Wall Street’s major indices plunged this week as the coronavirus spread around the world and fears about its impact escalated. In recent days, the number of confirmed cases and deaths rose dramatically in Italy, South Korea, Iran and other countries outside of China.

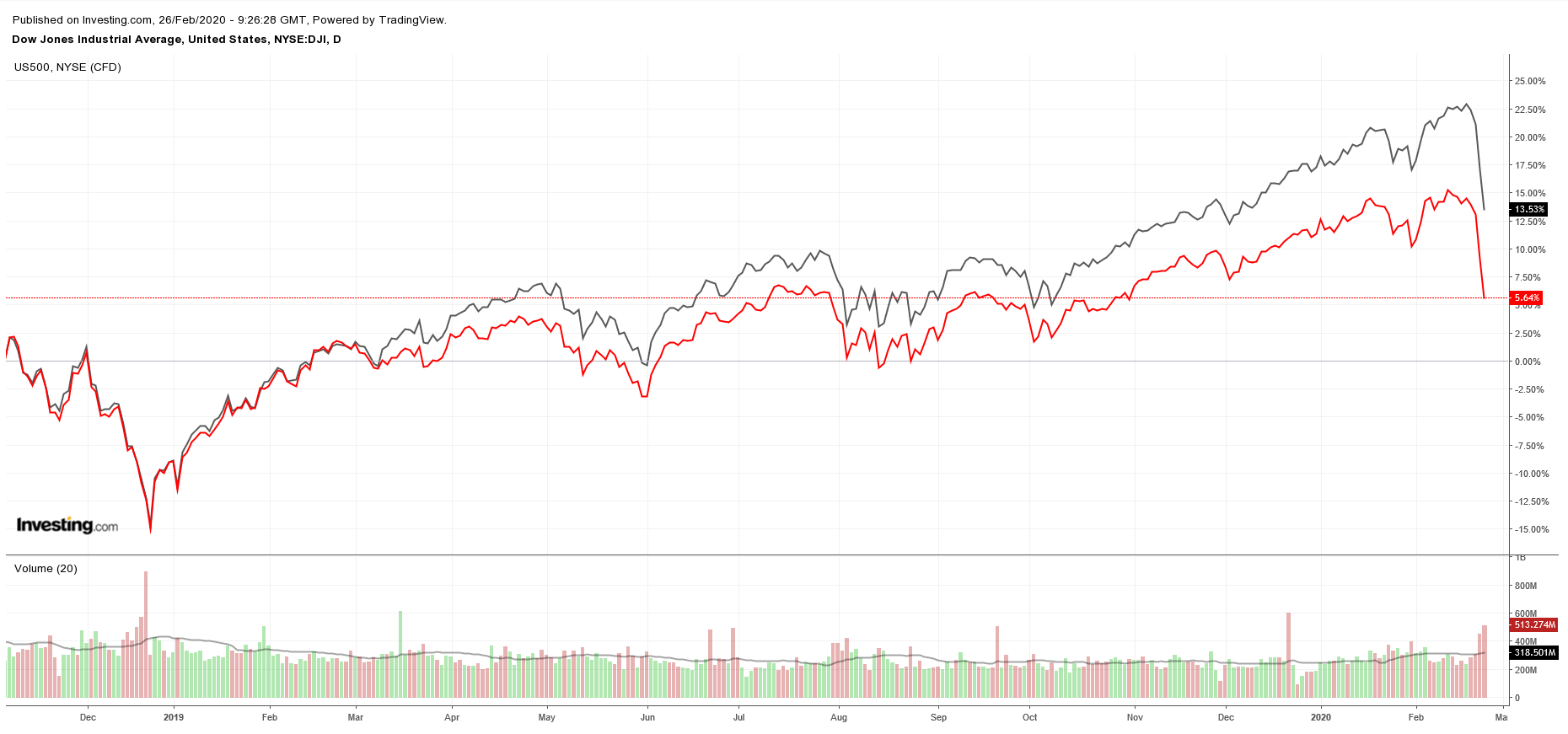

Due to the uncertain economic implications, investors have offloaded risky assets. Both the Dow and S&P 500 suffered their biggest four-day percentage losses since the massive sell-off in December 2018. These declines put both benchmarks about 8% below their record highs reached earlier this month.

While it will be difficult for most companies to insulate themselves from the effects of the fast-spreading disease, three names are likely to be among the few unscathed by the full-blown global outbreak of the coronavirus.

1. Zoom Video Communications

Zoom Video Communications (NASDAQ:ZM), headquartered in San Jose, California, provides remote conferencing services using cloud computing. It is widely considered the leader in modern enterprise video communications, with an easy, reliable cloud platform for video and audio conferencing, online meetings, chat and webinars.

The company has seen its shares surge almost 41% since news of the coronavirus outbreak sent shockwaves across financial markets on Jan. 21, compared to the S&P 500’s 6% drop over the same time period. The stock, which has rallied 57% year-to-date, soared to a fresh all-time high of $111.80 on Tuesday, before closing at $107.08 with a market cap of $29 billion.

As the reach of the virus expands, companies worldwide will likely need employees to work from home, thus creating new demand for remote-work tools.

The remote conferencing services provider next reports earnings after the U.S. market closes on Mar. 4. Consensus calls for earnings per share of $0.07 for the fourth quarter, while revenue is forecast to jump 66% from the year-ago period to $176.5 million.

2. Netflix

Netflix (NASDAQ:NFLX) is the second name to consider buying as fears surrounding the outbreak grow. While the company doesn’t have any operations in China, the increasing impact on the U.S. could lift demand for the media-services provider.

Since Jan. 21, Netflix’s stock has gained 6% and is up more than 11% YTD. Shares, which hit a 52-week high of $392.95 on Feb. 19, settled at $360.09 yesterday with a market cap of $158.1 billion.

The Centers for Disease Control and Prevention stepped up its call for the U.S. public to start preparing for a possible outbreak at home on Tuesday. The CDC's Dr. Nancy Messonnier stated that “we are asking the American public to work with us to prepare in the expectation that this could be bad.” The CDC has so far confirmed 53 cases in the U.S.

The sweeping effects of COVID-19 could result in more people staying home and turning to Netflix for entertainment.

The streaming company already reported strong quarterly earnings last month that saw its total subscriber base grow to 167 million.

3. TAL Education Group

Tomorrow Advancing Life Education Group (NYSE:TAL) is the final name that should be on your radar as it provides online tutoring services for primary and secondary school students in China.

While local governments in China delay the re-opening of schools to limit the spread of the coronavirus, parents across many quarantined cities are taking advantage of online education for their children. Some provinces and schools have also requested that children tune into online courses during this time.

Shares of TAL Education Group are up around 5% since Jan. 21. YTD. The stock, which ended at $56.58 last night, has gained nearly 18% in 2020 and reached a record-high of $59.76 on Feb. 14. TAL has a valuation of $34 billion.

The education and technology enterprise offers tutoring services to kindergarten through 12th-grade students, covering core academic subjects, such as math, physics and English. Since its establishment, TAL has been committed to integrating the internet and technology into education to deliver a better study experience for children.

The company beat revenue expectations last month and total student enrollments increased by 66% y/y to more than 2.3 million in the quarter ended Nov. 30.