Fed 'Sea Change' Swamps Gold. Next Stop Down?

Dan Norcini | Oct 29, 2015 01:15

WOW! I know no other way of saying it than to say that the Fed took everyone by surprise. I certainly did not expect this Fed, this timid FOMC, to sound such a hawkish note.

As dovish as Draghi and the ECB sounded last week, that's how hawkish the Fed sounded this week. Talk about a sea change in attitude!

Needless to say, the market reaction was clear—especially in gold and in currencies—a December rate hike is coming. Before we all get absolutely giddy, however, we still need to see the November and the December payroll numbers. That said, with the entirety of the market leaning to the NO RATE HIKE THIS YEAR side, all it took was a NOT DOVISH note to upset the entire apple cart.

Every single gold trader who bought into this rally expecting a dovish Fed is now running for their lives. Just as the bears were terrified prior to the Fed meeting and were exiting yesterday morning, yesterday afternoon it was the bulls who were terror-stricken.

I can't yet say what's coming next. However, IF—and this is an enormous “IF”—the Fed is actually going to hike rates this year, then it is hard to see gold going anywhere but down since this is going to lend tremendous support to the US dollar.

I am not sure what has been happening behind the scenes with the Fed. It was a given that they have been concerned about overseas development and particularly the strong dollar which has been exerting downward pressure on the commodity complex. I have written in the recent past that the Fed does not want sinking commodity prices – at least not commodity prices falling so low that they impact jobs in those industries which produce or profit from them. That would be a deflationary signal and works at cross purposes to the Fed's desire to achieve an annual 2% rate of inflation. But how we get there from here, with a surging US dollar, escapes me.

Maybe the Fed sees something on the payrolls front that we do not as yet see. What's really strange about this is that if the Fed indeed did not want the US dollar to surge higher, one would have thought that the ultra dovish Draghi/ECB comments, alongside the Chinese devaluation of the yuan, would have been enough to keep the tone of the statement dovish.

Apparently not.

Now what? Well, the market has to ONCE AGAIN ( SIGH!) adjust to the Fed comments so that it now reflects a hawkish stance instead of the previous dovish stance that existed until as recently as 1:00PM CDT yesterday.

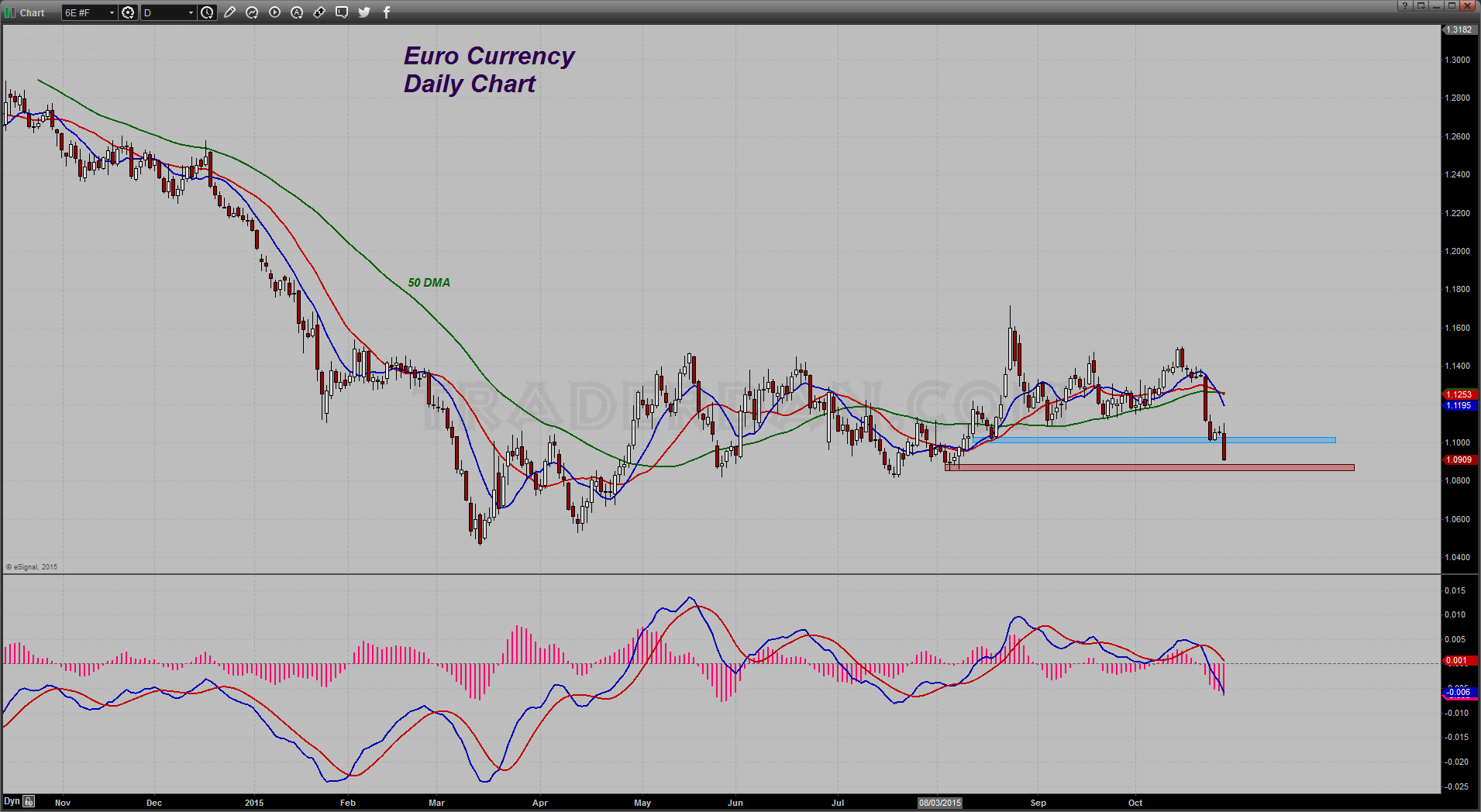

It certainly makes me wonder if the euro is going to take out 1.090 and head down for a test of 1.085.

From a TA perspective, if the euro fails to hold above 1.080, odds favor it moving down to 1.060 and possibly even the ECB/QE induced low near 1.045.

As a currency guy, what incentive does one have now for buying the euro with the tone of both the U.S. and EU Central Banks being what it is at the moment??

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.