The financial sphere witnessed a significant transformation this week due to a considerable surge in Treasury yields. To illustrate, there was an increase from 4.09 to 4.31 in the benchmark 10-year U.S. Treasury yield, indicating a rise of 22 basis points over the week.

This escalation primarily resulted from unanticipated inflation data with February's U.S. producer price index showing a month-on-month growth of 0.6%, double than what was projected at 0.3%. This sudden inflation spike has influenced various financial assets and had notable effects on high-duration fixed-income instruments and interest rate-sensitive equities like those related to real estate.

Impact on ETFs Amidst Escalating Treasury Yields?

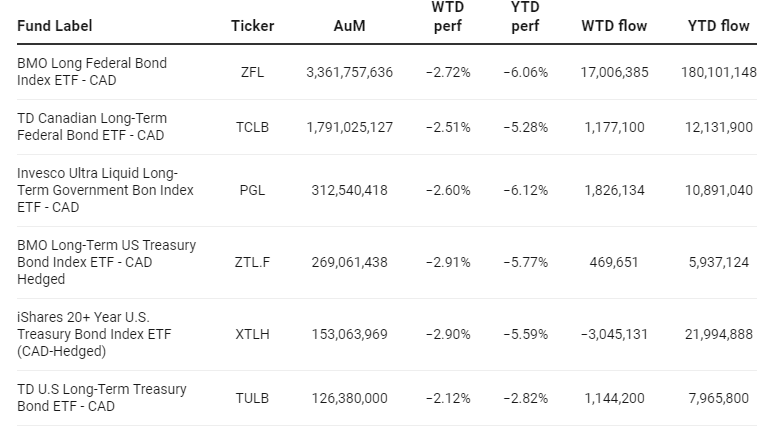

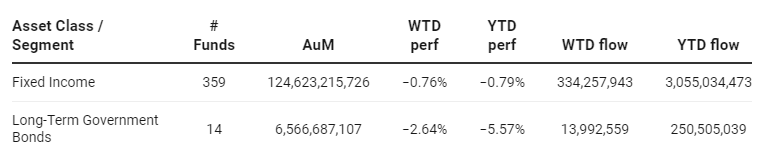

ETFs reacted differently to these changes; overall, there was a slight downward trend for fixed-income asset class ETFs with an aggregate loss of about 0.84% over the week observed. However, more detailed analysis shows that long-term government bond ETFs experienced greater falls as they registered a weekly decline of around 2.91%. This highlights how rising yields directly affect long-duration debt instrument performance negatively.

Focus on ZFL and TCLB ETFs

Two prominent ETF examples reflecting this pattern are the BMO (TSX:BMO) Long Federal Bond Index ETF (ZFL) and the TD (TSX:TD) Canadian Long Term Federal Bond ETF (TCLB). The ZFL suffered nearly identical losses as its broader segment with its $3.3 billion assets under management sliding down by approximately 2.72%. Similarly, the TCLB was also impacted with a drop of -2.51%.

Group Data:

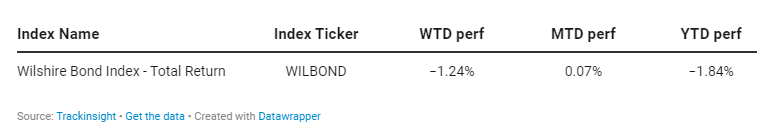

Index Data: