In 2024, global political elections are poised to significantly influence investment landscapes. Economic challenges and technological advancements have spurred widespread calls for change, impacting political and investment landscapes alike. This article will spotlight key elections worldwide, with a special focus on the U.S., and explore investment strategies for navigating this period of political uncertainties.

Global elections 2024: Insights into key races

Elections in more than 80 nations and territories are expected to occur this year. While the U.S. election has taken precedence in the minds of many, the European Union’s (EU) 27 member states are scheduled to elect a new European Parliament in June, amid other important regional and national European elections this year.

India will hold the world’s largest election starting in April, while other pivotal emerging market nations, namely Mexico and Brazil, will have elections in June and October, respectively. Despite the ongoing war, both Russia and Ukraine will have elections taking place in their respective jurisdictions during March.

A common observation among political scholars is the growing ‘democratic backsliding’ occurring within sovereign states. Democratic backsliding is characterized as the process of declining integrity for democratic values or institutions in a political system.

Against the backdrop of a difficult economic environment, populist movements are gaining momentum, leading voters to seek alternatives to liberal democracies, which puts incumbents in places like the U.S. and Europe at a rare disadvantage in this election cycle and sets the stage for less liberal challengers/populists to succeed.

As noted in a recent report published by the think tank European Council on Foreign Relations, the 2024 European Parliament elections will see a major shift to the right in many countries, with populist parties gaining votes and seats across the EU.

Regarding India, Prime Minister Narendra Modi is likely to win a third term in office. Though India has exhibited economic protectionist tendencies, it has been a rapidly growing economy under the Modi government. However, from a global perspective, India has taken an ‘in their best interest’ stance, showing its willingness to be a strategic partner of the US and the West while also being one of the largest buyers of Russian energy and a large buyer of Russian arms amid the Ukrainian war.

U.S. Elections: Familiar names, different policies, one commonality

Undoubtedly, of all the elections occurring this year, the U.S. presidential and congressional elections are the most important and impactful to the global economy. At this juncture, the two presidential candidates will be President Joe Biden and former President Donald Trump.

While the policies of both men are starkly different, Trump’s being broadly characterized as ‘unilateralist/America-first’, whereas Biden has positioned himself as a ‘Globalist’ – they do share one common viewpoint: China.

The U.S. policy toward China has looked very similar during both presidential terms, as the tariffs that President Trump instituted on Chinese goods entering America during his first term were extended by President Biden.

As has been well documented, President Biden has banned semiconductor exports to China; and during his campaigning speeches, former President Trump has stated his willingness to impose tariffs of 60% or higher on Chinese goods were he to win a second term in office. His (i.e. President Trump’s) tariff strategy could revive the trade war he triggered during his first term as president. Besides China, the rhetoric and political posturing of both men have highlighted their differing viewpoints on domestic and foreign matters.

Adjacent to the presidential election is the U.S. Senate elections, and there is a strong possibility that the Republican party will win. If that happens, and President Biden is re-elected, the willingness and ability of the U.S. Executive and Legislative branches of government to work together in meaningfully and constructively comes into question.

Exploring elections year U.S. stock market performance

The nebulous nature of political risk and the uncertainty that it brings can be difficult to plan for or guard against, but some insights can be taken from past elections.

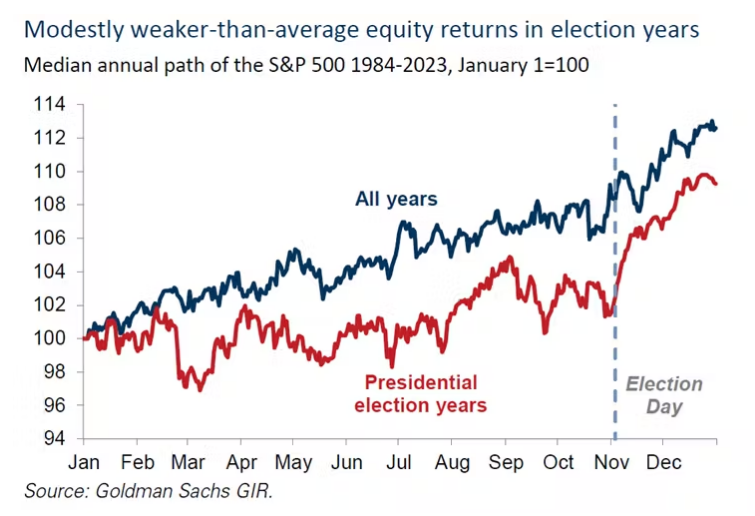

Research from Goldman Sachs (NYSE:GS) indicates that equity returns have generally been modestly weaker than average in presidential election years. In the 10 election years since 1984, the S&P 500 generated a median total return of 11% (inclusive of dividends), compared with a median return of 15% across all years since 1984.

However, in part because of some coinciding large macroeconomic shocks, the distribution of election year returns has been extremely wide, ranging from as low as -37% in 2008 to as high as +23% in 1996.

Goldman’s research also states that earnings growth typically drives presidential election year returns. US GDP and corporate profit growth have typically been stronger than average in these years.

Despite this, a widening equity risk premium has typically reduced the S&P 500 P/E valuation multiple by 3% in presidential election years. Finally, Goldman’s research also indicates that election year returns tend to be even more backloaded than usual.

In a typical year, equity returns demonstrate strong seasonality late in the year, with equities returning an average of 4% in the last two months of the year. In election years, regardless of the election outcome, decreasing uncertainty typically boosts equity valuations and prices after Election Day, surpassing the usual seasonal trends.

Indeed, the S&P 500 P/E multiple has declined by a median of 6% in the first 10 months of election years and rebounded by 3% in the last two months of the year.

Exploring Buffer ETFs to mitigate elections uncertainty in U.S. markets

Although historical data does provide some insight regarding what has occurred leading up to the U.S. elections, much remains unknown at this point. Ultimately, the reception of the policy proposals from the candidates will be made evident in how the market reacts.

However, for individuals who want to mitigate the uncertainty that is present, buffer ETFs provide investors with the upside of an asset’s returns, generally up to a capped percentage, while also providing downside protection on the first predetermined percentage of losses.

Simply put, investors trade in some upside for additional downside protection. However, buffer ETFs have an outcome period embedded within their investment strategy, normally one year, meaning that the stated caps and buffers apply only to investors who purchase on the rebalance date and hold the ETF throughout the entire outcome period.

Investors who purchase after the rebalance date will receive different caps and buffers based on the performance of the referenced index between the rebalance date and when they purchased the fund.

Within the Canadian ETF landscape, investors can utilize buffer ETF solutions from First Trust and BMO (TSX:BMO) that provide them exposure to the U.S. Equity market.

First Trust Vest Fund of Buffer ETFs (Canada) ETF (Ticker: BUFR)

First Trust Vest Fund of Buffer ETFs (Canada) ETF (Ticker: BUFR) is a fund of fund offering that provides unitholders with capital appreciation and exposure to U.S. large capitalization companies included in the S&P 500® Index through investment in an equally weighted portfolio of First Trust Vest Funds. The fund will match the price return of the SPDR® S&P 500® ETF Trust up to a predetermined upside cap while providing a buffer against the first 10% of the decrease in the market price of the underlying ETF for approximately a one-year period.

The underlying funds that comprise BUFR are also available for purchase, namely, AUGB.F, FEBB.F, MAYB.F, and NOVB.F, providing a predetermined upside cap of at least 16%, respectively, while buffering against the first 10% of the decrease in market price of the underlying ETF, over a period of approximately one year.

BMO’s range of Buffer ETFs

In the case of BMO, their buffer ETF offerings currently consist of BMO US Equity Buffer Hedged to CAD ETF – January (Ticker: ZJAN) and BMO US Equity Buffer Hedged to CAD ETF – October (Ticker: ZOCT), which provide investors with exposure to the large-cap segment of the US equity market, namely the S&P 500 Hedged to Canadian Dollars Index, while providing a buffer against the first 15% of a decrease in the market price of the Index, over a period of approximately one year.

This content was originally published by our partners at the Canadian ETF Marketplace.