How Not To Become A Bitcoin Millionaire (But What To Do If Profit Is Preferred)

Andy Hecht | Jan 21, 2021 07:59

This article was written exclusively for Investing.com

- Wild December and January for the leader of the digital currency asset class

- Meaningless price forecasts from analysts

- Lost passwords and missing millions

- Custody and gravity are both powerful forces

I'm a Bitcoin and digital currency fan, but I'm also a novice when it comes to this new asset class.

The global nature of the currencies appeals to my libertarian leanings. If governments did a reasonable job managing funds and the money supply, there would be no reason for the cryptos. Sadly, they do not, and the situation is getting worse. As the US deficit swells to the $30 trillion level and stimulus keeps coming, the argument favoring the digital currency revolution becomes compelling.

But I'm also now in my sixth decade, so can officially say I am an old-school kind of guy. Technology continues to perplex me at times. And though I consider myself young at heart, my mind isn't the same as it was decades ago. One sign of this: I tend to forget passwords soon after I set them up and enter them on a website.

So I had to smile in sympathy the other day when I read about newly minted Bitcoin millionaires losing access to their newly minted—and steadily rising—profits because of precisely the same problem: a lapse in memory that caused them to forget their crypto wallet passwords.

Here are are a few simple things to know about Bitcoin and precautions to help avoid those and other risks.

Wild December and January for the leader of the digital currency asset class

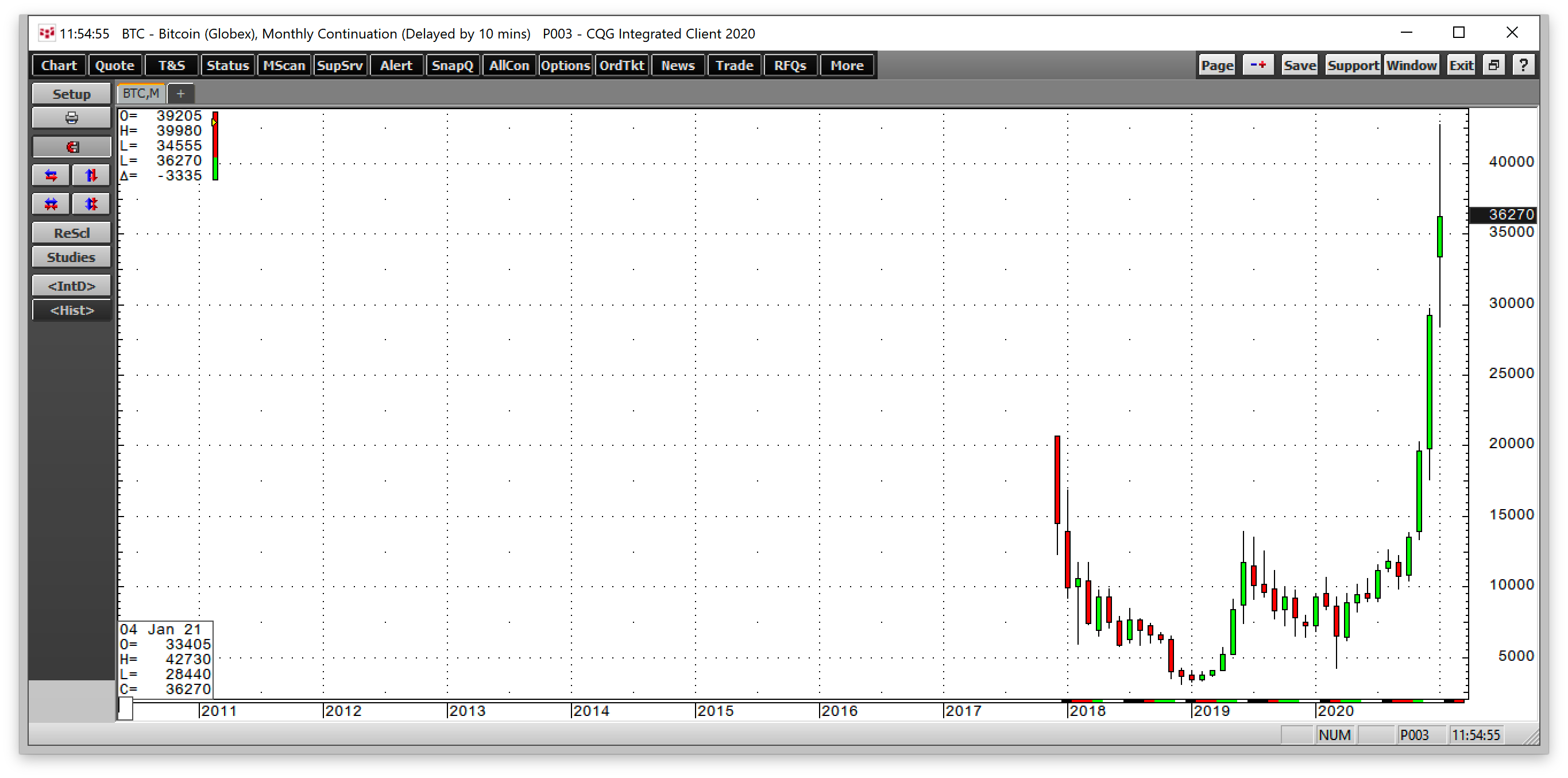

When other asset prices fell in March 2020, Bitcoin retreated to a low of $4,210 per token. The price was almost one-fifth the level at the late 2017 high when the asset class’s market cap reached over $800 billion. In 2019, Bitcoin rose to a lower peak of $13,915.

As the monthly chart of CME Bitcoin futures highlights, the price moved above the 2019 high in November.

The technical break to the upside lit an explosive match under the cryptocurrency. At the beginning of 2021, the price reached the $42,730 level and was trading at over $36,000 per token at the end of last week. The asset class’s market cap was near the $1 trillion level.

Meaningless price forecasts from analysts

Everyone loves a bull market. Now, many pundits are writing that Bitcoin is the new gold and that investors are fleeing the yellow metal for the obscure digital tokens.

Bitcoin has had plenty of detractors over the years. Warren Buffett once called Bitcoin “ ” in 2017. So far, they've all been wrong.

Meanwhile, the cryptoasset frenzy has even hit the global investment bank run by Mr. Dimon. At the beginning of 2021, an analyst from JP Morgan Chase said that Bitcoin has the potential to reach $146,000 .

I find that statement as suspect as the ones made in 2017. It seems like the $146,000 level was picked out of the air. Analysts have models that compare the digital currency’s market cap to other competing assets, which validate their predictions. I pay no attention to those calls and consider them, as Mr. Munger would say, worthless.

Markets tend to go a lot higher than anyone believes possible during bullish periods and far lower than even the most committed bear thinks during price carnage. If you have any doubt, just look at the crude oil futures market, which moved to a record low}} of negative $40.32 on April 20, 2020.

Lost passwords and missing millions

There are many reports of lost millions, if not billions, from people who simply forget their digital keys or passwords for their Bitcoin or other crypto wallets. A piece on PCGAMER recounts a computer programmers’ loss of 7,002 Bitcoins worth around a quarter-of-a-billion dollars because he forgot his password. If a programmer faces this problem, what chances does a crypto neophyte like me have?

An article in the New York Times last week estimates that of 18.5 million Bitcoins, 20% are lost in stranded wallets. There are retrieval methods when we lose passwords for a bank, investment, or other types of accounts. With Bitcoins in private wallets however, those who lose the keys wind up as the bigggest losers.

When I did a {{0|Google search for the question, "what happens if I lost my Bitcoin private key,' the answer is: “If you forget your private key, there’s no way to regain access.”

Custody and gravity are both powerful forces

So, if you choose to invest in Bitcoin, or another cryptocurrency for that matter, and opt to store it in a private wallet, write down your key and keep it in a secure place. Make copies and put those in a safe.

Alternatively, some online exchanges can store the cryptos, but there are risks. Coinbase is an exchange that keeps almost 99% of its assets in offline cold storage that can’t be accessed or hacked. Other online exchanges offer similar storage services. For the digital currency market to mature, custody is the critical issue. In the meantime, cryptonews provides valuable suggestions for storing cryptocurrencies safely.

Keep records of your digital currency savings and store them safely. Custody remains the leading issue for me and many others, whether you tend to forget passwords or not. Saving cryptoassets on your computer increases the risk of a hack. An old-school mindset in this digital currency world is a disability.

As for investing in Bitcoin and the other digital currencies, it's difficult to make a call on which direction any of them will head next. One thing for sure, expect volatility.

The takeaway is that digital currencies are markets. And like all markets, risk rises during parabolic moves.

Whether Bitcoin reaches a high at $42,730, or the current explosive rally will find a peak at double, triple, quadruple that level or more, gravity will eventually cause a massive correction. Guard against losing access to those tokens, but also have an exit plan for price risk.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.