GuruFocus -

Insight into Bridgewater Associates' Latest Strategic Moves in Q1 2024

Ray Dalio (Trades, Portfolio), the visionary behind Bridgewater Associates, has once again made significant adjustments to his investment portfolio in the first quarter of 2024. As the founder, Co-Chairman, and Co-Chief Investment Officer of one of the world's largest hedge funds, Dalio continues to influence the financial markets with his strategic decisions. Known for his principled approach to investing and management, Dalio has been a pivotal figure in the finance world, often compared to Steve Jobs for his innovative contributions to investment strategies.

New Additions to the Portfolio Ray Dalio (Trades, Portfolio)'s Bridgewater Associates has expanded its portfolio by adding a total of 72 stocks. Noteworthy new acquisitions include:

- Amazon.com Inc (NASDAQ:AMZN), purchasing 1,047,891 shares, which now represent 0.96% of the portfolio, valued at approximately $189 million.

- Advanced Micro Devices Inc (NASDAQ:AMD), with 679,454 shares, making up about 0.62% of the portfolio, valued at around $122.63 million.

- iShares MSCI South Korea ETF (EWY), adding 874,991 shares, accounting for 0.3% of the portfolio, with a total value of $58.72 million.

Significant Increases in Existing PositionsAmong the increased stakes, the most significant is in Alphabet Inc (NASDAQ:GOOGL), where Dalio added an additional 3,324,416 shares, bringing the total to 5,368,853 shares. This adjustment marks a substantial 162.61% increase in share count and has a 2.54% impact on the current portfolio, totaling approximately $810.32 million. Another major increase was in NVIDIA Corp (NASDAQ:NVDA), with an additional 436,110 shares, bringing the total to 704,599 shares, valued at approximately $636.65 million.

Complete Exits from Certain Holdings In the first quarter of 2024, Ray Dalio (Trades, Portfolio) also decided to exit completely from 137 holdings, including:

- CME Group Inc (NASDAQ:CME), where he sold all 98,463 shares, impacting the portfolio by -0.12%.

- American Homes 4 Rent (NYSE:AMH), liquidating all 595,129 shares, also resulting in a -0.12% portfolio impact.

Reductions in Key HoldingsDalio reduced his positions in several stocks, notably

- PDD Holdings Inc (NASDAQ:PDD), reducing his stake by 892,158 shares, which led to a -36.61% decrease in shares and a -0.73% impact on the portfolio. PDD traded at an average price of $131.01 during the quarter.

- Coca-Cola Co (NYSE:NYSE:KO), cutting down by 1,714,657 shares, resulting in a -21.42% reduction and a -0.57% impact on the portfolio. KO's average trading price was $60.07 during the quarter.

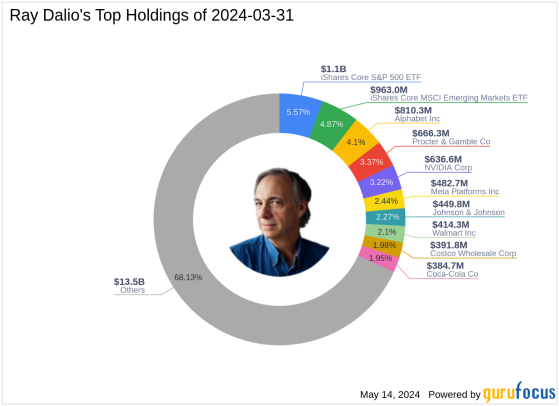

Portfolio Overview and Sector AllocationAs of the first quarter of 2024, Ray Dalio (Trades, Portfolio)'s portfolio included 679 stocks. The top holdings were 5.57% in iShares Core S&P 500 ETF (IVV), 4.87% in iShares Core MSCI Emerging Markets ETF (NYSE:IEMG), and 4.1% in Alphabet Inc (NASDAQ:GOOGL). The portfolio's sector allocation is well-diversified across all 11 industries, including Consumer Defensive, Healthcare, Technology, and more, reflecting Dalio's strategic approach to risk management and capital allocation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This content was originally published on Gurufocus.com