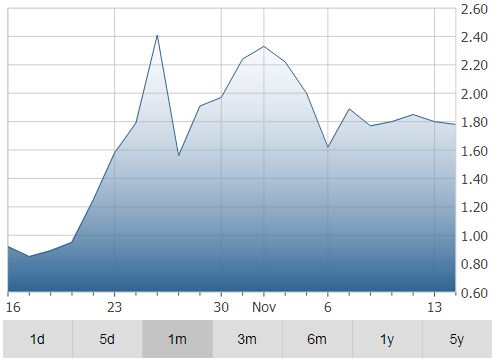

Liberty One Lithium Corp. (V:LBY) – $1.80

Oil & Gas Exploration and Production

Liberty One Lithium is a Canada-based junior exploration company. Liberty’s assets include the Pocitos West property and the North Paradox property. Pocitos West comprises 39,000 acres in the middle of the renowned lithium triangle in the West Salta Province, Argentina. Alternatively, the North Paradox property covers 4,480 acres in Grand County, Utah, 15 kilometers west of the town of Moab.

- Market Cap: $118 Million

- M/M Return: 114.3%

- Average Daily Volume – 30 days: 184,000

- Average Daily Volume – 90 Days: 1,123,000

Millennial Lithium Corp. (V:ML) – $3.50

Specialty Mining & Metals

Millennial Lithium is a Canada-based exploration stage company with three properties under development. The Company’s flagship project is the Pastos Grandes Project, which comprises 6,360 hectares in the Salta Province, Argentina. Millennial is currently engaged in financing the project and expects Pastos Grandes to begin production in 2020.

- Market Cap: $197 Million

- M/M Return: 91.3%

- Average Daily Volume – 30 days: 355,000

- Average Daily Volume – 90 Days: 251,000

Disclosure: Neither the author nor any of the principals at SmallCapPower, or their family members, own units in any of the companies mentioned above.