Investing.com Launches AI Stock-Picking Tool for Canadian Market

What's New | Jan 16, 2025 04:16

Investors focused on the Canadian stock market can now get an undeniable advantage over other retail investors: ProPicks AI is introducing extended coverage to TSX stocks, bringing the power of institutional-grade AI to your local market.

Originally launched in November 2023 using models for the US market, ProPicks AI is an AI-powered stock picker that finds exciting investment opportunities every month. We recently published the results of ProPicks AI in its first year after launch for the US market, with a staggering +84% gain for our top Tech Titans strategy – double the S&P 500’s performance in one of the most bullish years in history.

Our new localized AI models have analyzed Canadian companies using 250+ financial metrics to find the country’s best stocks and identify winners that are projected to outperform the TSX .

ProPicks AI is trained on the most extensive data available to help investors navigate the challenges of accurately valuing companies and planning their investment strategies in the Canadian market.

To start, ProPicks AI is launching with three localized strategies for the Canadian market.

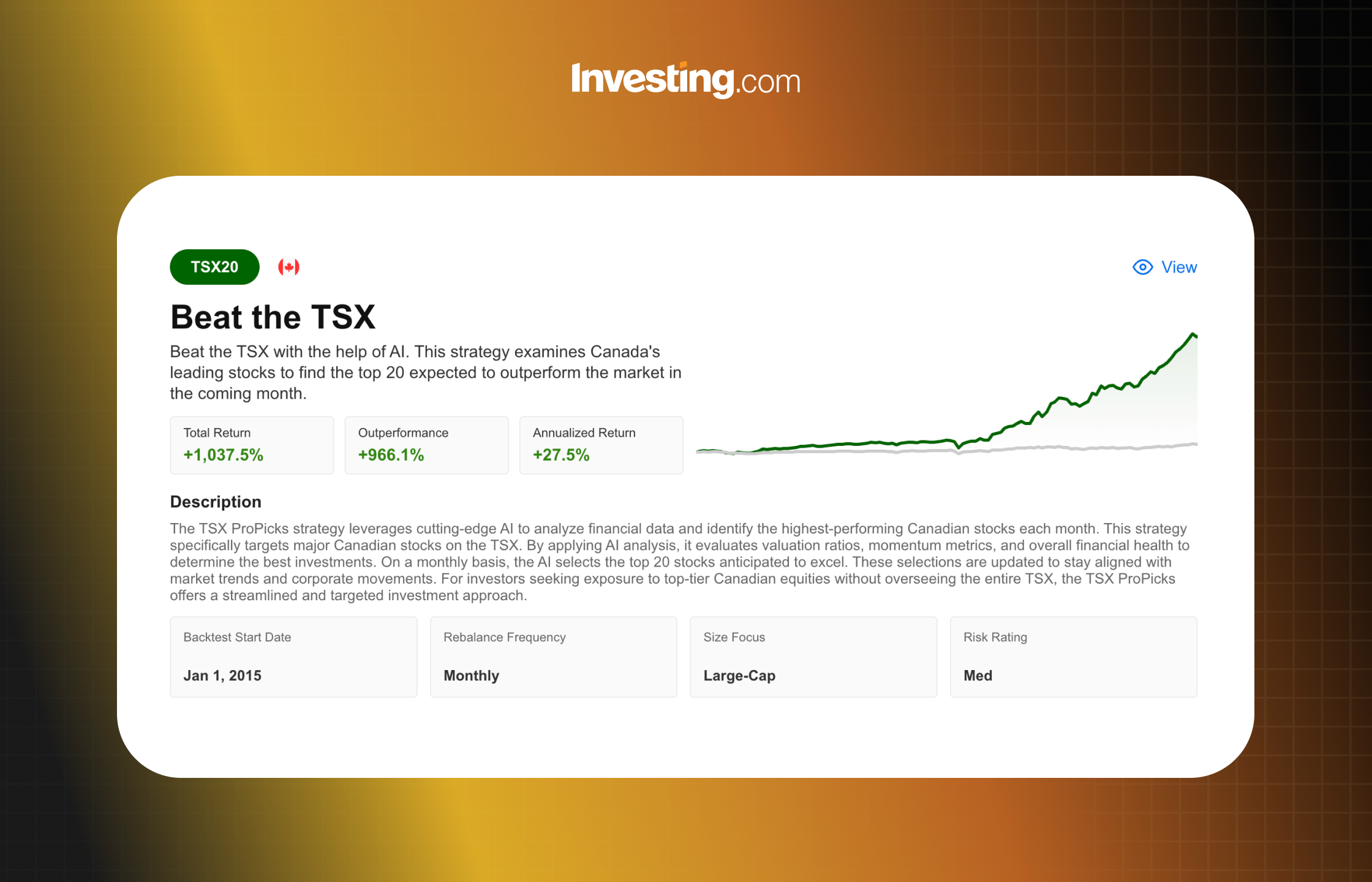

- Beat the TSX - Designed for broad market exposure, with 10 years’ back-tested performance showing +1033% total gains

- Canadian Bargains - Identifies undervalued Canadian stocks with strong fundamentals, with 10 years’ back-tested performance showing +622% total gains

- Canadian Growth - Focuses on high-growth Canadian companies with strong revenue and earnings growth, with 5 years’ back-tested performance showing +343% total gains

A Case Study in AI-Powered Stock Selection

To understand how ProPicks AI works in practice, let's look at a back-tested example from our Beat the TSX strategy.

When our AI picked CES Energy Solutions Corp. (TSX: CEU) on Oct 1, 2024, it based this decision on three key factors:

- Company had raised its dividend for 4 consecutive years

- Analysts had revised their earnings upwards for the upcoming period

- Stock was trading at a low P/E ratio relative to near-term earnings growth

The result?

Since being added to the Beat the TSX Strategy in Oct 2024, CES Energy Solutions Corp. has delivered a remarkable +30.2% return (based on backtesting). This represents turning every $1,000 invested into approximately $1,302.

How the Canadian Market Benefits from Global AI Stock Selection

By analyzing over 15,000 companies across major global exchanges, ProPicks AI has developed a more nuanced understanding of what makes a stock successful in any market environment.

Just as neural networks become more sophisticated when exposed to diverse data, our AI gains deeper insights by analyzing multiple markets and exchanges. This process, known in AI research as transfer learning 1, means that knowledge gained from analyzing 11 different markets such as the US, Germany, and Spain, helps identify winning stocks in the Canadian market, and vice versa.

"When we train our AI on multiple markets, it discovers universal patterns of successful companies that transcend geographical boundaries," explains Andy Pai, VP of Subscription Products at Investing.com. "Our experience with US markets provides valuable insights for analyzing companies in other regions, and in turn, this broader exposure helps refine our US stock selection process."

Learn more about the science behind ProPicks AI.

What Makes ProPicks AI Different for Canadian Investors

The power of ProPicks AI lies in its ability to analyze over 250 financial metrics across 25 years of market data. For each market, the AI:

- Processes local financial statements and trading data

- Adjusts for market-specific factors and accounting standards

- Identifies winning combinations of factors that predict outperformance

- Updates selections monthly to stay current with market conditions

ProPicks AI represents a significant investment in bringing institutional-quality analysis to individual investors:

- Over $4 million annually invested in data licensing

- Another $4 million in computing resources for AI analysis

- Hundreds of hours in quality assurance by a team of experts

"The reality is most investors don't have the time, resources, or frankly, the desire to do this heavy lifting themselves. And they shouldn't have to," notes Pai. "We package our premium analyses into an affordable subscription so Canadian investors can bypass the manual search and skip to a shortlist of stocks that our AI has singled out as the strongest candidates for success.”

Getting Started with ProPicks

Step 1. Choose your AI-powered investment strategy

- Select the strategy (you can choose more than one) that matches your goals, risk preferences, and comfort level.

Step 2. Use it as an idea generator to source new monthly stock picks

- Focus on newly added stocks: Conduct in-depth analysis; Review fundamentals; Compare to peers; Consider the key stats that matter to you most — like dividend yield or revenue growth; Utilize premium data like Fair Value, ProTips, and Company Health Score.

- Make trades aligned with your strategy and risk preferences.

If you want to follow the AI-powered strategies one-to-one in order to match their performance, you’ll need to choose the entire monthly portfolio of stocks and hold them equally weighted. Then check the monthly updates sent via email, and posted on our platform.

Note that it takes some effort to recalculate and rebalance the stocks equally. Also, buying and selling monthly may have tax implications for capital gains, as well as transaction fees depending on your location and broker.

We always recommend doing your own due diligence as past performance doesn’t guarantee future returns.

The Bottom Line

By focusing on data-filtered selections and reducing the emotional bias that often leads retail investors around the world to decision paralysis, ProPicks AI now makes it easier to choose stocks with confidence.

Explore our latest Canadian investment strategies and start getting monthly stock updates. Get started now.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.