Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.

Investing.com | Apr 11, 2024 08:31

Robotics and Artificial intelligence (AI) are not just the future but also the present, and they are poised to revolutionize our world and daily lives, both personally and professionally.

Experts in these fields suggest that we are still in the early stages. It's akin to being able to invest in Internet-related stocks at the dawn of the Internet age. That's why allocating some of our capital to invest in robotics and AI for the medium to long term could be a rewarding idea.

There are two primary ways to do this:

You might think you need to invest in two separate ETFs, one for robotics and one for AI. However, it's simpler than that. You can invest in an ETF that covers both sectors together.

Here are three such ETFs that combine both robotics and AI sectors:

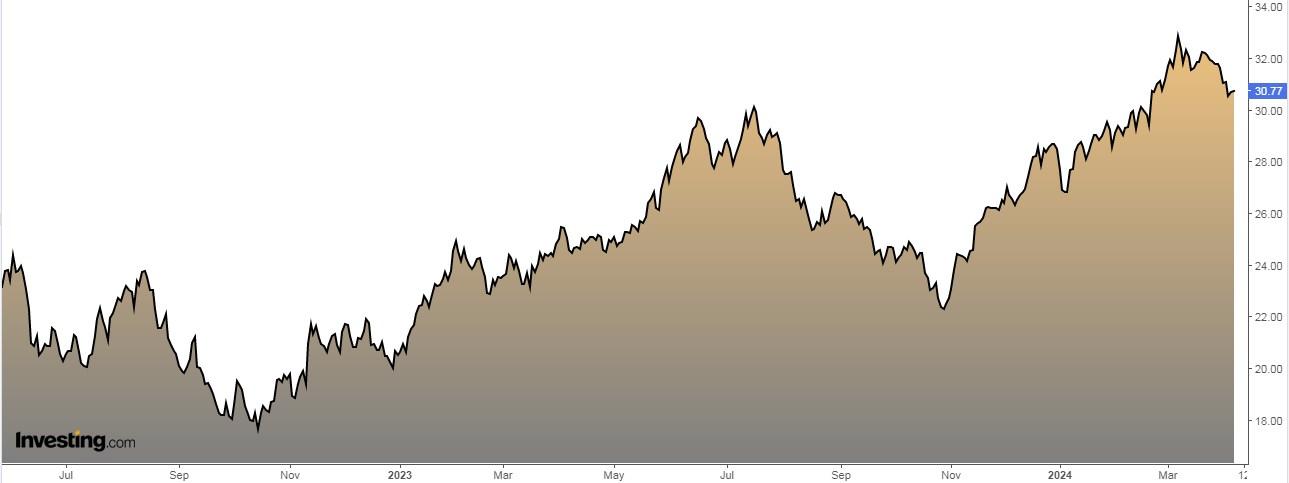

Global X Robotics & Artificial Intelligence ETF (NASDAQ:BOTZ) replicates the Global Robotics & Artificial Intelligence Thematic index, which is made up of companies from around the world that stand to benefit from the rise of robotics and AI.

The ETF has a U.S. and a European version.

Total annual fees are 0.50% Dividends from the ETF are distributed to investors every six months.

The ETF was launched on November 16, 2021 and is domiciled in Ireland.

Its 1-year yield is 26.29%. It invests in 45 companies, with the following being the most heavily weighted:

By country, its investments are distributed as follows:

iShares U.S. Tech Breakthrough Multisector ETF (NYSE:TECB) was created in 2020. Dividends are paid quarterly.

Commissions are 0.40%. The yield since its creation is 10.80%. The ETF replicates the NYSE FactSet index (NYSE:FDS) U.S. Tech Breakthrough, which is Formed by U.S.-listed companies engaged in the research and development of cutting-edge products and services in the areas of robotics and artificial intelligence.

Its main positions are:

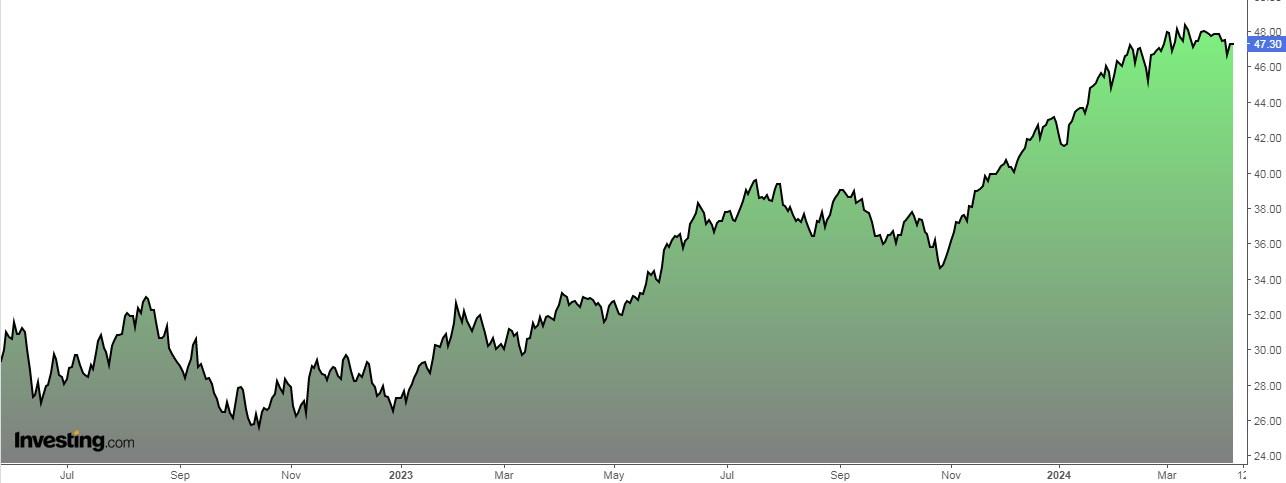

Invesco AI and Next Gen Software ETF (NYSE:IGPT) was launched in June 2005 and has fees of 0.60%. Its return since its inception is 15.26%.

The ETF replicates the Stoxx World AC NexGen index and invests at least 90% of its assets in the stocks that make up the index.

Its main positions are:

***

Want to try the tools that maximize your portfolio? Take advantage .

Use the code and get almost 40% off your 1-year subscription - less than what a Netflix subscription costs you! (And you get more out of your investments too). With it you'll get:

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.