3 Numbers: India Growth On Track, Global Equities, U.S. Yields

James Picerno | Oct 12, 2015 01:11

Monday is a slow day for economic news, although India’s update on industrial production will provide new insight on how the growth leader in emerging markets is faring amid wobbly macro data for the world. Meanwhile, it’ll be interesting to see if last week’s bounce in global equity markets spills over into today’s trading. Ditto for Treasury yields, which just posted their biggest weekly gain since late-August.

India: Industrial Production (1200 GMT): India’s economy is expected to grow moderately faster than China’s this year and in 2016, according to last week’s revised IMF forecasts.

The OECD is also projecting that India’s macro trend will compare favourably with the usual suspects, based on the group’s October update of its composite leading indicator (CLI).

“Among the major emerging economies, CLIs continue to point to a loss of growth momentum in China, and weak growth momentum in Brazil and Russia," the OECD advised last week. One notable exception: "Firming growth is expected in India.”

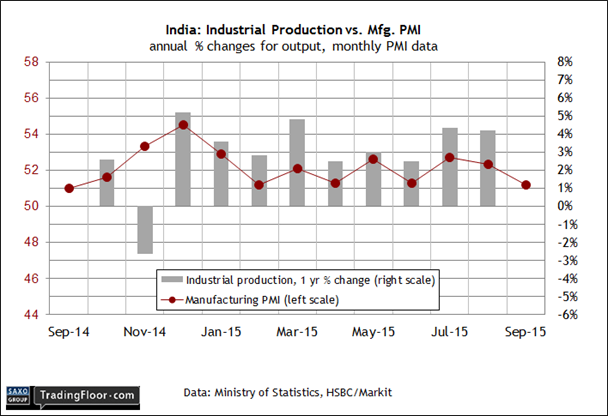

Relative outperformance for India’s economy is still a reasonable estimate, but today’s update on industrial production may dull the edge. Sentiment in the manufacturing sector dipped in September to a seven-month low. Although Markit’s purchasing managers’ index (PMI) slipped to 51.2 last month, that’s still above the neutral 50.0 mark.

However, growth looks set to weaken in the hard data for industrial activity generally. “The sector’s labour market was squeezed in September as companies attempted to minimise operating costs,” noted a Markit economist. “This bodes ill for the economy in the near term and suggests that manufacturers’ expectations for future output growth are clouded with uncertainty.”

A softer round of growth isn’t surprising in a world where manufacturing output overall is softer if not contracting in some countries, namely, China. India is still on track to deliver comparatively upbeat numbers overall. But as today’s update on industrial activity may show, the world’s poster child for growth isn’t immune to the macro headwinds blowing all around it.

India’s central bank seems to agree. Late last month the Reserve Bank cut its policy rate for the fourth time this year by a larger-than-expected 50 basis points to 6.75%.

Global Stock Markets : Equity markets around the world rallied last week, delivering a refreshing contrast from the bearish mood that has been weighing on sentiment ever since China’s surprise announcement of currency devaluation in August inspired a wave of selling.

But if expectations for softer growth now cast a shadow over the macro outlook, the same attitude adjustment inspired the bulls last week to assume that the US Federal Reserve Bank would delay its rate hike - again.

"The prospect of the first rate hike being pushed back to next year is giving the markets a boost this week," noted a senior market analyst at OANDA on Friday. "Whether that continues... could depend on how earnings season starts following what is likely to have been another challenging quarter."

The dovish Fed minutes for last month’s policy meeting offered some support for bidding up equities. The central bank on Thursday published a report that revealed that policymakers were concerned about decelerating growth in the world economy - a factor that helped convince the Fed to keep interest rates close to zero at last month’s Federal Open Market Committee meeting.

If that factor is the main support for equity prices, keeping the rally going could be a tall order. Atlanta Fed President Dennis Lockhart, a voting member on the central bank’s monetary policy committee, said on Friday that a rate hike was still on the table for this year.

"The economy remains on a satisfactory track and ... I see a (rate) liftoff decision later this year at the October or December FOMC meetings as likely appropriate," he said at a conference.

In any case, the S&P 500 closed up last week, rising to its highest level since mid-August. The crowd will be eager to see if the risk-on trade will endure in the days ahead. A key factor, of course, is the incoming US economic data, including this week’s US updates on retail sales (Wednesday) and industrial production (Friday). Meantime, a cautious optimism prevails.

One potential stumbling block: earnings reports in the weeks ahead. “Sputtering global growth, lower oil prices, and continued dollar strength suggest the Q3 earnings season will be the weakest since the 2009 recession, raising doubts about the feasibility of large-caps’ 2016 earnings targets,” warned Roubini Global Economics in a note to clients last week. “We expect S&P 500 earnings per share to come in at $29 - a 2% year-on-year decline, but still 2% above the much-reduced consensus expectation ($28.50).”

US: 2-Year Treasury Yield: Key interest rates in the US bounced back last week after tumbling in September. Is that a sign that tighter monetary policy is coming after all? Alternatively, the modest rise in yields may simply be a case of adjustment after the previous week’s risk-off trade went a bit too far.

But even if you’re clear on why rates increased last week, it’s not obvious that clarity will be forthcoming in the days ahead. "Based on my forecast, yes, I am expecting higher rates this year,” New York Fed President William Dudley said on CNBC on Friday. "But it's a forecast, and we're going to get a lot of data between now and December. So it's not a commitment."

Given the maybe/possibly/perhaps outlook from Fed officials at the moment it would hardly be a shock to see Treasury yields remain in a tight range in the days ahead until the economic numbers offer compelling evidence to reprice bonds one way or the other.

The recent past, however, isn’t all that productive if you’re trying to reason from the perspective of the hard data on the employment numbers, which are second to none for deciding if there’s a growing case for raising rates.

Disappointing employment reports in August and September favour the monetary doves. But the softer pace in payrolls contrasts with last week’s bullish slide in jobless claims - a key leading indicator - to levels that are close to four-decade lows.

Clarifying the next move for Treasury yields is a function of new macro numbers. The week’s main events for US data: retail sales (Wednesday) and industrial production (Friday). Meantime, bonds are likely to be in a holding pattern.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.