S&P 500: A Pattern That Almost Never Fails Is Signaling a Bullish Year Ahead

Investing.com | May 27, 2024 03:11

- The S&P 500's strong start in 2024 suggests potential continued gains based on historical patterns.

- While performance after Memorial Day tends to be mixed, this bullish signal indicates otherwise.

- Meanwhile, investors' allocation to US stocks remains at record highs.

- Want to invest by taking advantage of market opportunities? Don't hesitate to try InvestingPro! Subscribe HERE and get almost 40% discount for a limited time on your 1 year plan !

- Super Micro Computer (NASDAQ:SMCI)

- Vistra Energy Corp (NYSE:VST)

- Constellation Energy Corp (NASDAQ:CEG)

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add soon.

This Memorial Day, investors are looking to history for clues about the market's future performance. Traditionally, the post-Memorial Day period has seen mixed results.

Before 1996, markets generally performed well during this week. However, since 1996, performance has been weaker, with the Dow Jones Industrial Average averaging a meager 0.05% return.

However, the S&P 500 and Nasdaq still managed positive average returns of 0.31% and 0.88% respectively during this timeframe.

S&P 500's Bullish Signal

There's a potentially positive indicator for the rest of the year based on the S&P 500's recent milestone. The index recently crossed its 100th trading day for 2024.

Historically, when the S&P 500 rises in the first 100 days, it tends to continue its upward trajectory for the remainder of the year.

This pattern has held in 17 out of 20 previous years, with an average gain of 8.8%. Encouragingly, the S&P 500 has climbed 11.3% so far this year, suggesting a potential continuation of the positive trend.

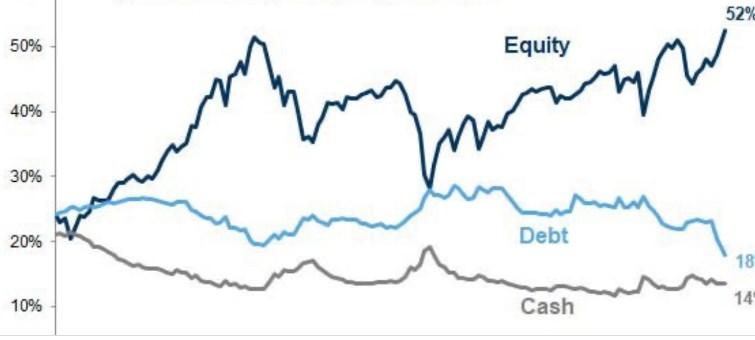

As of now, investors' allocation to US stocks remains at record highs.

Utilities Sector Surprises, Dividend Payouts Hit Record Highs

The market is also seeing some unexpected developments in specific sectors. Three of the top five gainers in the S&P 500 for 2024 are utilities companies:

This surge highlights the dynamic nature of the market and the potential for unexpected growth in certain areas.

On a broader scale, U.S. companies are rewarding investors with record-breaking dividend payouts. In Q1 2024, dividends reached a staggering $164.3 billion, a 7% increase compared to the same period last year.

This trend is mirrored globally, with total dividends hitting a new high of $339.2 billion.

Walgreens Stands Alone with Dividend Cut

While the overall trend in dividends is positive, there's one notable exception. Walgreens (NASDAQ:WBA) recently decided to slash its quarterly dividend by nearly half.

This move contributed significantly to the stock's 40% downturn so far in 2024, highlighting the potential consequences of such decisions for a company's performance.

Investor Sentiment (AAII)

Bullish sentiment, i.e. expectations that stock prices will rise over the next six months, increased 6.2 percentage points to 47% and remains above its historical average of 37.5%.

Bearish sentiment, i.e. expectations that stock prices will fall over the next six months, is at 26.3% and remains below its historical average of 31%.

***

Take the opportunity and get 40% off your 1-year subscription. With it, you'll get:

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.