WTI Crude Oil Non-Commercial Positions:

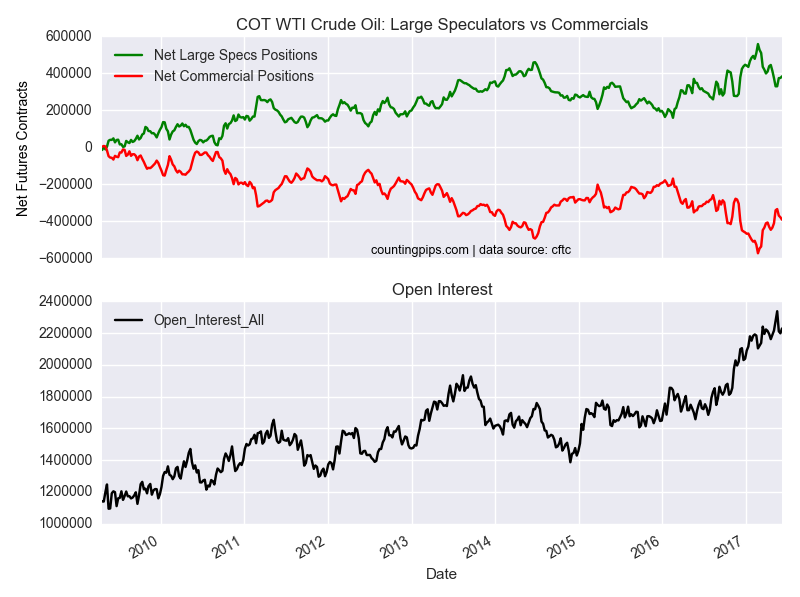

Large speculators added to their bullish net positions in the WTI crude oil futures markets last week for a fourth consecutive week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial contracts of WTI crude futures, traded by large speculators and hedge funds, totaled a net position of 382,469 contracts in the data reported through June 6th. This was a weekly gain of 8,714 contracts from the previous week which had a total of 373,755 net contracts.

Speculative net positions in WTI crude have advanced by +53,718 net contracts in the past four weeks and are now at their highest level since April 25th when the net level totaled +411,822 contracts.

WTI Crude Oil Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -390,819 contracts last week. This was a weekly increase of -13,054 contracts from the total net of -377,765 contracts reported the previous week.

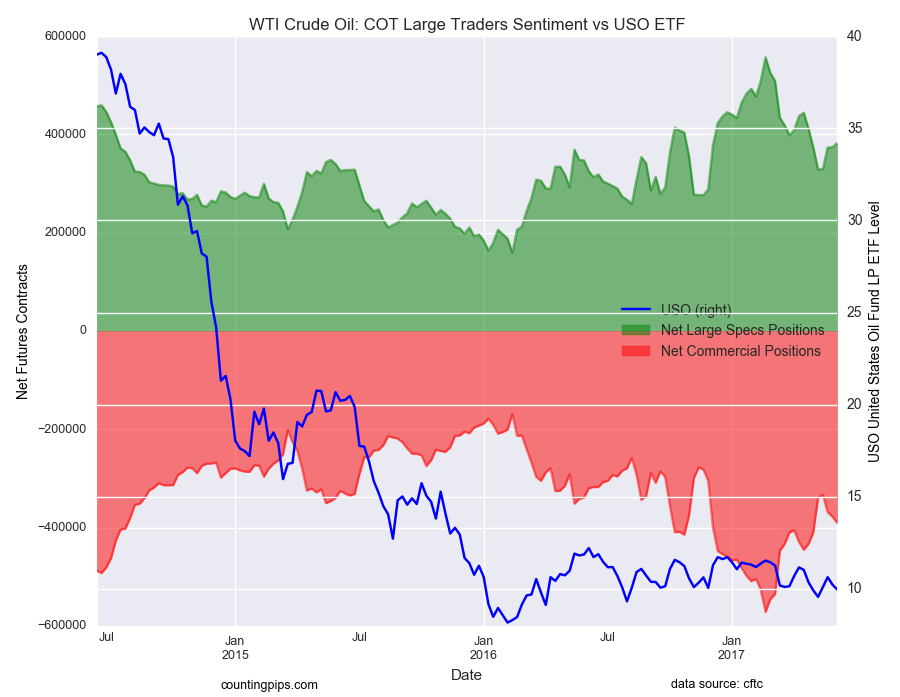

(NYSE:USO) Crude Oil ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the USO Crude Oil ETF, which tracks the price of WTI crude oil, closed at approximately $9.97 which was a decrease of $-0.27 from the previous close of $10.24, according to ETF market data.